Golden Rule of Borrowing Personal Loans in India (2026 Guide)

Golden Rule of Borrowing Personal Loans in India (2026 Guide)

Personal loans have become one of the most common financial tools for Indian households. With just a few clicks on a mobile app or a quick visit to a bank branch, money can be credited into your account within hours. In 2026, personal loans are easier to access than ever before.

However, public opinion on social media and recent financial data reveal a growing concern: many people are borrowing for short-term comfort rather than long-term stability.

Discussions on platforms like X (formerly Twitter) show a mix of caution, regret from past experiences, and growing awareness about responsible borrowing. People openly share stories of debt traps, high interest rates, and emotional stress caused by impulsive loans. At the same time, many admire disciplined borrowers who use loans carefully and follow simple financial rules.

With new borrower protection measures introduced by the Reserve Bank of India (RBI) in 2025 and 2026, this is the right time to understand the Golden Rules of Borrowing Personal Loans. These rules are not about avoiding loans completely, but about using them wisely so that they support your life instead of controlling it.

Table of Contents

Key Takeaways

- Borrow only for genuine needs, not for lifestyle or impulse spending.

- Keep total EMIs within 40% of your monthly income to avoid financial stress.

- Compare lenders carefully and read the fine print before signing any loan agreement.

- Use RBI’s 2026 borrower protections like cooling-off periods and low foreclosure charges.

- Avoid high-interest loan traps and prefer safer alternatives when possible.

- Protect your credit score by paying EMIs on time and avoiding multiple applications.

- Build an emergency fund so loans remain a backup, not a habit.

- Personal loans should serve your financial stability, not control your future.

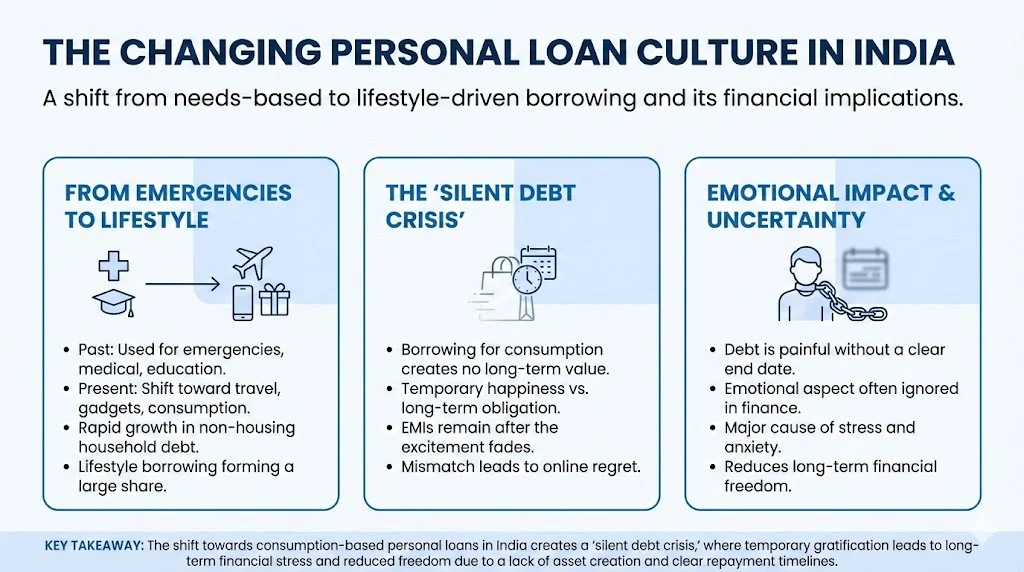

The Changing Personal Loan Culture In India

In earlier years, personal loans were mainly used for emergencies, medical needs, or education. But recent trends show a shift toward lifestyle borrowing. A significant portion of borrowers now use personal loans for travel, gadgets, celebrations, and consumption-based spending. Household debt unrelated to housing has grown rapidly and now forms a large share of total personal debt.

Many financial commentators describe this trend as a “silent debt crisis.” Borrowing for consumption does not create assets or long-term value. Once the excitement of a holiday or new phone fades, the EMIs remain. This mismatch between temporary happiness and long-term obligation is at the heart of many regrets shared online.

