Graham Number by Benjamin Graham: The One Number Value Investors Trust

Graham Number by Benjamin Graham The One Number Value Investors Trust | Image With TheStreet

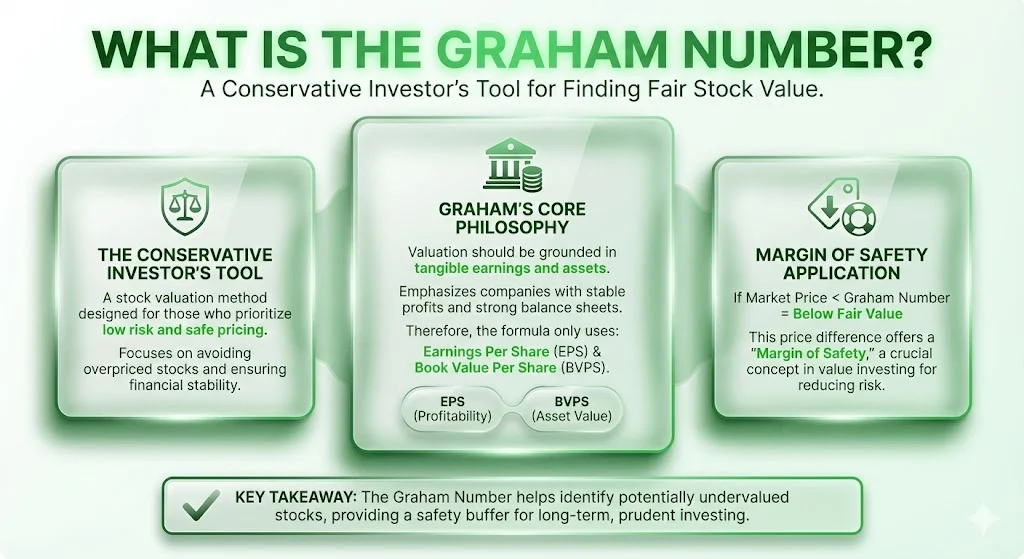

The Graham Number is one of the oldest and most respected valuation ideas in the stock market. It comes from Benjamin Graham who is known as the father of value investing and also the mentor of Warren Buffett. Even today in 2025 many investors still use this number to check if a stock is trading at a fair price or if it has moved too far from its real value.

In simple words the Graham Number tells you the highest price a defensive investor should pay for a stock. It uses only two basic financial numbers which are earnings per share and book value per share. If the market price of a stock is below this number then the stock is seen as undervalued based on Graham’s rules.

Table of Contents

Key takeaways On Graham Number

- The Graham Number was created from the investing ideas of Benjamin Graham

- It shows the maximum safe price to pay for a stock

- The formula uses earnings per share and book value per share

- It is based on a P E limit of 15 and a P B limit of 1.5

- It is mainly used by conservative and defensive investors

- It is still used in 2025 as a quick value check in high priced markets

What Is The Graham Number?

The Graham Number also called the Benjamin Graham Number is a stock valuation tool. It shows the fair value of a stock for a conservative investor. A conservative investor is someone who does not want to take high risk and prefers to buy stocks at a safe price.

According to Graham a stock should not be priced too high when compared to its earnings and its assets. He believed that investors should focus on companies that have stable profits and strong balance sheets. This is why the Graham Number only uses earnings per share and book value per share.

If a stock is trading below its Graham Number then it means the market price is lower than what Graham would consider fair. In that case the stock may offer a margin of safety. This margin of safety is one of the most important ideas in value investing.

How The Graham Number Was Created?

