Rule of 72 by Luca Pacioli: Meaning, History, and Why It Still Matters

Rule of 72 by Luca Pacioli: Meaning, History, and Why It Still Matters | Image Via Wikipedia

The Rule of 72 is one of the simplest ideas in personal finance. It helps people understand how fast money can grow with compound interest. Even after hundreds of years, it remains useful because it explains a complex concept in a very direct way.

This rule is often shared among investors, students, and finance educators because it works without calculators. It gives a quick estimate of how long it takes for money to double, based on a fixed annual growth rate.

Table of Contents

Key Takeaways

- The Rule of 72 estimates how many years it takes for money to double

- You divide 72 by the annual rate of return

- It works best for rates between 6 percent and 10 percent

- The rule is linked to Luca Pacioli’s work from the 15th century

- It applies to investing, inflation, debt, and dividend growth

Also Read: 100 Minus Age Rule by John Bogle Explained Clearly: This Rule Built Millionaire Portfolios

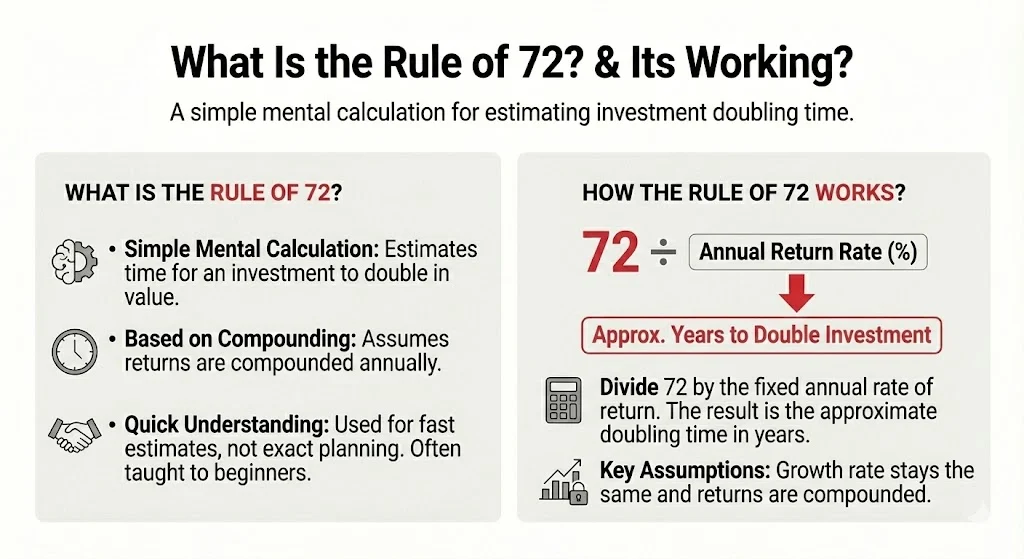

What Is the Rule of 72?

The Rule of 72 is a simple mental calculation used in finance. It helps estimate how long an investment may take to double in value when the returns are compounded every year. This rule is mainly used for quick understanding, not for exact planning.

Instead of using calculators or complex formulas, the Rule of 72 gives a fast answer that is close enough for most real life situations. Because of this, it is often taught to beginners in personal finance.

How the Rule of 72 Works?

The working of the rule is based on one easy division. You divide the number 72 by the expected annual rate of return. The result tells you the approximate number of years needed for the investment to double.

Here is the basic structure of the rule:

- Take the fixed number 72

- Divide it by the annual return rate

- The final number shows the doubling time in years

This method assumes that the growth rate stays the same each year and that returns are compounded.

Simple Formula Explained

The Rule of 72 uses one basic calculation.

Years to double = 72 ÷ annual rate of return

You always use the percentage number, not the decimal. For example, use 6 instead of 0.06.

If you want to reverse the calculation, you can also estimate the return needed to double money within a specific time.

Rate of return = 72 ÷ number of years

This flexibility makes the rule useful in many financial situations.

Examples Using Common Growth Rates

Below is a simple representation of how the rule works with common return rates.

| Annual Rate | Years to Double |

|---|---|

| 6 percent | 12 years |

| 8 percent | 9 years |

| 10 percent | 7.2 years |

These numbers are approximate. They are close enough to help with planning and comparison.