One widely shared thought captures this feeling clearly: debt becomes more painful when there is no clear sense of when it will end. This emotional aspect of borrowing is often ignored in financial discussions, but it plays a major role in stress, anxiety, and reduced financial freedom.

Golden Rule 1: Borrow Only What You Truly Need

The first and most important rule is simple: borrow only for genuine needs, not for convenience or impulse.

Responsible uses of personal loans include:

- Medical emergencies

- Education or skill development

- Essential home repairs

- Debt consolidation when it lowers overall interest burden

Risky uses include:

- Holidays and leisure travel

- Expensive gadgets

- Luxury shopping

- Social pressure spending such as weddings beyond affordability

Before taking a loan, ask yourself one honest question:

Will this loan improve my long-term financial position or only satisfy a short-term desire?

If the benefit ends quickly but the repayment lasts for years, the loan is likely working against you.

Also Read: Rule of 5x Salary for Personal Loans: Fact Or Marketing Gimmick?

Golden Rule 2: Follow the 40% EMI Rule

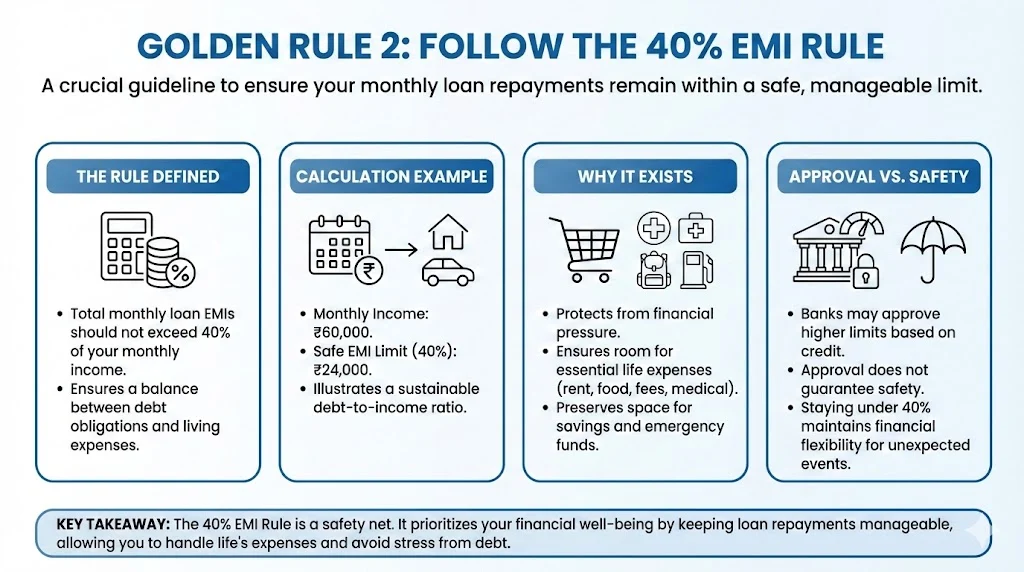

One of the most widely respected financial guidelines in India is the 40% EMI rule. It states that your total monthly loan repayments should not exceed 40% of your monthly income.

For example:

- Monthly income: ₹60,000

- Safe EMI limit: ₹24,000

This rule exists to protect you from financial pressure. Life expenses such as rent, food, school fees, fuel, and medical costs continue regardless of your loan obligations. If most of your income goes into EMIs, there is little room left for savings or emergencies.

Banks may approve higher limits based on your credit score, but approval does not mean safety. Staying under 40% keeps your finances flexible and helps you avoid stress during job changes or unexpected expenses.