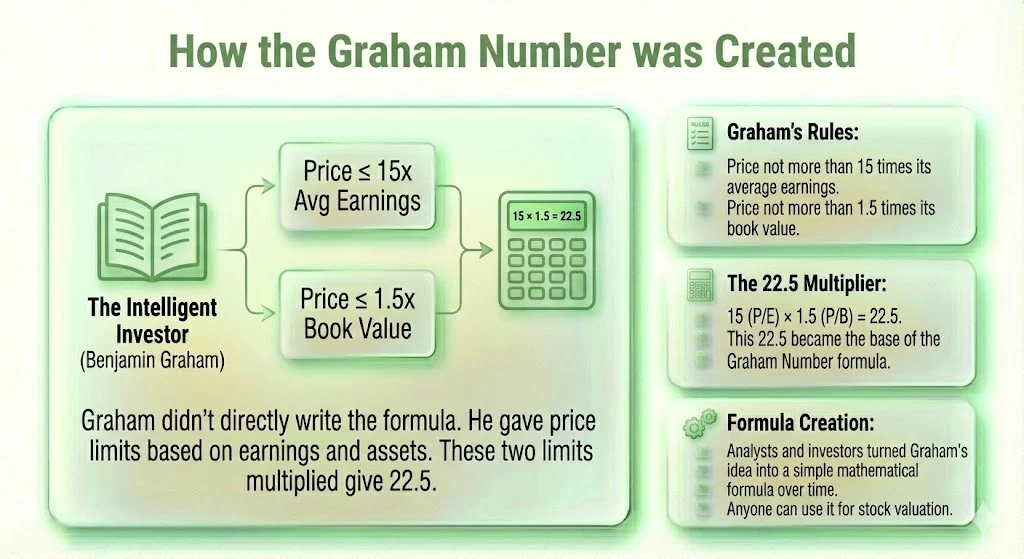

Benjamin Graham explained his stock selection rules in his famous book The Intelligent Investor. He did not directly write the formula of the Graham Number. He gave limits on how expensive a stock should be based on earnings and assets.

Graham suggested that the price of a stock should not be more than 15 times its average earnings. He also said that the price should not be more than 1.5 times its book value. When these two limits are multiplied the result is 22.5.

This 22.5 became the base of the Graham Number formula. Over time analysts and investors turned this idea into a simple mathematical formula that anyone can use.

Also Read: Margin Of safety Rule In Intelligent Investor : The Safety Formula Wall Street Hates

Graham Number formula

The formula of the Graham Number is

Graham Number = square root of 22.5 x EPS x BVPS

Where

EPS means Earnings Per Share

BVPS means Book Value Per Share

The number 22.5 comes from 15 multiplied by 1.5. The 15 represents the maximum P E ratio and the 1.5 represents the maximum P B ratio that Graham allowed.

Earnings per share is calculated as:

Net profit divided by total shares

Book value per share is calculated as:

Shareholders equity divided by total shares

This formula gives the highest price that a defensive investor should be willing to pay for a stock.

Example of Graham Number

Let us take a simple example. Assume a company has

EPS of 8

BVPS of 1.2

Now apply the formula

Graham Number = square root of 22.5 x 8 x 1.2

First multiply the values

22.5 x 8 x 1.2 = 216

Now take the square root

Square root of 216 is 14.6969

So the Graham Number is 14.6969

This means that based on Graham’s rules a conservative investor should only buy this stock if its market price is below 14.6969. If the stock is trading above this level then it is considered overvalued.

Why the Graham Number is still used in 2025

In 2025 and 2026 many stock markets are trading at high valuations. Growth stocks and technology companies have pushed prices higher. Because of this many investors look for tools that help them avoid overpaying.

On X which is also called Twitter value investors still discuss the Graham Number. Many users use it to screen stocks in sectors like insurance manufacturing and mining. These are asset heavy sectors where book value and earnings still matter.

Some investors shared that certain stocks were trading 150 percent below their Graham implied value. This made those stocks attractive for defensive investing. Another user pointed out a stock with a Graham Number of around 276 while the market price was 283. This suggested caution and possible overvaluation.

In Indonesia many retail investors calculate the Graham Number for local stocks. They call stocks trading below this value as diskon which means discounted.

