Rule of 144 Finance Guide: Your Money Can Grow 4X

Rule of 144 Finance Guide: Your Money Can Grow 4X

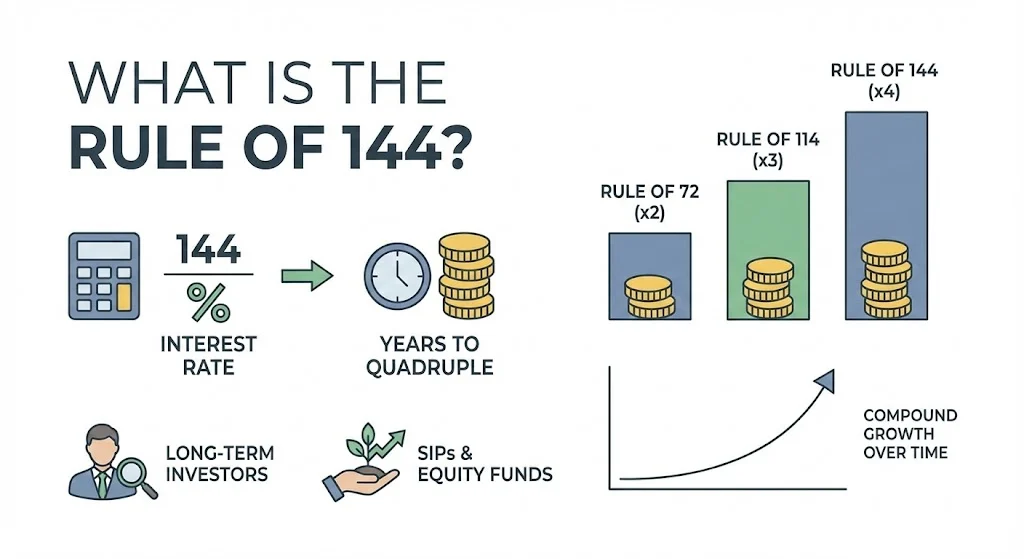

The Rule of 144 is a simple finance rule that helps investors understand how long it may take for their money to grow four times. It is used in long term investing to get a clear idea of wealth growth without complex calculations. This rule is now widely used by people who invest in mutual funds, SIPs, fixed deposits and stocks.

In recent years the Rule of 144 has gained strong popularity in India and global markets. Many investors use it to plan retirement goals and long term wealth targets. It is often shared in finance education threads because it shows how time and compounding work together.

Table of Contents

Key Takeaways

- The Rule of 144 helps estimate when your investment may become four times

- It works on simple division using your expected return rate

- It is useful for mutual funds, SIPs, stocks and fixed deposits

- It is part of the 72 114 144 compounding rule group

- It supports long term financial planning

Also Read: 20 30 40 Rule For Buying A House: Buy a Home Without Debt Stress

What Is the Rule of 144

The Rule of 144 is a thumb rule used in investing. It tells you how many years it can take for your money to become four times its original value. This rule is based on compound growth which means your returns also earn returns over time.

This rule is similar to the Rule of 72 and Rule of 114. The Rule of 72 estimates how long it takes to double money. The Rule of 114 shows how long it takes to triple money. The Rule of 144 goes one step further and shows when money becomes four times.

It is used by long term investors who focus on steady returns and discipline. It is also popular among people who invest in SIPs and equity mutual funds.

Rule of 144 Formula

The formula of the Rule of 144 is very simple.

Years to quadruple = 144 ÷ Annual rate of return

The return rate is taken in percentage form. You do not need complex calculators to use this rule. You only need to know your expected yearly return.

For example if an investment gives 12 percent return per year then

144 ÷ 12 = 12 years

This means your money may become four times in around 12 years.