Golden Rule 3: Compare Lenders and Read the Fine Print

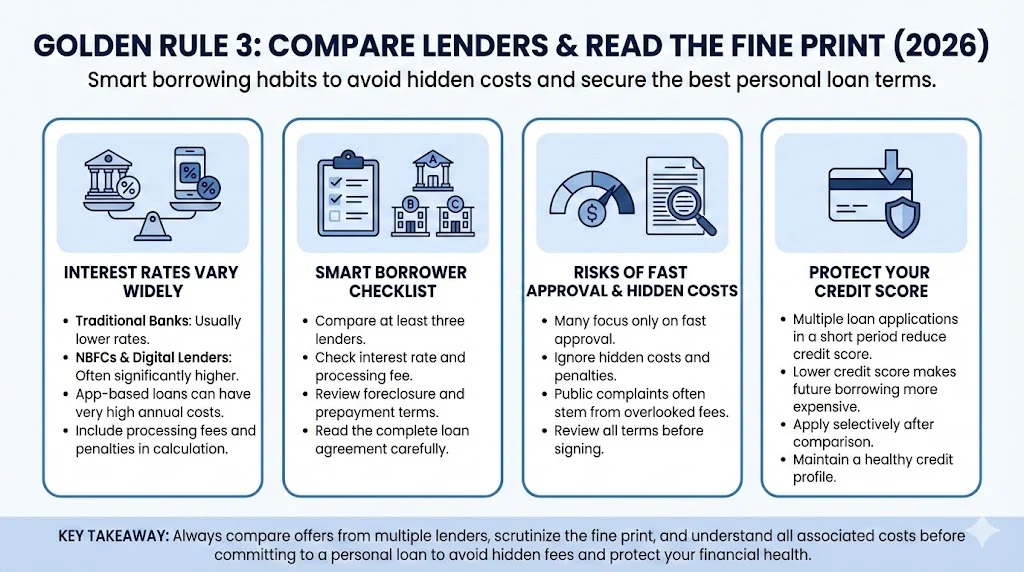

In 2026, interest rates on personal loans vary widely. Traditional banks usually offer lower rates, while NBFCs and digital lenders may charge significantly more. Some app-based loans can reach very high annual costs when processing fees and penalties are included.

A smart borrower always:

- Compares at least three lenders

- Checks interest rate and processing fee

- Reviews foreclosure and prepayment terms

- Reads the complete loan agreement

Many public complaints come from borrowers who focused only on fast approval and ignored the hidden costs. Multiple loan applications in a short period can also reduce your credit score, making future borrowing more expensive.

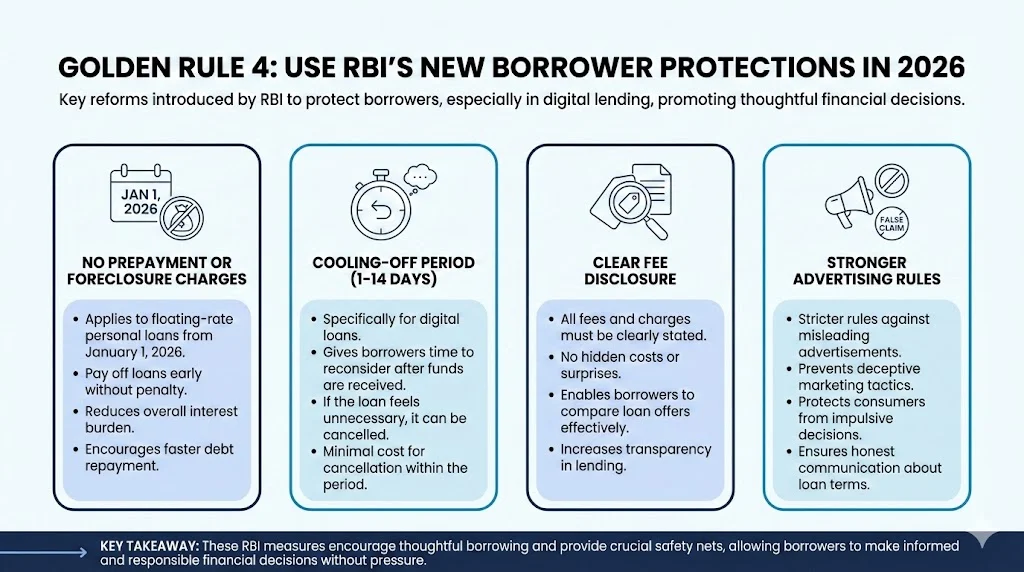

Golden Rule 4: Use RBI’s New Borrower Protections in 2026

RBI has introduced important reforms to protect borrowers, especially in digital lending.

Key protections include:

- No prepayment or foreclosure charges on floating-rate personal loans from January 1, 2026

- Cooling-off periods of 1 to 14 days for digital loans

- Clear disclosure of all fees and charges

- Stronger rules against misleading advertisements

The cooling-off period is especially useful. It gives borrowers time to reconsider after receiving funds. If the loan feels unnecessary, it can be cancelled with minimal cost.