Graham Number & Margin Of Safety

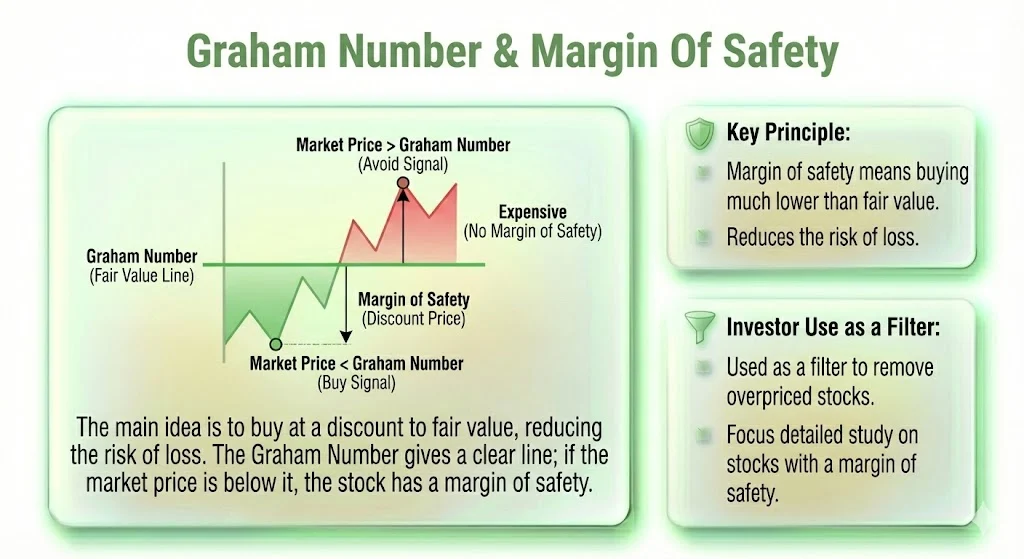

The main idea behind the Graham Number is margin of safety. This means buying a stock at a price that is much lower than its fair value. When you buy at a discount you reduce the risk of loss.

The Graham Number gives a clear line. If the market price is below this line then the stock has a margin of safety. If the price is above this line then the stock is too expensive for a conservative investor.

This is why many value investors use the Graham Number as a filter. They first remove stocks that are priced too high. Then they study the remaining stocks in more detail.

Advantages Of The Graham Number

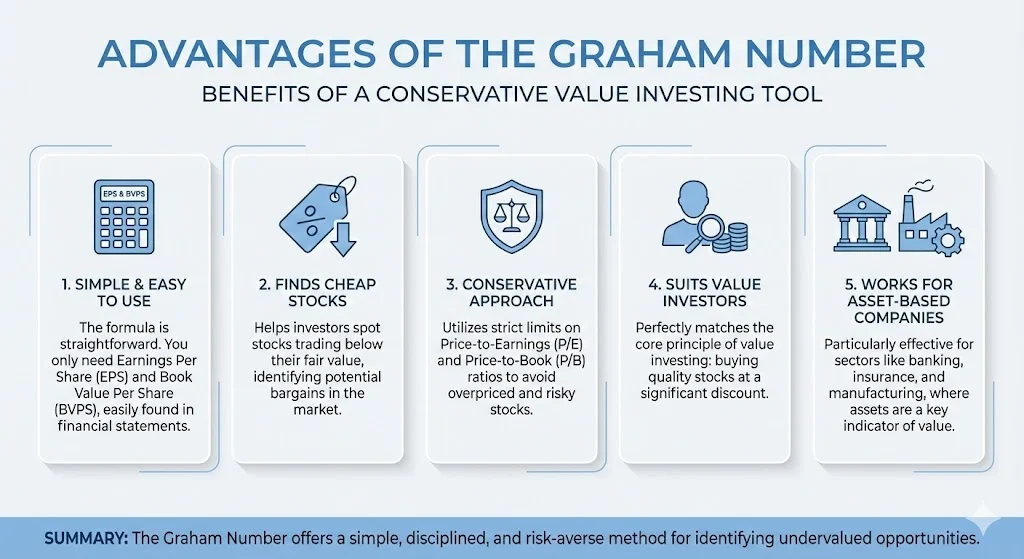

The Graham Number has several benefits for investors.

- It is simple: The formula is easy to use. You only need EPS and BVPS which are available in financial statements.

- It helps find cheap stocks: It helps investors spot stocks that are trading below their fair value.

