Margin Of safety Rule In Intelligent Investor : The Safety Formula Wall Street Hates

Margin Of safety Rule In Intelligent Investor : The Safety Formula Wall Street Hates

The margin of safety rule is one of the most important ideas in investing. It was introduced by Benjamin Graham in Chapter 20 of The Intelligent Investor. Graham described it as the central concept of sound investing. This rule is simple but very powerful.

It tells investors to buy assets at a price that is well below their real value. This gap between value and price gives protection. It protects against mistakes, market drops, and events that no one can predict. In modern markets this rule is even more important.

Key Takeaways On Margin Of Safety Rule

- Margin of safety means buying assets far below their real worth

- It protects investors from losses and wrong estimates

- It removes the need to predict the future

- It helps investors stay calm in volatile markets

- It is the foundation of value investing

Table of Contents

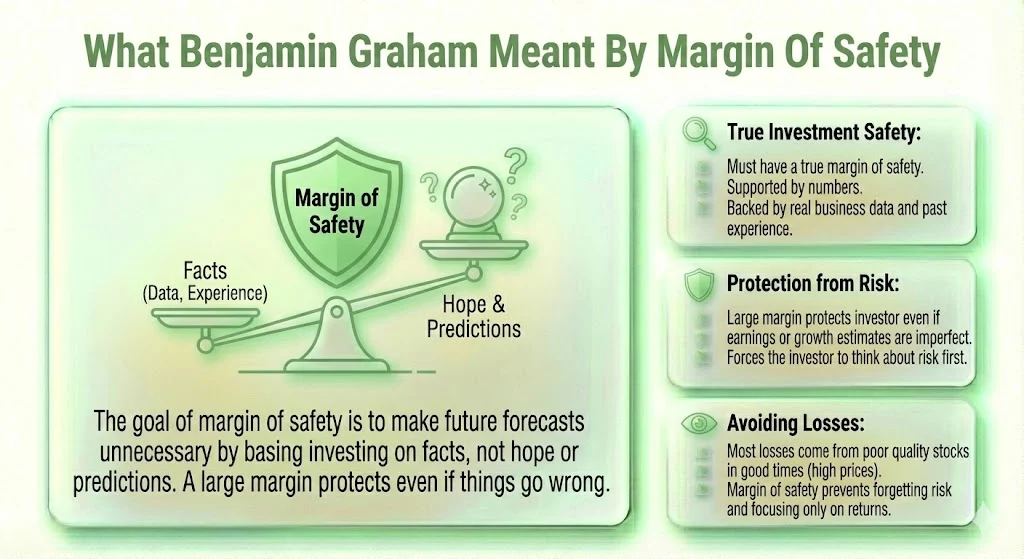

What Benjamin Graham Meant By Margin Of Safety

Benjamin Graham believed that investing should be based on facts. It should not be based on hope or predictions. He said the goal of margin of safety is to make future forecasts unnecessary. When you buy a stock with a large margin of safety, you do not need perfect estimates about earnings or growth.

Graham explained that a true investment must have a true margin of safety. This safety must be supported by numbers. It must be backed by real business data and past experience. If the margin is large enough, even if things go wrong, the investor stays protected.

He also said that most investor losses come from buying poor quality stocks during good times. When prices are high, people forget risk. They focus only on returns. Margin of safety forces the investor to think about risk first.

Also Read: Graham Number by Benjamin Graham: The One Number Value Investors Trust

How Margin Of Safety Works In Real Investing?

The idea is simple. First you estimate the intrinsic value of a stock. This is the real value of the business. It is based on earnings, assets, cash flow, and business strength. After that you compare this value to the market price.

If the stock trades far below its intrinsic value, it offers a margin of safety. If it trades close to or above its value, the margin is low or missing. In such cases the stock becomes risky even if the company is good.

For example if a stock is worth 100 based on careful analysis and it trades at 60, the margin of safety is 40. This gives room for errors. If earnings drop or the economy slows, the investor still has protection.

