Rule Of One For Loan Prepayment: Save Lakhs On Home Loan Interest

Rule Of One For Loan Prepayment: Save Lakhs On Home Loan Interest

Paying off a loan early has always been a smart step for many borrowers in India. It helps reduce debt faster and saves a large amount of interest over time. But in the past, many banks charged heavy penalties when people tried to repay loans early. This discouraged borrowers from becoming debt free and made prepayment costly.

Key Takeaways

- Rule of One removes prepayment penalties on floating rate loans when funds come from one source

- It applies to loans sanctioned or renewed on or after January 1, 2026

- Borrowers can use savings, salary bonus, inheritance or sale of one asset

- Penalties may still apply when funds come from multiple sources or fresh loans

- Strong public support as people welcome borrower friendly reform

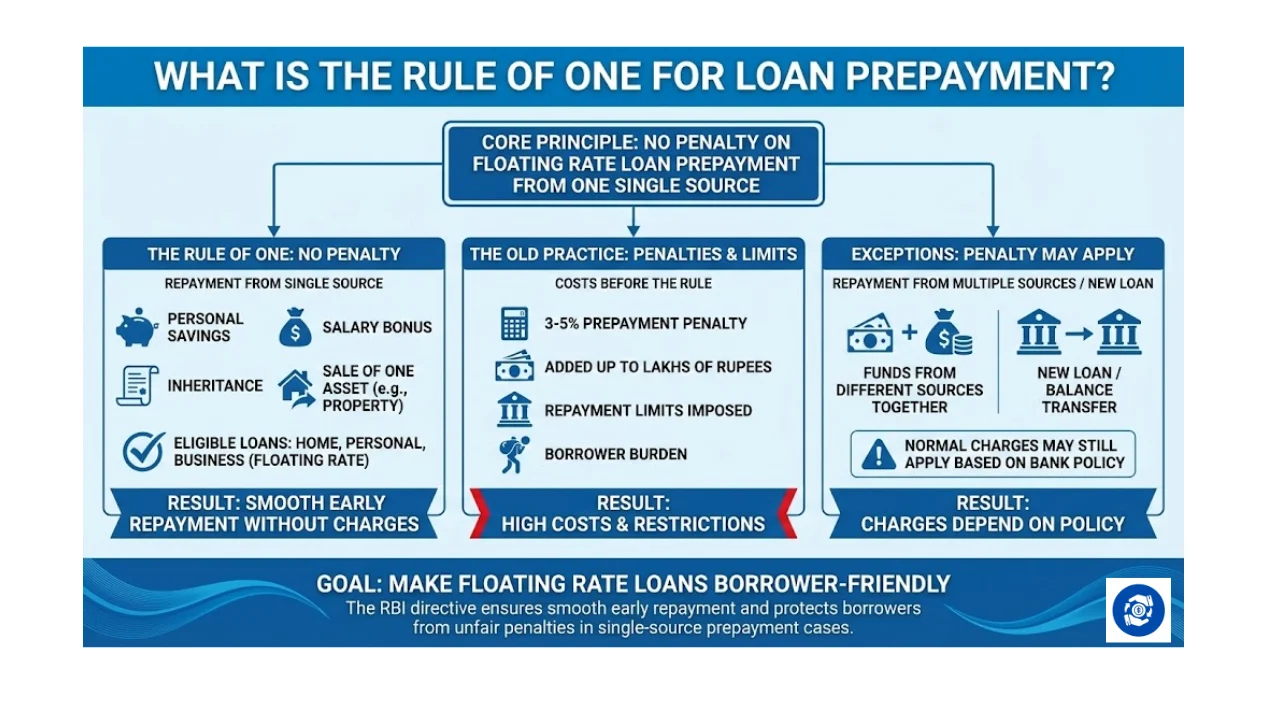

The Reserve Bank of India has now brought a major change to fix this problem. The new Rule of One under the Prepayment Charges on Loans Directions, 2025 prevents banks and financial institutions from charging prepayment or foreclosure fees when borrowers repay floating rate loans using money from a single source. This rule will apply for all new or renewed floating rate loans approved on or after January 1, 2026.

Also Read: The 50 30 20 Rule Of Budgeting By Elizabeth Warren

What Is The Rule Of One For Loan Prepayment

The Rule of One means that when you repay your floating rate loan using funds from one single source, the bank cannot charge a penalty. The source can be your personal savings, salary bonus, inheritance, or money received by selling a single asset like one property. The loan may be a home loan, personal loan or business loan as long as it runs on a floating rate.

Earlier, borrowers often paid 3 to 5 percent of the prepayment amount as penalty. For large loans like home loans, this added up to lakhs of rupees. Many banks also imposed limits on how much you can repay in one go. The Rule of One ends these practices in such single source cases and allows smooth early repayment.