- It is conservative: Since it uses strict limits on P E and P B it avoids overpriced stocks.

- It suits value investors: It matches the core idea of buying stocks at a discount.

- It works well for asset based companies: Sectors like banking insurance and manufacturing fit well with this model.

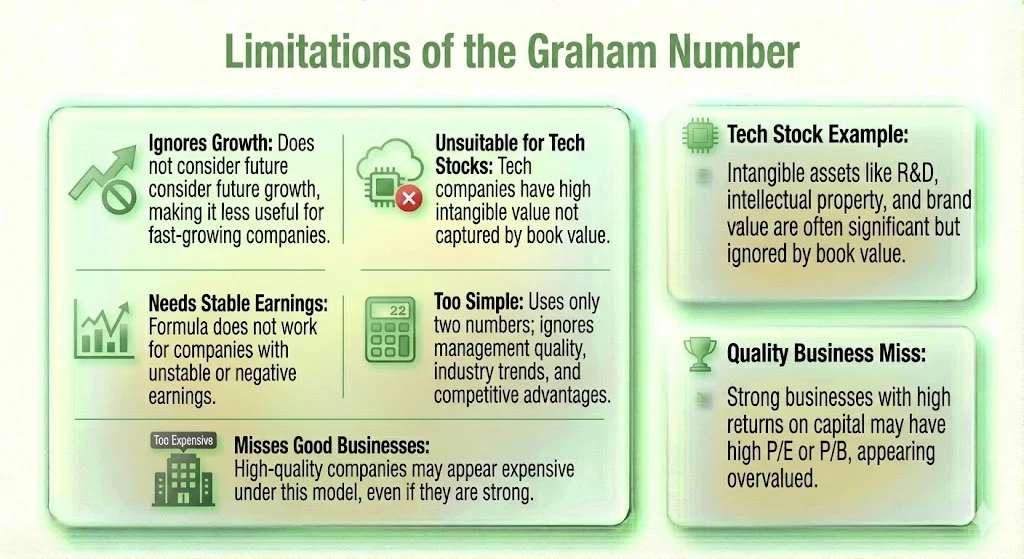

Limitations of the Graham Number

The Graham Number also has weaknesses they are as follow:

- It ignores growth: It does not consider future growth of a company. This makes it less useful for fast growing companies.

- It does not suit technology stocks: Tech companies have high intangible value which book value does not capture.

- It needs stable earnings: If a company has unstable or negative earnings then the formula does not work.

- It uses only two numbers: It does not look at management quality or industry trends.

- It can miss good businesses: High quality companies may look expensive under this model even if they are strong.

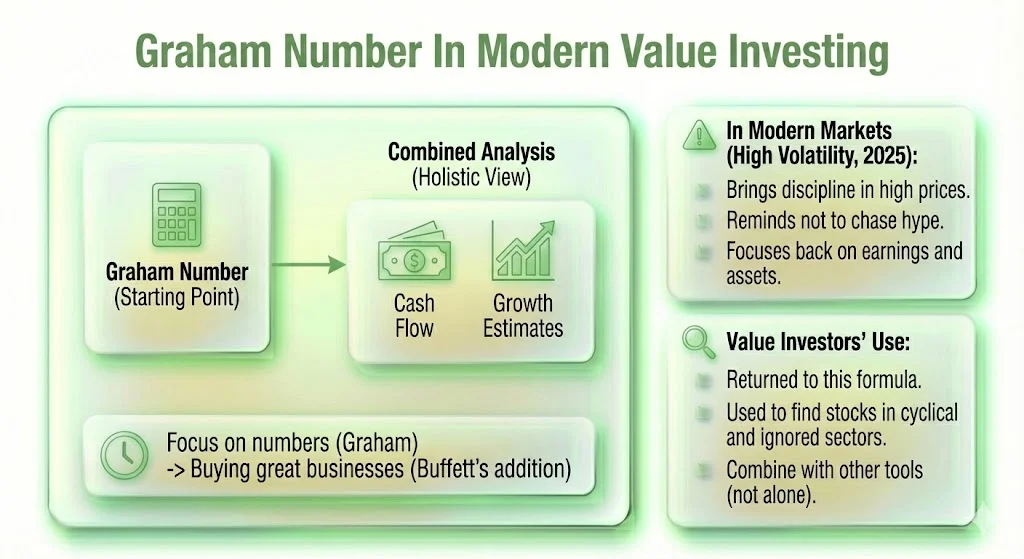

Graham Number In Modern Value Investing

Today many investors use the Graham Number as a starting point. They do not use it alone. They combine it with other tools like cash flow analysis or growth estimates.

