Swiggy Stock Crashes 7% – Buy Opportunity or Warning Sign?

Swiggy Stock Crashes 7% – Buy Opportunity or Warning Sign? | Image Via Live Mint

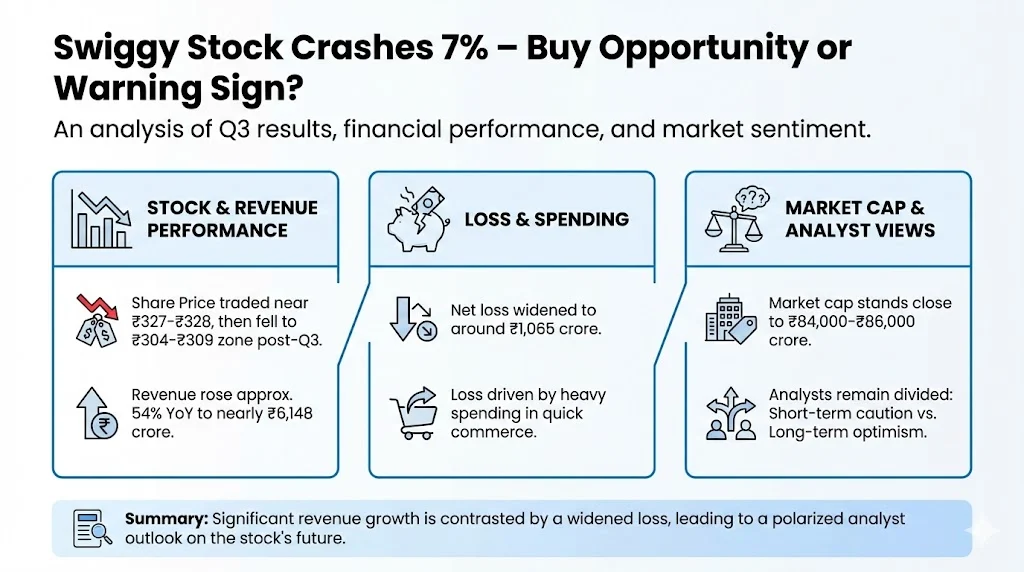

Swiggy share price became one of the most discussed topics in late January 2026 after the company released its Q3 FY26 results. The stock saw sharp movements on the NSE as investors reacted to strong revenue growth but widening losses. This reaction placed Swiggy at the center of debates around quick commerce, profitability, and post IPO performance.

The discussion around Swiggy is not limited to stock charts. It reflects a larger story of India’s tech driven consumer companies where high growth meets pressure for sustainable profits. Market participants now track every update from Swiggy closely as the company enters a critical phase of execution.

Table of Contents

Key Takeaways

- Swiggy share price traded near ₹327 to ₹328 before falling to the ₹304 to ₹309 zone after Q3 results

- Revenue rose about 54 percent year on year to nearly ₹6,148 crore

- Net loss widened to around ₹1,065 crore due to heavy spending in quick commerce

- Market cap stands close to ₹84,000 to ₹86,000 crore

- Analysts remain divided between short term caution and long term optimism

Also Read: Bitcoin Crash 2026 Shocking Price Drop: Crypto Market Panic or Opportunity

Swiggy has remained volatile since its listing in 2025. In the last one month, the stock has declined around 17 to 18 percent. Over the past three to six months, the fall has crossed 20 percent. From its peak levels in September 2025, the stock is down more than 23 percent. This shows a clear downward trend at the start of 2026 despite strong top line growth.

Swiggy Share Price Movement in January 2026

On January 29, Swiggy shares closed near ₹327 to ₹328 after gaining around 1.3 percent during the session. The trading range remained between ₹321 and ₹330. However, early trading on January 30 saw a sharp dip. The stock slipped to nearly ₹304 to ₹309 in some sessions. This marked a decline of about 5 to 7 percent in a single day.

The 52 week range of Swiggy shares highlights the scale of volatility. The stock touched a high of about ₹474 in September 2025. It also recorded a low near ₹297 in May 2025. These wide movements indicate that investors are still trying to find the right valuation for the company.

Market capitalization currently stands around ₹84,000 to ₹86,000 crore. This keeps Swiggy among the major listed consumer tech firms in India. Yet the recent fall has raised questions about near term confidence.

Q3 FY26 Results Snapshot

Swiggy reported strong revenue growth in the December quarter of FY26. Revenue from operations rose by nearly 54 percent year on year to around ₹6,148 crore. This growth came mainly from food delivery and quick commerce segments.

Food delivery showed steady improvement. Gross order value grew around 20 percent. Operating margins also improved to about 3 percent. This suggests that Swiggy’s core business is becoming more efficient with scale.

