Bitcoin Crash 2026 Shocking Price Drop: Crypto Market Panic or Opportunity

Bitcoin Crash 2026 Shocking Price Drop Crypto Market Panic or Opportunity

Bitcoin faced a sharp fall in late January 2026 and it quickly became one of the most discussed topics across financial platforms and social media. The price dropped from above 90,000 dollars to nearly 82,000 to 85,000 dollars in a single day. This movement shocked short term traders and raised questions about market stability.

The fall did not happen due to one single reason. A mix of macro pressure, ETF outflows, technical breakdowns and global uncertainty pushed the market lower. At the same time public opinion stayed divided between fear and long term confidence.

Key Takeaways

- Bitcoin dropped 6 to 10 percent in one day and touched a two month low

- ETF outflows crossed 1.1 billion dollars in one week

- Gold and silver attracted capital away from crypto

- Federal Reserve policy increased risk off sentiment

- Social media shows panic and long term optimism at the same time

This correction erased recent gains and placed pressure on the wider crypto market. Ethereum and Dogecoin also recorded losses of more than 6 percent. Traders are now watching the 80,000 to 81,000 dollar range as a key support zone.

Also Read: Swiggy Stock Crashes 7% – Buy Opportunity or Warning Sign?

Bitcoin Price Fall in January 2026

Bitcoin started falling on January 29 and continued sliding into January 30. The price moved from above 90,000 dollars to around 81,000 to 83,000 dollars during intraday trading. This became the lowest level of 2026 and the weakest price since November 2025.

The drop reached nearly 10 percent at one point. Later the price stabilized near the 82,000 to 85,000 dollar range. Such a fast decline created heavy selling pressure across crypto exchanges and futures markets.

This event also showed that Bitcoin still reacts strongly to macro events. It moved in the same direction as technology stocks and other risk assets. This behavior disappointed investors who expected Bitcoin to act as a hedge.

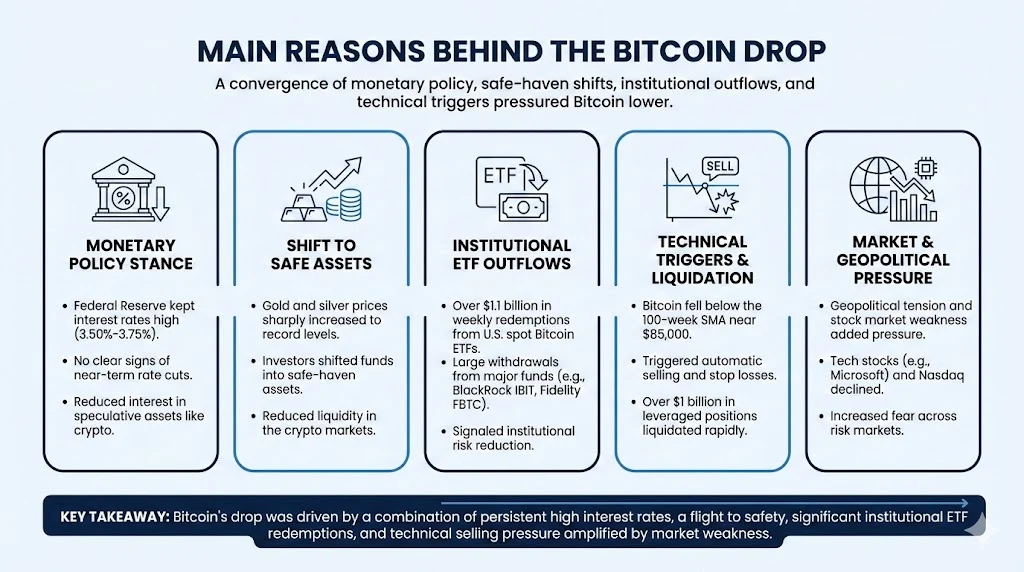

Main Reasons Behind the Bitcoin Drop

Several factors worked together to push Bitcoin lower. These drivers came from financial markets, investor behavior and technical indicators.

The Federal Reserve kept interest rates between 3.50 percent and 3.75 percent in its first 2026 meeting. There were no clear signs of near term cuts. This stance reduced interest in speculative assets like crypto.

Gold and silver prices moved sharply higher. Gold touched around 5,600 dollars and silver reached record levels. Investors shifted funds into these safe assets which reduced liquidity in crypto markets.

Another major factor was ETF outflows. U.S. spot Bitcoin ETFs recorded over 1.1 billion dollars in weekly redemptions. Funds such as BlackRock IBIT and Fidelity FBTC saw large withdrawals. This signaled institutional risk reduction.

Technical indicators also played a role. Bitcoin fell below the 100 week simple moving average near 85,000 dollars. This triggered automatic selling and stop losses. Over 1 billion dollars in leveraged positions were liquidated in a short time.