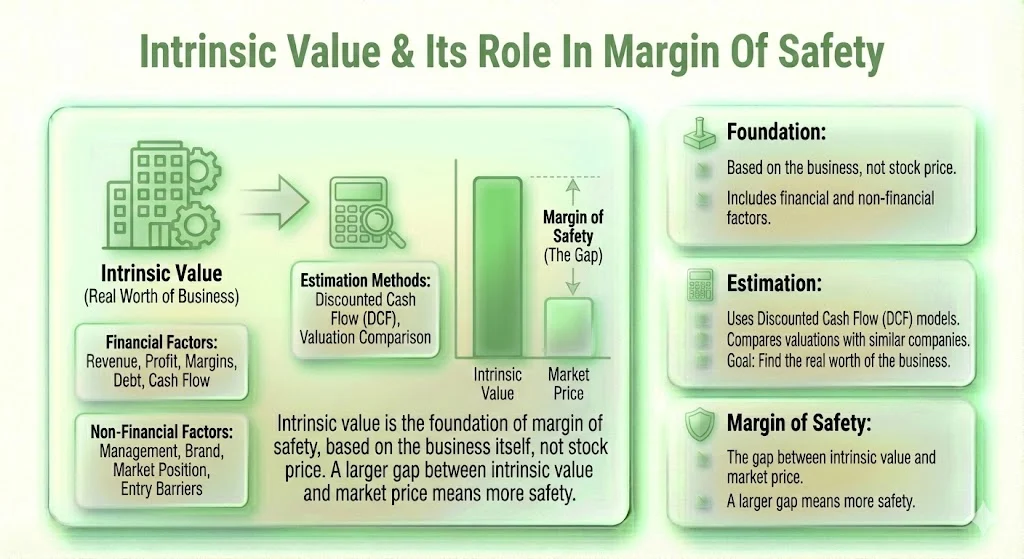

Intrinsic Value & Its Role In Margin Of Safety

Intrinsic value is the foundation of margin of safety. It is not based on the stock price. It is based on the business itself. It includes financial and non financial factors.

Financial factors include revenue growth, profit growth, operating margins, debt levels, return on capital, and cash flow. Non financial factors include management quality, brand strength, market position, and entry barriers.

Investors often use discounted cash flow models to estimate intrinsic value. Some also compare valuations with similar companies. The exact method can differ but the goal is the same. Find the real worth of the business.

The margin of safety is the gap between this intrinsic value and the market price. A larger gap means more safety.

Why Margin Of Safety Matters More In Modern Markets

In recent years markets have seen high valuations. AI stocks, growth stocks, and tech shares often trade at very high prices. Many stocks trade far above their intrinsic value. This leaves little room for mistakes.

From 2024 to 2026 this issue became more visible. Investors saw strong price swings. Inflation fears, interest rate changes, and global tensions added risk. In such conditions margin of safety became more important than ever.

Many investors on social media now warn about overpaying for quality stocks. Even great companies become bad investments if bought at too high a price. High price to earnings multiples reduce margin of safety. They turn investing into speculation.

What Value Investors Say About Margin Of Safety Today

Recent discussions show strong respect for this principle. On X many investors call it survival. They say it is the only true hedge against irrational markets. One popular quote says margin of safety is not optional. It is survival.

People also talk about emotional discipline. Margin of safety helps investors ignore market noise. It helps them focus on facts instead of hype. It keeps them from chasing stocks out of fear of missing out.

With high valuations in many markets, investors warn that risk management is often missing. They say the margin of safety rule has never been more relevant.