How The Rule Of 144 Works In Real Life

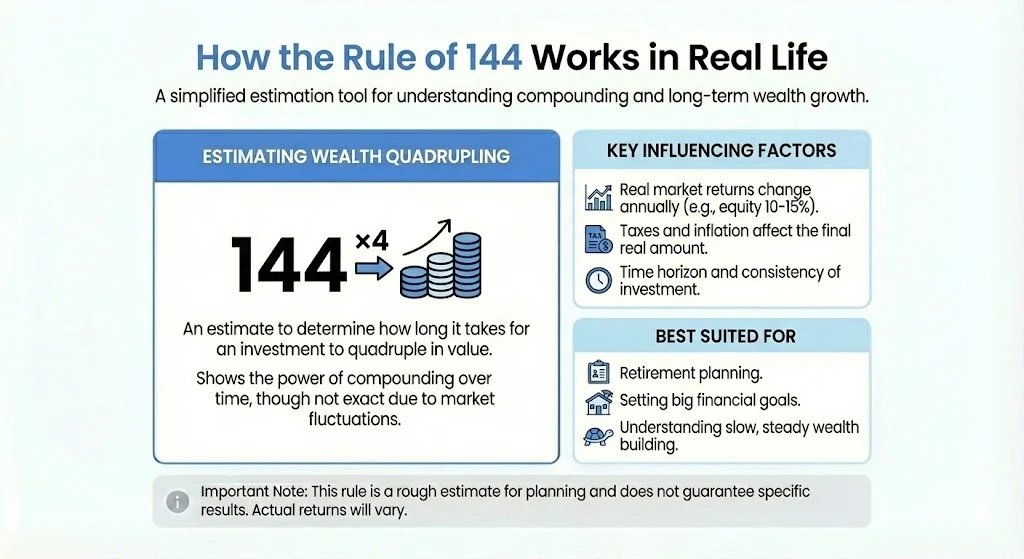

The Rule of 144 is not exact. It is an estimate that helps you plan. Real market returns change every year. Taxes and inflation also affect the final amount. Still this rule gives a clear picture of how compounding works over time.

This rule is often used for equity mutual funds and SIPs. These investments usually deliver returns in the range of 10 to 15 percent in the long run. With such returns the time to grow money four times becomes reasonable.

Many investors use this rule when planning retirement or big financial goals. It helps them understand that wealth is built slowly and steadily.

Rule Of 144 Examples

Here are some real world return examples based on recent finance discussions.

| Annual Return | Years to 4x |

|---|---|

| 12% | 12 years |

| 9% | 16 years |

| 6% | 24 years |

At 12 percent which is common for equity mutual funds your money may become four times in about 12 years.

At 9 percent which is often seen in balanced funds it may take about 16 years.

At 6 percent which is common for fixed deposits and bonds it may take about 24 years.

This table shows why higher long term returns matter.

How ₹2 Lakh Can Become ₹8 Lakh

The Rule of 144 is often explained using a simple example of ₹2 lakh growing to ₹8 lakh. ₹8 lakh is four times of ₹2 lakh so the rule applies here.

Using different return rates we can estimate the time.

| Rate of Return | Years Required | Initial Amount | Final Amount |

|---|---|---|---|

| 8% | 18 | 2,00,000 | 8,00,000 |

| 10% | 14.4 | 2,00,000 | 8,00,000 |

| 12% | 12 | 2,00,000 | 8,00,000 |

At 8 percent it may take around 18 years.

At 10 percent it may take around 14.4 years.

At 12 percent it may take around 12 years.

This example is often used in SIP and mutual fund planning.