However, when repayment is done using funds from different sources together or by taking a new loan such as a balance transfer, normal charges may still apply based on the bank policy. Still, the RBI directive makes floating rate loans much more borrower friendly than before.

Why RBI Introduced Rule Of One

The RBI introduced this rule to support fair banking and encourage disciplined financial behaviour. Borrowers should not be punished for attempting to close their loans early. Early repayment reduces debt risk for both borrowers and lenders. It also builds financial stability in households.

There have been many complaints that banks rejected large prepayment requests or imposed limits like allowing closure of only a few EMIs at a time. This created frustration among borrowers. With the Rule of One, RBI aims to remove confusion and protect consumer interest.

Public Response And Social Media Buzz

The Rule of One has gained strong appreciation on X (formerly Twitter). Influencers, finance educators and common borrowers have welcomed the step. Many users highlight how prepayment penalties earlier felt like a punishment for being a responsible borrower. Posts explaining the rule have received high engagement in the form of likes, reposts and bookmarks.

Some users shared that banks earlier denied large prepayments or imposed restrictions. Others spoke about savings worth lakhs of rupees on home loans through this change. News updates about the rule received wide attention as people view it as a big win for consumer rights. Overall sentiment is clearly positive, and there is almost no criticism of the rule.

How Loan Prepayment Works Under The Rule

Loan prepayment means paying off your loan amount before the original end date of the tenure. This can happen through:

- Full repayment where the entire outstanding amount is cleared

- Part repayment where a lump sum is paid along with regular EMIs

In floating rate loans, prepayment reduces the outstanding principal. This directly lowers the interest applied in the future. Over the full term, the borrower saves a large amount of money.

Now under the Rule of One, when this repayment is made using funds from a single source, no extra penalty fee can be added by the bank.

One Simple Listicle Explaining Eligible Single Source Funds

Here are common single sources that qualify under the Rule of One:

- Salary bonus or incentives received from employer

- Personal savings accumulated in bank accounts

- Money inherited from family or relatives

- Sale proceeds from one property or one asset

- Maturity amount from a single investment product

This list helps borrowers understand what counts as a single source. If repayment comes from more than one of these together, normal bank rules may apply.

Benefits Of The Rule Of One For Borrowers

The biggest advantage is interest savings. When you reduce your principal early, your total interest amount falls sharply over time. This benefit is highest in the early years of the loan. The rule also supports financial freedom, since people can now repay without fear of penalty.

Another key benefit is transparency. Borrowers now know clearly when prepayment charges do not apply. Earlier, rules varied across lenders and created confusion. The Rule of One simplifies the system.

This change also supports long term credit health. People who repay loans early often maintain stronger credit scores. This helps them secure better loan terms in the future.

Impact On Home, Personal And Business Loans

Floating rate home loans form the biggest share of retail loan portfolios. The Rule of One will therefore benefit crores of home loan customers in India. The effect is also strong for personal loans since interest rates are higher and interest savings can be significant. Business loans under floating rates will also qualify.

Borrowers who receive a bonus, sell a property or receive inheritance now have more confidence in closing part or full loans early without penalty.

What Borrowers Should Keep In Mind

Even though the Rule of One is helpful, borrowers should assess their financial situation before prepaying. Emergency savings should not be fully exhausted. Other financial goals should also be considered.

It is also important to confirm the loan type. Fixed rate loans may still have charges as per lender policy. Only floating rate loans receive full protection under the RBI directive.

When repaying from multiple sources or via refinancing, charges may apply based on the bank agreement. So reviewing the loan document remains important.

Rule Of One And The Future Of Borrower Rights

The Rule of One is seen as part of a broader trend of RBI reforms to support fair lending standards. Recent public discussions show rising awareness about loan rules, risk weights, insurance practices and bank charges. With this step, RBI has sent a strong message that responsible borrowers must not face unnecessary financial barriers.

The move is expected to increase trust in the loan ecosystem. It may also promote financial planning habits where borrowers prioritise debt reduction when they receive surplus income.

Conclusion

The Rule of One for loan prepayment marks a major shift in borrower friendly policy in India. By removing penalties on floating rate loans when repayment comes from one source, the RBI has given people greater freedom to manage debt on their own terms. Public response shows clear support for this reform, with borrowers appreciating the transparency and fairness it brings.

For those carrying floating rate loans, this rule opens the door to faster debt relief without extra cost. It encourages disciplined repayment and supports long term financial stability. With the change taking effect from January 1, 2026, borrowers now have time to plan ahead and make the most of this important new provision.

Tags: loan prepayment, RBI rules 2026, floating rate loans India, Rule of One RBI, home loan prepayment India, borrower rights India

Share This Post