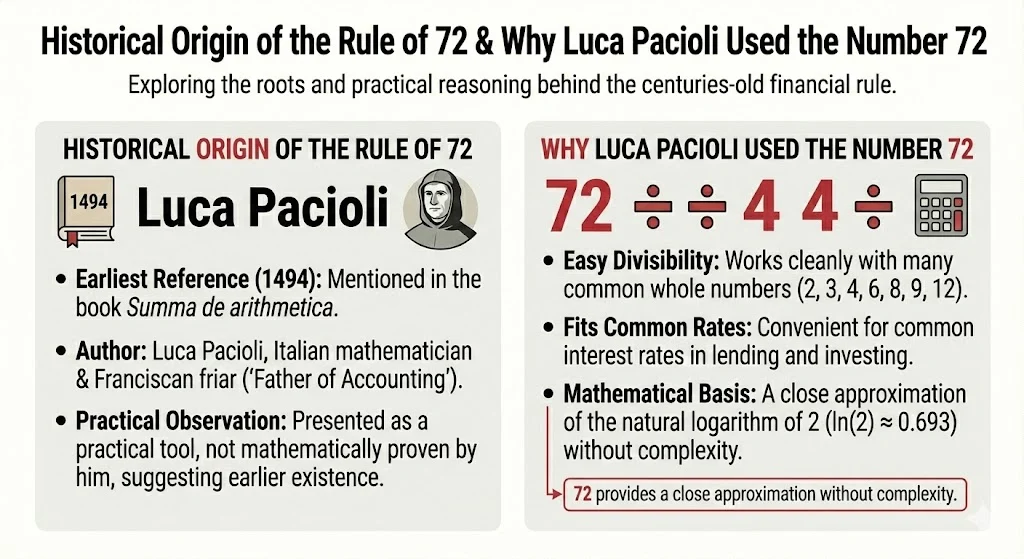

Historical Origin of the Rule of 72

The earliest known reference to the Rule of 72 appears in 1494. It was mentioned in the book Summa de arithmetica.

The author was Luca Pacioli, an Italian mathematician and Franciscan friar. He is widely known as the father of accounting.

Pacioli did not mathematically prove the rule. He presented it as a practical observation, which suggests the idea existed even before his time.

Why Luca Pacioli Used the Number 72?

The number 72 is easy to divide. It works cleanly with many whole numbers like 2, 3, 4, 6, 8, 9, and 12.

Because of this, it fits common interest rates used in lending and investing. This convenience is one reason the rule survived for centuries.

The math behind it comes from the natural logarithm of 2, which is close to 0.693. The number 72 provides a close approximation without complexity.

Common Myths Around the Rule of 72

Many people believe Albert Einstein created the Rule of 72. Some even claim he called compound interest the eighth wonder of the world.

There is no historical proof of this. The earliest clear reference remains linked to Luca Pacioli’s work from the 15th century.

Despite the myth, the popularity of the rule continues because it works well in everyday finance.

Why the Rule of 72 Is Still Popular Today

Recent discussions from 2025 and 2026 show strong interest in the rule. Many investors share it on social platforms as a basic wealth concept.

People often describe it as a simple way to understand compounding. It helps explain why starting early matters more than chasing high returns.

Posts commonly highlight examples like 10 percent growth doubling money in about seven years. These examples make long term investing easier to grasp.

Use of the Rule of 72 in Investing

The rule helps investors compare different return scenarios. It allows quick judgment on whether a return rate is attractive.

For long term investments like stocks, mutual funds, or retirement accounts, it gives a rough growth timeline.

Dividend investors also use it to understand how reinvested income compounds over time.

Application to Dividend Investing

Dividend investing focuses on steady income and long term growth. The Rule of 72 shows how even modest returns can lead to significant growth.

At 6 percent growth, money doubles in about twelve years. Over decades, this creates multiple doubling cycles.

This explains why dividend investors value consistency and patience over short term price movement.

Rule of 72 and Inflation

The rule also works in reverse. It can estimate how long money loses half its value due to inflation.

If inflation runs at 6 percent, purchasing power may drop by half in about twelve years.

This insight helps people understand why low interest savings accounts fail to protect wealth over time.

Use of the Rule of 72 for Debt

Debt grows through compound interest as well. The Rule of 72 can show how fast unpaid balances increase.

For example, credit card debt at 12 percent may double in six years.

This highlights the importance of managing high interest debt early.

Accuracy and Limitations of the Rule

The Rule of 72 is not exact. It is an approximation meant for quick understanding.

It works best when interest rates fall between 6 percent and 10 percent. Accuracy declines at very low or very high rates.

It also assumes a constant rate, which rarely happens in real markets.

Adjustments and Variations of the Rule

Some people adjust the rule for better precision.

At rates higher than 10 percent, using 73 instead of 72 improves accuracy. For daily compounding, numbers like 69 or 69.3 are sometimes used.

These variations are useful, but the original rule remains the easiest to remember.

Why the Rule of 72 Matters in Today’s Economy

In periods of market volatility, people look for clarity. The Rule of 72 offers a simple framework.

It helps investors see how asset quality affects growth speed. Higher returns move the clock faster.

It also reinforces the idea that inflation quietly erodes savings over time.

Final Thoughts on the Rule of 72

The Rule of 72 has survived for over five centuries because it explains a powerful idea with minimal effort.

It does not replace detailed planning, calculators, or financial advice. It provides a starting point.

Understanding this rule helps people think clearly about growth, time, and financial choices in a changing economy.

Tags: Rule of 72, compound interest, Luca Pacioli, personal finance basics, investing education, financial literacy

Share This Post