Instamart and quick commerce recorded very high growth in gross order value of over 100 percent year on year. Average order value also improved. However, contribution margin in this segment remained negative at around minus 2.5 percent. This shows that rapid expansion is still coming at a cost.

Despite revenue growth, net loss widened to about ₹1,065 crore compared to ₹799 crore in the same quarter last year. Adjusted EBITDA loss stood between ₹712 and ₹782 crore. Heavy investments in dark stores, delivery network, and customer offers increased expenses.

Why the Stock Fell After Results

The market reaction focused more on losses than on revenue growth. Investors were expecting clearer progress toward profitability in quick commerce. Instead, losses widened as Swiggy continued to spend aggressively.

Competition in quick commerce remains intense. Players are fighting for market share using discounts and faster delivery promises. Swiggy management stated that it is avoiding deep discount wars and focusing on sustainable growth. While this approach is positive in the long run, it slowed near term expansion compared to rivals.

Another factor was guidance. Management maintained its target of achieving contribution margin breakeven in quick commerce by Q1 FY27. However, analysts noted that the path to this goal looks steeper than before due to competitive pressure and rising costs.

These points led to short term disappointment. As a result, the stock saw selling pressure immediately after the results announcement.

Analyst Views Remain Mixed

Brokerage reactions to Swiggy’s Q3 performance were divided. Some firms downgraded their outlook due to weaker than expected profitability in quick commerce. Others maintained a positive long term view based on valuation and business potential.

A few brokerages reduced their target prices to the ₹335 to ₹375 range. They cited slower growth in quick commerce and higher losses as key reasons. These firms prefer peers that show clearer profit visibility.

On the other hand, several analysts kept a Buy rating with targets between ₹440 and ₹546. They believe Swiggy is trading at a valuation discount compared to competitors. They also see long term opportunity in quick commerce and food delivery scale.

Consensus estimates suggest an average 12 month target price between ₹480 and ₹563. This implies an upside of 50 to 70 percent from current levels. Still, most analysts advise caution in the short term until profitability improves.

Management Strategy and Balance Sheet

Swiggy’s leadership emphasized disciplined execution in its earnings commentary. The company stated that it will not chase unsustainable growth through heavy subsidies. Instead, it will focus on higher order value, better margins, and differentiated product offerings.

The company recently raised around ₹10,000 crore through a qualified institutional placement. This strengthened its balance sheet and provided long term funding for expansion. With strong cash reserves, Swiggy aims to support innovation while controlling losses.

Management also highlighted growth in multi service users. Over 36 percent of users now use more than one Swiggy service such as food delivery and Instamart. This cross sell strategy can improve customer lifetime value over time.

Public Sentiment and Social Media Buzz

Public opinion on Swiggy share price remains divided. Many retail investors expressed frustration over widening losses despite strong revenue growth. The post results drop of 5 to 7 percent added to disappointment.

At the same time, there is appreciation for Swiggy’s execution in food delivery. Users and analysts praised improvements in margins and order growth. There is also support for the company’s decision to avoid irrational competition in quick commerce.

Some investors view the current decline as a buying opportunity. They believe that once breakeven is achieved, the stock could rebound strongly. Others remain cautious and prefer to wait for clearer profit trends.

Overall tone across online discussions reflects cautious realism. There is concern about near term performance but confidence in the company’s long term strategy.

What Investors Are Watching Next

The next few quarters will be critical for Swiggy. Investors will closely track progress in quick commerce contribution margins. Any signs of faster movement toward breakeven could improve sentiment.

Food delivery margins will also remain in focus. Continued improvement here can offset losses from other segments. Growth in average order value and user base will indicate the strength of demand.

Competition remains a major risk factor. Price wars or aggressive expansion by rivals could delay Swiggy’s profitability targets. At the same time, a more rational competitive environment could help the stock re rate.

Macroeconomic conditions and consumer spending trends will also influence performance. As a consumer tech stock, Swiggy is sensitive to changes in discretionary spending.

Conclusion

Swiggy share price in January 2026 reflects the tension between growth and profitability. The company delivered strong revenue expansion but disappointed markets with wider losses. This led to sharp short term correction in the stock.

Analysts and investors remain divided. Some focus on the challenges in quick commerce. Others highlight the long term opportunity and valuation comfort. Management’s strategy of disciplined growth and its strong balance sheet provide support for future execution.

The story of Swiggy in 2026 is still unfolding. It represents the broader challenge faced by high growth tech firms in India. Balancing scale with sustainable profits will determine whether the recent fall is a temporary setback or part of a longer adjustment phase.

Tags: Swiggy share price, Swiggy Q3 results, Indian tech stocks, quick commerce sector, food delivery market, NSE stocks

Share This Post