Geopolitical tension and stock market weakness added more pressure. Technology stocks such as Microsoft declined. This pulled the Nasdaq lower and increased fear across risk markets.

Market Data Snapshot

| Factor | Data |

|---|---|

| Bitcoin price fall | From above 90,000 to around 81,000 to 83,000 |

| Intraday drop | About 6 to 10 percent |

| ETF outflows | Over 1.1 billion dollars in one week |

| Gold price | Around 5,600 dollars |

| Liquidations | Over 1 billion dollars |

| Key support zone | 80,000 to 81,000 |

This table shows that the fall was not minor. It was driven by both technical and fundamental forces.

Impact on Crypto Market and Stocks

The Bitcoin drop affected the entire crypto ecosystem. Ethereum fell more than 6 percent. Dogecoin and Solana also moved lower. Total crypto market value declined to nearly 2.97 trillion dollars.

Crypto related stocks faced heavy losses. Coinbase dropped about 7 percent in one session and more than 17 percent for the year. Gemini stock declined nearly 8 percent in a day and over 20 percent year to date.

Spot trading volume also slowed. January volume was close to 900 billion dollars. Last year it was near 1.7 trillion dollars. This shows reduced participation and cautious sentiment.

Some Bitcoin mining companies performed better than exchanges. Hut 8 and CleanSpark reported year to date gains. These firms expanded into data services linked with artificial intelligence which supported their revenues.

Public Opinion and Social Media Reaction

Public reaction on X and other platforms showed mixed emotions. Some users called it a crash. Others saw it as a healthy correction.

Here is one listicle summarizing the main sentiment trends.

- Short term fear

Many traders expressed frustration over losses. Some predicted a fall below 80,000 dollars. Panic selling was visible in futures markets. - Buy the dip attitude

Long term holders compared this move with past cycles. They mentioned the 2022 crash and later recovery. They viewed this fall as a chance to accumulate. - Macro blame

Most users blamed Federal Reserve policy and capital shift to gold. Few blamed Bitcoin fundamentals. This shows confidence in the asset itself. - Respect for resilience

Some praised Bitcoin for bouncing quickly from lows. They highlighted its history of recovery after sharp falls.

Overall sentiment leaned toward cautious optimism. Pain was present but hope remained strong.

Technical Levels Traders Are Watching

Technical analysis shows that 85,000 dollars was a key level. Once it broke selling accelerated. The next major support sits between 80,000 and 81,000 dollars.

If Bitcoin holds above this range it could move sideways and rebuild momentum. A rebound above 90,000 dollars would improve confidence and reduce fear.

If it breaks below 80,000 dollars then deeper correction could follow. Analysts see this as a test of long term strength rather than a collapse.

Volume and ETF flow will be important signals. If outflows slow down then pressure may ease.

Is This a Crash or a Healthy Correction

Many experts view this fall as a correction within a volatile bull phase. Bitcoin has seen similar drops in previous years. These moves often reset leverage and remove weak positions.

The macro environment is still uncertain. High interest rates and geopolitical risks remain. This keeps investors cautious.

At the same time adoption and institutional interest have not ended. ETF demand may return once stability improves. Long term holders still see Bitcoin as a store of value and hedge against currency risk.

This makes the current phase more like consolidation than collapse.

What This Means for Investors

Investors now face two main choices. Short term traders must manage risk and avoid heavy leverage. Long term investors may view this as a strategic entry zone.

It is important not to expect guaranteed recovery or instant gains. Crypto remains highly volatile. Market direction depends on interest rates, global events and capital flows.

Diversification and risk control remain essential. Blind speculation increases losses during sharp moves.

Outlook for the Coming Weeks

The next few weeks will be critical. Federal Reserve signals and ETF flow data will guide sentiment. Gold and silver trends will also influence crypto demand.

If macro pressure eases Bitcoin could recover toward 90,000 dollars. If uncertainty continues prices may remain in the 80,000 to 85,000 range.

Public opinion suggests patience rather than panic. The idea of pain now and opportunity ahead dominates discussions.

This event once again shows that Bitcoin reacts to both global finance and investor psychology. It remains a high risk asset with high attention and strong emotional impact.

Conclusion

The Bitcoin fall in January 2026 was driven by ETF outflows, Federal Reserve policy, capital shift to precious metals and technical breakdowns. The price dropped from above 90,000 dollars to near 82,000 dollars in a single day. This created fear but also renewed debate about long term opportunity.

Social media shows frustration and hope at the same time. Support near 80,000 to 81,000 dollars will decide the next direction. For now the market remains cautious but not defeated.

This episode highlights crypto volatility and its link with macro events. Bitcoin continues to test investor patience and belief in every cycle.

Tags: Bitcoin price, Crypto market news, Bitcoin crash 2026, Cryptocurrency trends, Financial markets, ETF outflows

Share This Post