Benjamin Graham focused on numbers. Warren Buffett later added the idea of buying great businesses. Because of this some investors say the Graham Number is too strict.

Still in times of high market prices this number brings discipline. It reminds investors not to chase hype. It brings focus back to earnings and assets.

In 2025 with market volatility and macro uncertainty many value focused investors have returned to this formula. They use it to find stocks in cyclical and ignored sectors.

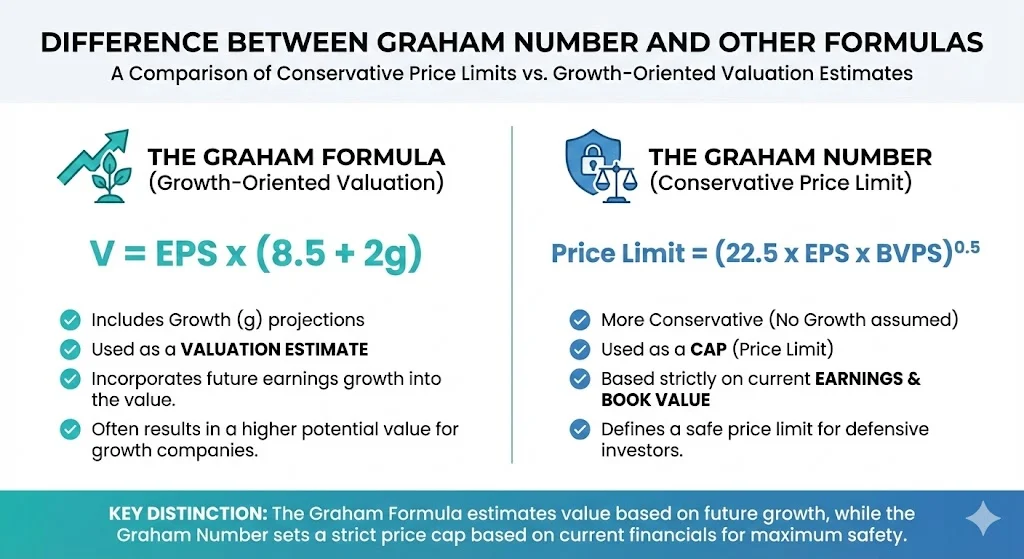

Difference between Graham Number and Other Formulas

There is also something called the Graham Formula which is different. That formula includes growth and looks like

V = EPS x (8.5 + 2g)

This is not the same as the Graham Number. The Graham Number is only about price limits based on earnings and book value. It is more conservative.

The Graham Number is used as a cap. The Graham Formula is used as a valuation estimate.

Who Was Benjamin Graham?

Benjamin Graham was a famous investor and teacher. He taught Warren Buffett. He wrote books that shaped value investing. His main idea was to buy stocks when they are cheap compared to their real worth.

He believed in studying financial statements. He believed in protecting capital first. The Graham Number comes from this mindset.

Final Views On Graham Number

The Graham Number is a simple but powerful valuation tool. It shows the maximum price a conservative investor should pay for a stock. It is based on earnings and book value. It uses strict limits to avoid overpaying.

Even in 2025 and 2026 it is still used by value investors. It is not perfect. It does not suit growth stocks. But for asset rich companies it remains a useful filter.

It keeps investors focused on safety. It keeps emotions out of investing. That is why this old formula still has a place in modern markets.

Tags: Graham Number, Benjamin Graham, Value Investing, Stock Valuation, Margin of Safety, Undervalued Stocks

Share This Post