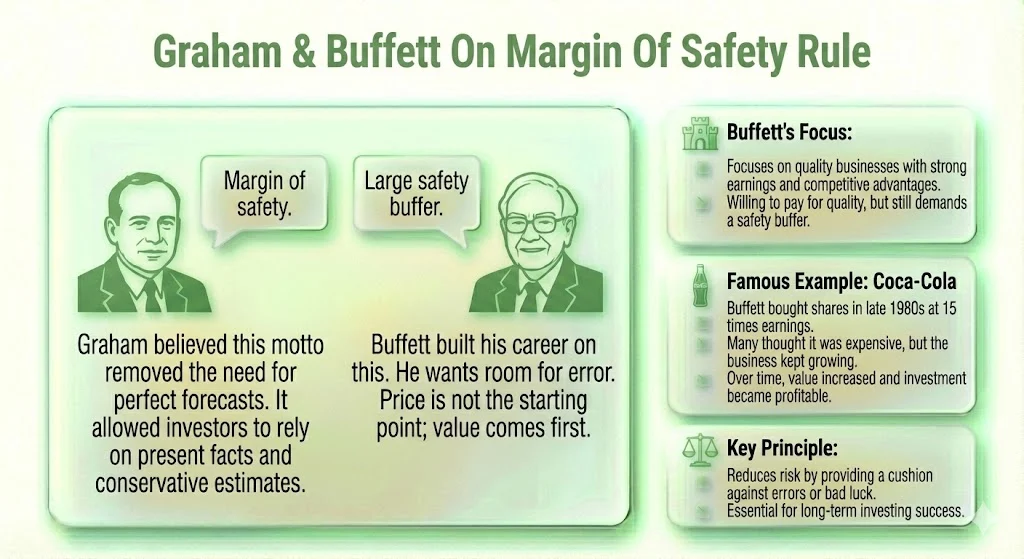

Graham & Buffett On Margin Of Safety Rule

Benjamin Graham summed up his idea in three words. Margin of safety. He believed this motto removed the need for perfect forecasts. It allowed investors to rely on present facts and conservative estimates.

Warren Buffett built his entire career on this idea. He always looks for a large margin of safety. He does not want to cut it close. He wants room for error.

Buffett also focuses on quality businesses. He is willing to pay for strong earnings and competitive advantages. But he still wants a safety buffer. Price is not the starting point for him. Value comes first.

A famous example is Coca Cola. In the late 1980s Buffett bought shares when many thought it was expensive. The stock traded at 15 times earnings. But the business kept growing. Over time the value increased and the investment became very profitable.

The Two Thirds Rule From Benjamin Graham

Graham also gave a clear rule for enterprising investors. He suggested buying stocks at two thirds or less of their indicated value. This means paying no more than 66 percent of what the business is worth.

This rule creates a strong margin of safety. It allows for errors in analysis. It also protects against economic downturns. Many value investors still use this rule today.

How Margin Of Safety Reduces Risk?

Margin of safety does not remove risk. It reduces the chance of permanent loss. It increases the odds of success over time.

There are many risks in investing. Some are known. Some are unknown. Graham called these unknown unknowns. These are risks no one can predict. A large margin of safety is the best defense against them.

It also protects against wrong assumptions. Every valuation is based on estimates. Growth may slow. Costs may rise. Markets may change. A wide safety margin gives room for these mistakes.

