Rule of 5x Salary for Personal Loans: Fact Or Marketing Gimmick?

Rule of 5x Salary for Personal Loans: Fact Or Marketing Gimmick?

Personal loan ads often promise that you can get a loan worth five times your salary. This idea has become popular in India and is now used as a quick way to attract borrowers. Many people believe this is a fixed rule used by all banks and lenders.

In reality, the rule of 5x salary works more like a headline number. It sounds simple and reassuring. But loan approval depends on many checks that go far beyond your salary alone.

Table of Contents

Key Takeaways

- The 5x salary rule is not a guaranteed formula for loan approval.

- Lenders use it mainly as a marketing benchmark.

- Credit score and debt to income ratio matter more than salary alone.

- Many borrowers get lower amounts than what ads suggest.

- Public opinion on social media shows rising caution about high borrowing.

Personal loans are unsecured loans. This means no property or asset is kept as security. Because of this risk, lenders study each applicant carefully. The 5x salary idea is only one part of a bigger process.

Also Read: Golden Rule of Borrowing Personal Loans in India (2026 Guide)

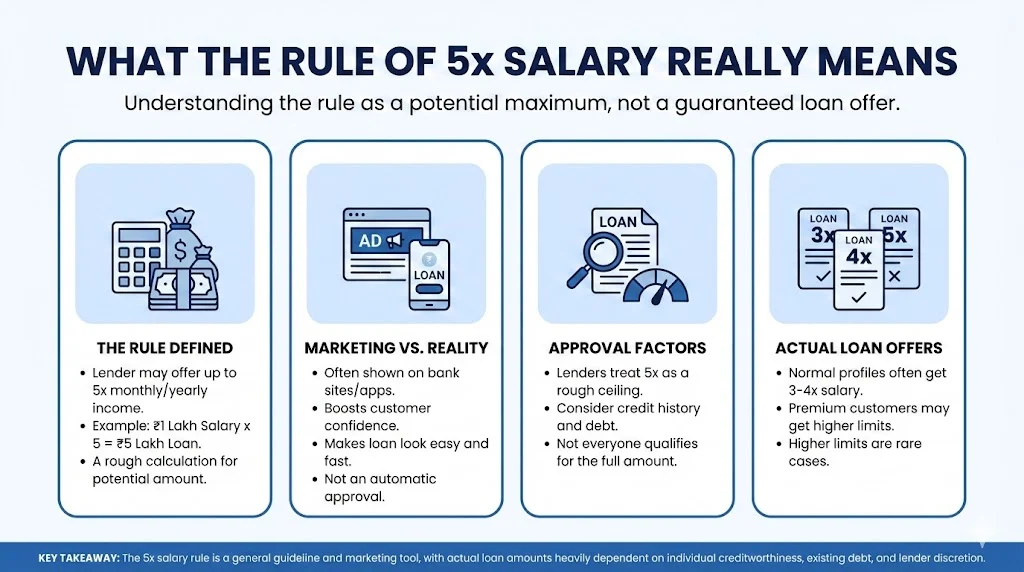

What The Rule of 5x Salary Really Means?

The rule of 5x salary means a lender may offer a personal loan amount equal to five times your monthly or yearly income. For example, if your monthly salary is ₹1 lakh, the ad may say you can get up to ₹5 lakh as a loan.

This number is often shown on bank websites and mobile apps. It helps customers feel confident before applying. It also makes the loan look easy and fast to get.

But lenders do not approve loans only on this rule. They treat it as a rough ceiling. It does not mean everyone will get that amount.

Some banks may offer only three or four times the salary for normal profiles. A few premium customers may get higher limits. These are rare cases.

Why Banks Promote the 5x Salary Rule

Banks and NBFCs compete for personal loan customers. The market is crowded. Every lender wants attention. A simple message like “Get loan up to 5x your salary” works well in ads.

It removes fear for first time borrowers. It creates a feeling of eligibility even before applying. This increases applications.

From a business view, this rule is easy to explain. It does not require long financial terms. It looks friendly and quick.

This does not mean banks are lying. Some customers do get loans close to this level. But it is not a promise.