These measures encourage thoughtful borrowing instead of impulsive decisions.

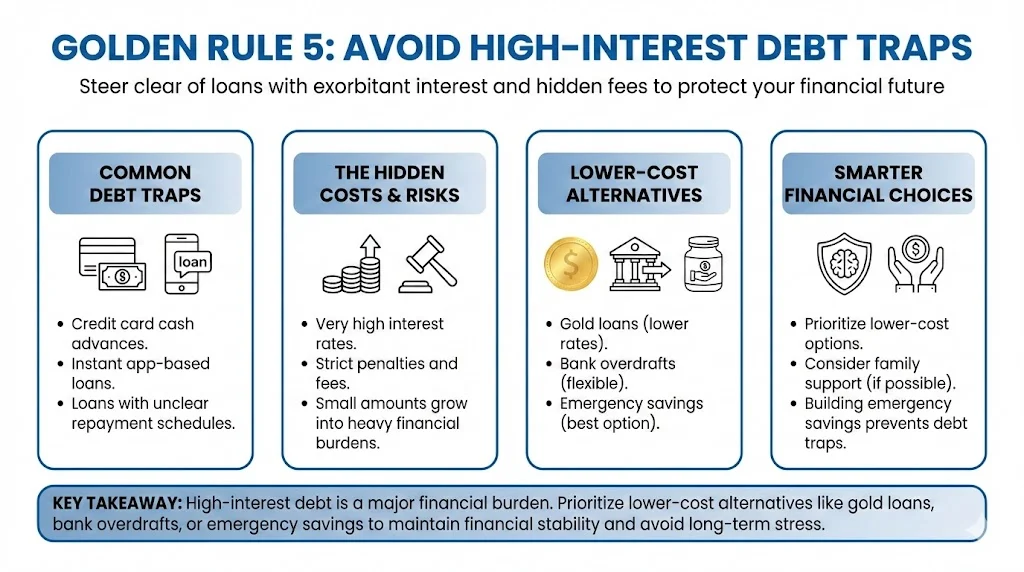

Golden Rule 5: Avoid High-Interest Debt Traps

Many people fall into trouble through:

- Credit card cash advances

- Instant app-based loans

- Loans with unclear repayment schedules

Such loans often come with very high interest rates and strict penalties. Over time, small amounts can grow into heavy financial burdens.

Lower-cost alternatives include:

- Gold loans

- Bank overdrafts

- Emergency savings

- Family support

These options may not be perfect, but they usually cost less than high-interest personal loans.

Golden Rule 6: Protect and Rebuild Your Credit Score

Your credit score plays a major role in loan approval and interest rates. A low score does not mean you cannot borrow, but it does mean you should proceed carefully.

To rebuild credit health:

- Take smaller loans first

- Pay EMIs on time

- Avoid multiple loan applications

- Keep credit card usage under control

A strong credit profile gives you access to better terms and reduces long-term costs.