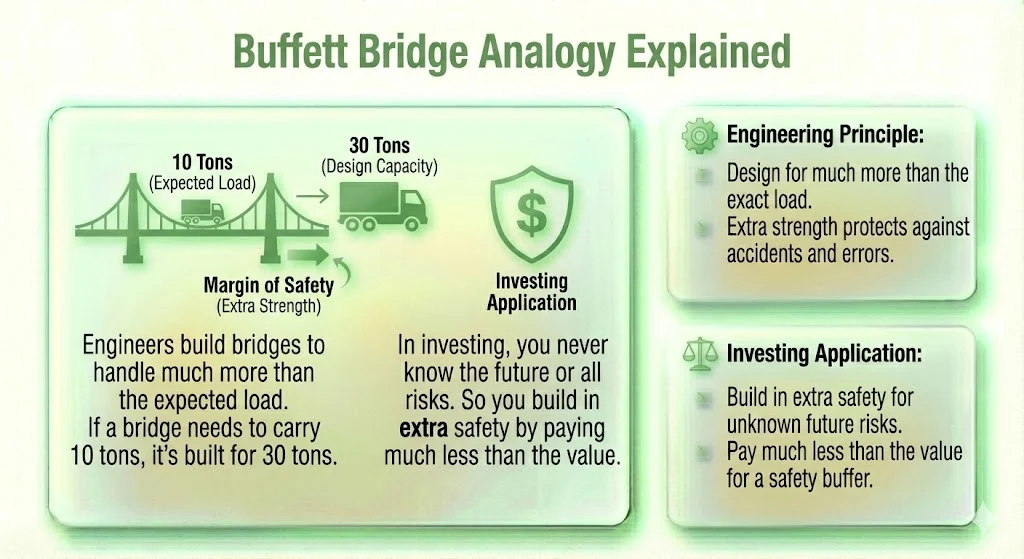

Buffett Bridge Analogy Explained

Buffett often explains margin of safety using a bridge example. When engineers build a bridge, they do not design it for the exact load. They design it to handle much more.

If a bridge needs to carry 10 tons, it is built for 30 tons. That extra strength is the margin of safety. It protects against accidents and errors.

Investing works the same way. You never know the future. You never know all the risks. So you build in extra safety by paying much less than the value.

Margin Of Safety & Diversification

Graham also stressed diversification. Even with a margin of safety some investments will fail. No method is perfect.

By holding a group of undervalued stocks, the overall risk is reduced. Losses in one stock can be offset by gains in others. Margin of safety improves the odds. Diversification protects against the unexpected.

How Modern Investors Apply The Rule?

Today the margin of safety idea is used in many areas. It is used in stocks, private credit, venture debt, and even energy investments. During trends like AI, some investors buy supporting businesses instead of the hottest stocks. These are called the shovels of the trend.

The key remains the same. Do not overpay. Demand a safety buffer. Protect the downside.

Some investors try to avoid margin of safety by making aggressive forecasts. They assume high growth to justify high prices. This is risky. It removes the safety net.

Public Sentiment Around Margin Of Safety

Recent tweets show strong respect for this principle. Many users call it timeless wisdom. They see it as the line between investing and gambling.

Some compare it to engineering buffers. Others link it to ruin avoidance. The idea is simple. Avoid big losses and you allow compounding to work.

People also pair it with other Graham ideas like Mr Market and intrinsic value. Together they form a complete investing philosophy.

Margin Of Safety In Current Market Conditions

From 2025 to 2026 markets faced many uncertainties. Inflation, geopolitical issues, and asset bubbles created risk. Traditional portfolios were questioned. But the margin of safety rule stayed relevant.

Investors looked for downside protection. They wanted assets priced with caution. They wanted to avoid permanent capital loss.

This rule helped investors stay rational. It helped them avoid hype. It helped them focus on real business value.

Why This Rule Will Always Matter?

The margin of safety rule is not tied to any one market. It works in all times. It works because human behavior does not change. Fear and greed always exist.

By buying with a large safety margin, investors protect their capital. They avoid wipeouts. They give themselves time to benefit from long term growth.

This is why the rule is still respected after more than 70 years. It remains the core of value investing. It remains the foundation of disciplined investing.

Key Margin Of Safety Ideas From Recent Discussions

| Idea | Meaning |

|---|---|

| Margin of safety is survival | It protects against irrational markets |

| Focus on downside | Protect capital before chasing returns |

| Avoid overpaying | High prices remove safety |

| Emotional discipline | Ignore hype and market moods |

| Demand a buffer | Never cut it close |

Final thoughts On Margin Of Safety Rule

Benjamin Graham created a simple rule that changed investing forever. Buy with a margin of safety. This one idea separates investors from speculators.

In modern markets filled with hype and high prices, this rule is more important than ever. It helps investors stay grounded. It protects them from big losses. It allows long term wealth to grow.

By focusing on value and safety, investors do not need to predict the future. They only need to buy wisely.

Tags: margin of safety, value investing, intelligent investor, benjamin graham, warren buffett, stock valuation

Share This Post