Dave Ramsey’s 15% Rule: How It Works And Why So Many People Follow It

Dave Ramsey’s 15% Rule: How It Works And Why So Many People Follow It

Saving for retirement feels important for every household. People want a simple rule that keeps them on track without causing stress in daily life. Dave Ramsey’s 15% Rule has become one of the most well known retirement strategies in the United States.

The rule suggests that people should invest 15% of their gross household income into retirement accounts once they are debt free (except the house) and have a full emergency fund.

Key Takeaways

- The 15% Rule means investing 15% of gross household income into retirement accounts.

- It begins after people finish paying non-mortgage debt and build an emergency fund.

- The rule is part of Dave Ramsey’s Baby Step 4.

- Supporters see it as realistic and easy to follow.

- Critics believe 15% may be too low in today’s high cost economy.

- Public opinion online is mixed but still leans positive.

The 15% Rule is designed to sit between security and balance. Ramsey’s plan focuses first on clearing debt and building a cash safety net. Only after that point does retirement investing begin. The goal is not just wealth growth. It is long-term peace of mind. Supporters say this structure keeps households stable while still building a strong future.

Also Read: Rule of 70 Economics: Meaning, Formula, Uses and Real-World Impact

What Exactly Is The 15% Rule?

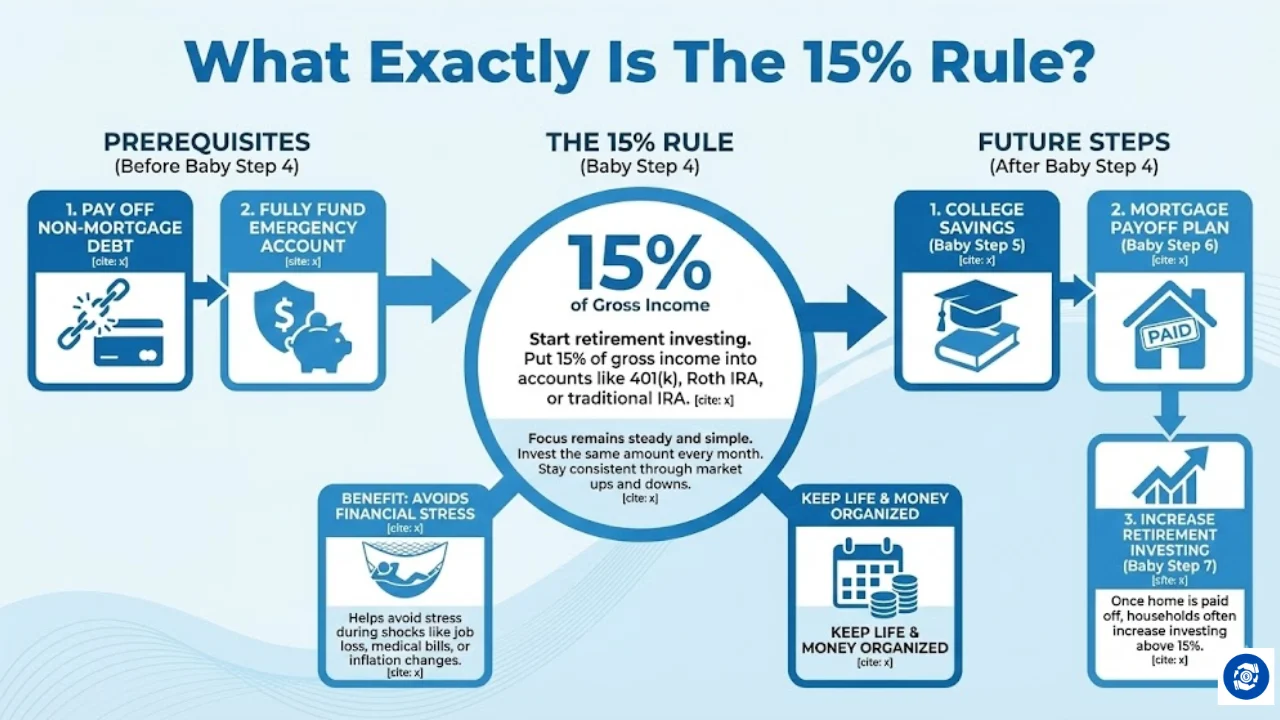

Dave Ramsey recommends starting retirement investing during Baby Step 4. At this step, people begin putting 15% of their gross income into plans like a 401(k), Roth IRA, traditional IRA or similar accounts. The focus remains steady and simple. Invest the same amount every month. Stay consistent through market ups and downs. Keep life and money organized.