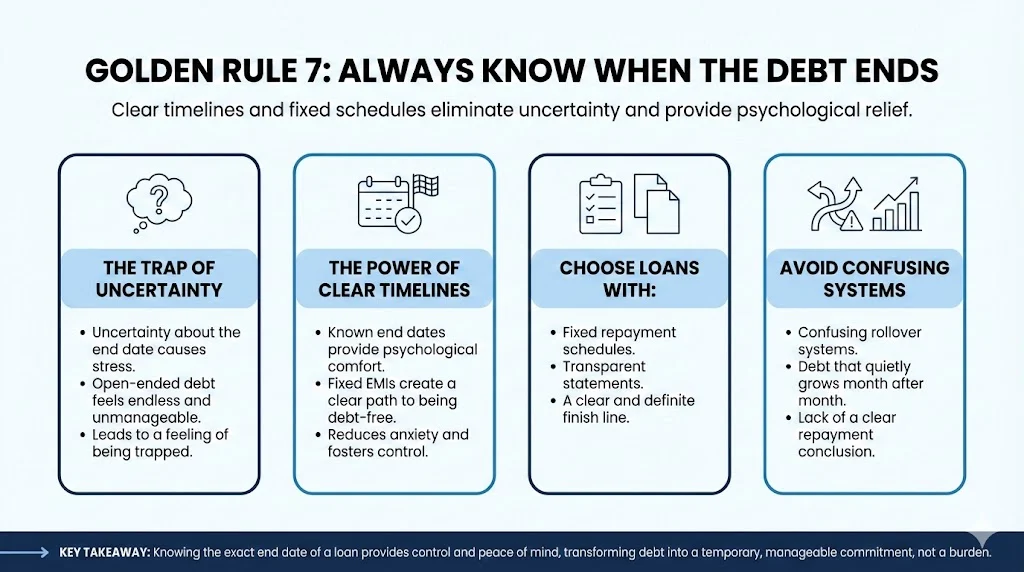

Golden Rule 7: Always Know When the Debt Ends

One reason people feel trapped is uncertainty. Loans with clear tenure and fixed EMIs provide psychological comfort because the end date is known.

Choose loans with:

- Fixed repayment schedules

- Transparent statements

- No confusing rollover systems

Avoid borrowing styles where debt quietly grows month after month without a clear finish line.

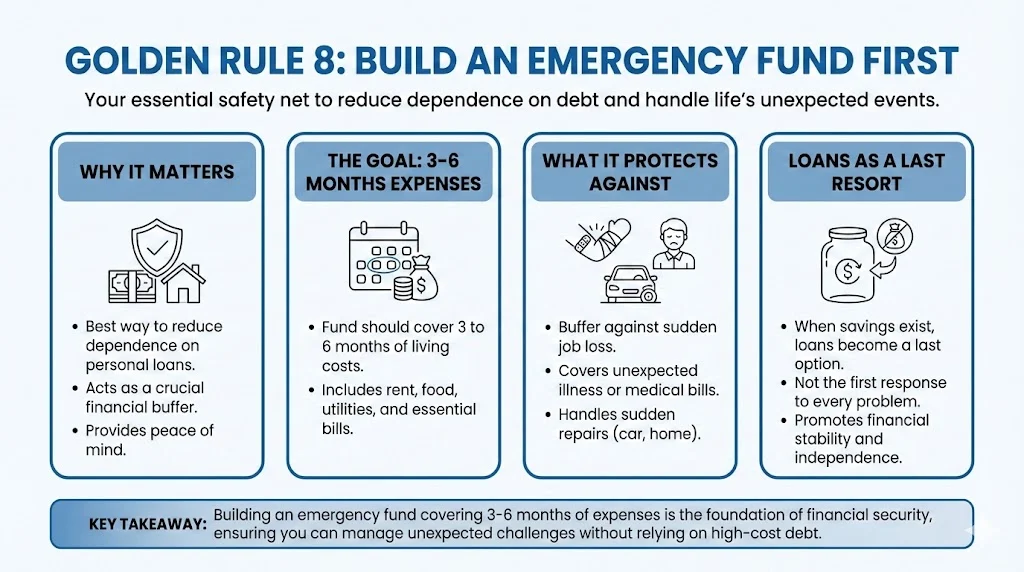

Golden Rule 8: Build an Emergency Fund First

The best way to reduce dependence on personal loans is to build an emergency fund covering three to six months of expenses. This fund acts as a buffer against job loss, illness, or sudden repairs.

When savings exist, loans become a last option rather than the first response to every problem.

What Public Opinion Teaches Us (Data From X)

Social media discussions in 2026 show two strong emotions: admiration for discipline and regret for excess. People praise borrowers who stay within limits, compare lenders, and use loans for meaningful purposes. At the same time, many warn against lifestyle debt and aggressive digital lenders.

This collective experience is shaping a new culture of awareness. Financial literacy is becoming as important as access to credit.

Final Thought: Debt Should Serve You, Not Control You

Personal loans are neither good nor bad by themselves. They are tools. When used wisely, they solve real problems. When used carelessly, they create long-term stress.

The true golden rule of borrowing in 2026 is balance:

borrow carefully, repay comfortably, and avoid turning today’s wants into tomorrow’s burden.

With RBI protections, smarter comparisons, and better awareness, borrowers now have the power to make informed choices. The responsibility lies in using that power wisely.

Share This Post