Why Investors Use the Rule of 144

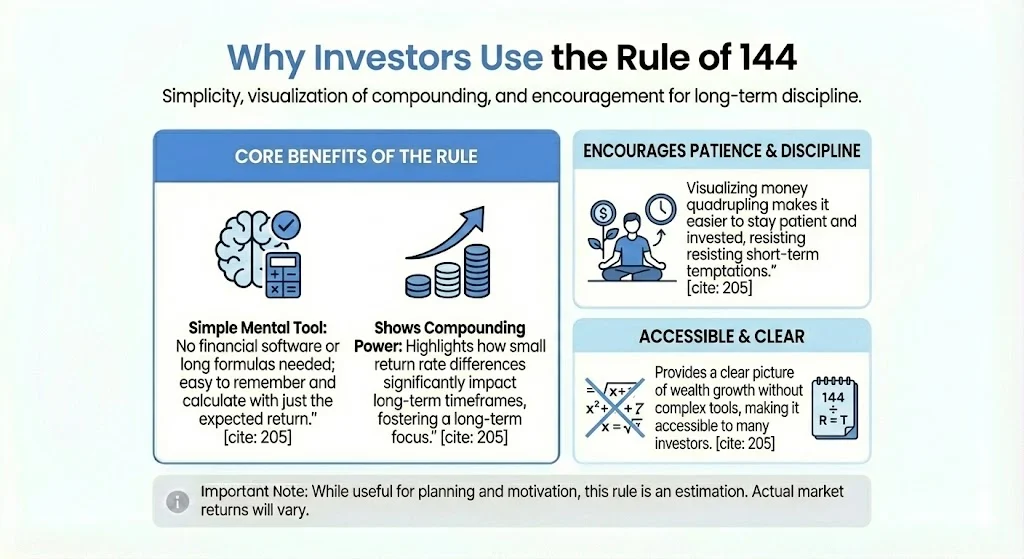

The Rule of 144 is popular because it is easy to remember. You do not need financial software or long formulas. You only need to know your expected return.

It also shows the real power of compounding. Small differences in return rates can change the final time by many years. This makes investors focus on long term growth instead of short term profits.

Many people on finance platforms say it helps them stay invested. When you see how money can become four times over time it becomes easier to stay patient.

Rule of 72 114 and 144 Together

These three rules are often taught together.

- Rule of 72 shows when money doubles.

- Rule of 114 shows when money triples.

- Rule of 144 shows when money becomes four times.

All three use the same method of dividing a number by the return rate. They are used in mutual fund planning and retirement planning.

For example at 12 percent return

72 ÷ 12 = 6 years to double

114 ÷ 12 = 9.5 years to triple

144 ÷ 12 = 12 years to quadruple

This shows how growth accelerates with time.

How SIP Investors Use the Rule of 144

SIP investors often use the Rule of 144 to understand long term wealth creation. When you invest every month in equity mutual funds you benefit from compounding and market growth.

Many long term equity SIPs have delivered returns near 10 to 12 percent over long periods. This means investors can see their total invested amount grow four times in 12 to 15 years.

This rule helps investors stay focused on time rather than daily market movement.

What People Say About the Rule of 144 ( From X )

Recent finance discussions show strong support for this rule. Many investors call it a golden rule of wealth building. They say it helps them stay disciplined and avoid panic.

People also use it in financial education posts. It is often shared as a must know rule for beginners. It shows that wealth does not come from shortcuts but from patience and consistency.

Many posts link it to retirement planning and financial freedom. It helps people see how even moderate returns can lead to large wealth if given enough time.

Difference Between Rule of 144 and Legal Rule 144

It is important to know that this finance rule is not the same as the legal Rule 144 used by the US SEC. The legal rule deals with selling restricted company shares.

The Rule of 144 discussed here is only about compounding and investment growth. They are two different things.

Is the Rule of 144 Accurate

The Rule of 144 is an estimate. It assumes stable compounding and fixed return. Real life investing does not work this way. Markets move up and down. Inflation and taxes reduce returns.

Still this rule is very useful for planning. It gives a clear target and helps people avoid unrealistic expectations.

It is best used for long term projections and goal setting.

Final Thoughts on the Rule of 144

The Rule of 144 is one of the most useful tools in personal finance. It shows how time and returns work together. It helps investors stay focused on long term wealth instead of quick gains.

Whether you invest in mutual funds, SIPs, stocks or fixed deposits this rule gives you a simple way to estimate future value. It also encourages patience and discipline which are the real keys to financial success.

When used with proper investment planning this rule can help you build strong long term wealth.

Tags: rule of 144, compounding rule, investment growth, mutual fund planning, personal finance, wealth building

Share This Post