The 15% target comes after two major milestones. First, all non-mortgage debt should be paid off. Second, a fully funded emergency account should be in place. Only then is it time to start saving for retirement. Supporters say this helps avoid financial stress during shocks like job loss, medical bills or inflation changes.

After Baby Step 4 comes college savings for children in Baby Step 5. Then comes the mortgage payoff plan in Baby Step 6. Finally, once the home is paid off completely (Baby Step 7), households often increase retirement investing above 15%.

Why Many Americans Prefer The 15% Approach

Supporters say the rule works because it is clear and achievable. A large share of workers in the US save far less than 15%. Some reports show only about 10% of Americans save 15% or more for retirement. Because of this, followers see the rule as a practical starting point rather than an extreme target.

Online discussions in 2025 and 2026 show similar opinions. Many comments say the rule creates structure without pressure. One investor described it as conservative, safe and logical for families also saving for a home. Others call it “simple, disciplined and effective”. Some people credit the plan for helping them retire debt free.

Positive views also highlight the mental benefit. People feel calmer when they have debt paid off, a roof fully owned and steady investments building over time.

Growing Debate In Today’s Economy

Not everyone agrees with the 15% target. A rising share of financial influencers and FIRE (Financial Independence, Retire Early) supporters argue that the number is too low. They say higher saving rates are needed to retire early or beat inflation.

Some common comments online include saving 25% or more. A few high-earning investors mention saving 40% to 55% of their income. These critics often say that 15% may work, but only as a starting point, especially in higher cost cities. Other comments suggest that once Baby Step 7 is complete, people should consider 20% or more.

Neutral voices say the 15% target should be seen as a guideline instead of a strict rule. Save 15% during the mortgage years. Then increase later when cash flow improves.

How The Rule Fits Into Real Life Planning

The reason Ramsey supports 15% instead of higher amounts is simple. People still need money for other goals. That includes college savings, home ownership, emergencies, and daily living costs. The rule is designed to keep retirement investing strong without sacrificing family stability.

At the same time, it avoids relying on Social Security alone. Many discussions in 2025 and 2026 point to rising concern over retirement security. Social Security benefits have seen cost of living adjustments like the 2.8% increase expected in 2026. But for many people, that still falls short of covering living expenses.

Saving 15% aims to fill that gap.

Real-World Impact: Public Opinion Snapshot

Here is a short listicle summarizing public reaction found in recent discussions:

- Supporters like the structure and discipline that keeps retirement steady.

- Many credit the rule for reducing stress while they pay off debt.

- Critics argue 15% may not be enough in a high inflation world.

- High-income earners often choose 20% to 50% instead.

- Neutral voices see 15% as a minimum rather than a final goal.

This mix of opinion shows that the rule is not fading. Instead, conversations around it continue to grow.

Where The 15% Rule Fits In A Modern Economy

In 2025 and early 2026, living costs have remained a concern. Market swings and economic news often push people to rethink retirement plans. Against this backdrop, Ramsey’s approach remains focused on simple math and consistent saving.

For many households carrying debt, 15% already feels ambitious. The plan pushes families to start somewhere realistic instead of waiting for a “perfect time”. Supporters say that waiting too long leads to under-saving and stress later in life.

Is 15% Enough For Everyone?

The honest answer is no single number fits every case. Higher earners may choose to invest more. People planning early retirement may also need larger savings. Others may prefer safer investments or slower paths.

But Ramsey’s plan is not built for extreme cases. It is designed for broad household use. It encourages people to build wealth steadily, avoid panic, and finish life debt free. For many average families, that structure delivers long-term security.

Final Thoughts

Dave Ramsey’s 15% Rule continues to spark discussion online and in financial circles. Supporters see it as a proven and realistic way to balance saving and living. Critics want more aggressive investing to match today’s economy. Yet both groups agree on one key idea. Saving early and consistently matters more than guessing market trends.

The rule remains one of the most recognized retirement strategies because it is simple. Pay off debt. Build an emergency fund. Then invest 15% of income into retirement accounts. Grow slowly. Stay focused. Avoid chaos. And for millions of households, that plan has already delivered real results.

Tags: Dave Ramsey, Retirement Planning, Personal Finance, Baby Steps, Investing Strategy, Savings Rate

Share This Post