The Real Factors That Decide Your Loan Amount

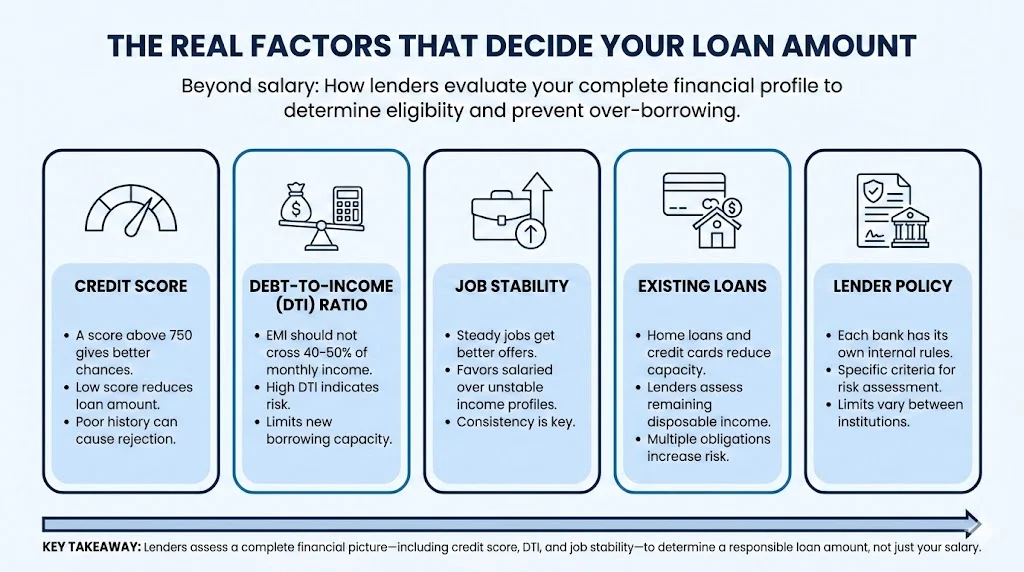

Salary alone does not decide your loan size. Lenders study many parts of your financial life. These checks protect them from risk and protect borrowers from over borrowing.

Here is the main list of factors lenders use.

Main Factors That Affect Personal Loan Eligibility

- Credit score

A score above 750 gives better chances. A low score reduces loan amount or causes rejection. - Debt to income ratio

Your EMI should not cross 40 to 50 percent of your monthly income. - Job stability

Salaried people with steady jobs get better offers than unstable income profiles. - Existing loans

Home loans and credit cards reduce your remaining capacity. - Lender policy

Each bank has its own internal rules for risk and limits.

This is the only listicle in the article as required.

If your profile looks risky, the lender may offer less than 5x salary or reject the loan.

What Twitter Data & Public Opinion Show

Recent discussions on X show mixed reactions to high borrowing multiples. There is no strong praise for the 5x salary rule. Most opinions lean toward caution.

Many users warn against borrowing too much. One user called lending at six times income criminal and advised people to avoid falling into debt traps.

Another trend shows people preferring financial independence. Staying debt free is seen as success. Easy credit is viewed as a short term fix for rising costs.

Some users link high loan multiples with economic pressure. Salaries grow slowly but expenses rise fast. Loans look helpful but may cause long term stress.

Overall sentiment is skeptical. Few people admire this rule. More people admire saving money and avoiding personal loans.

How India Differs From Global Lending Practices

The rule of 5x salary is mostly seen in India. In countries like the US and UK, lenders do not talk about salary multiples.

They focus on income proof and credit history. They also focus strongly on debt to income ratio.

This makes the Indian market unique. Salary multiples are used as selling points. Globally, such claims are rare.

This shows the rule is more cultural and market driven than scientific.

Is the Rule a Fact or a Gimmick

The rule is partly true and partly marketing.

It is true because some borrowers with strong profiles get loans close to five times their salary. These are people with high credit scores and low existing debt.

It is a gimmick because it is shown as a simple rule for everyone. In practice, many applicants get lower offers.

The rule works as a hook. It makes people apply. The real decision happens after detailed checks.

So it is not a lie. But it is also not a guarantee.

Risks of Believing the 5x Rule Blindly

Borrowers who trust this rule without calculation can face problems. Personal loan interest rates are high. Many range from 10 percent to 30 percent or more.

A large loan means high EMI. This can disturb monthly budgets. It can also affect future borrowing ability.

Some people use personal loans for lifestyle spending. This increases financial pressure later.

Public discussions show growing fear of debt traps. Many users now advise building emergency funds instead of using loans.

How to Think About Personal Loans Smartly

Instead of asking how much you can borrow, it is better to ask how much you can repay.

Look at your monthly income. Subtract fixed expenses. Keep EMI under safe limits.

Check your credit report before applying. Clear small debts if possible.

Do not apply only because an ad says you qualify for 5x salary. Apply only for what you truly need.

A smaller loan with easy EMI is safer than a big loan with stress.

Why Lenders Still Use This Rule

Despite criticism, lenders will keep using this rule. It works in advertising. It simplifies communication. It increases digital applications.

It also helps customers get an estimate without long forms.

But lenders internally rely on risk models. The rule is only the outer layer.

As interest rates rise, lenders also become stricter. This makes the rule even less reliable for many people.

Final View on the Rule of 5x Salary

The rule of 5x salary is not a fixed law. It is a flexible benchmark. It helps in promotion and quick estimates.

It should not be taken as financial advice. Actual loan approval depends on credit score, debts, and job stability.

Public opinion shows rising awareness. People now question easy borrowing. Many prefer discipline over debt.

For borrowers, the best approach is balance. Understand your limits. Do not trust headlines alone. Look at your full financial picture before taking a personal loan.

Tags: personal loan, salary based loans, credit score, debt management, financial awareness, loan eligibility

Share This Post