Rule of 70 Economics: Meaning, Formula, Uses and Real-World Impact

Rule of 70 Economics: Meaning, Formula, Uses and Real-World Impact

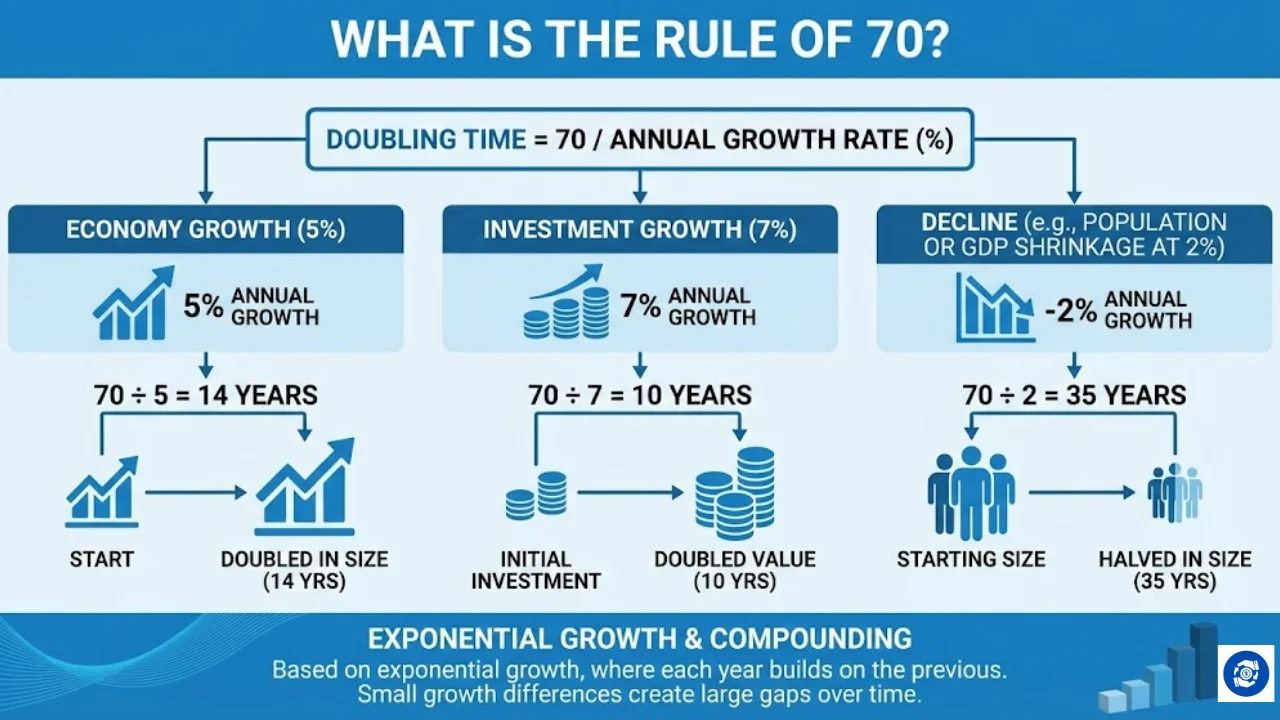

The Rule of 70 is a simple tool in economics and finance. It helps estimate how long it takes for a value to double when it grows at a steady rate. This value can be GDP, investments, population, or any other measure that grows over time.

Key Takeaways

- The Rule of 70 estimates doubling time using the formula: 70 divided by the annual growth rate.

- It is widely used in economics, demographics, and investment analysis.

- The rule is most accurate at lower growth rates below 10%.

- It highlights the strong effect of compounding growth over time.

- Public discussions today still use the concept to explain financial literacy.

The rule comes from the natural logarithm of 2, which is about 0.693. This value is rounded to 70 to make mental calculation easy. That is why the formula is used in classrooms and research. It gives a quick estimate without complex math. The Rule of 70 is sometimes called a doubling time formula. It is closely related to the Rule of 72 used in personal finance.

Also Read: Dave Ramsey’s 15% Rule: How It Works And Why So Many People Follow It

What Is the Rule of 70?

The Rule of 70 states that doubling time equals 70 divided by the annual growth rate expressed as a percent. If an economy grows at 5 percent each year, it takes about 14 years to double in size. If an investment grows at 7 percent, it doubles in about 10 years.

The same formula works with negative growth. If population or GDP shrinks at 2 percent per year, the size halves in about 35 years. This makes the rule useful for both expansion and decline.

The idea is based on exponential growth. This type of growth compounds. Each year builds on the previous year. Small growth differences create large gaps over time.

Why Economists Use the Rule of 70

The rule is common in macroeconomics. GDP growth is often slow, usually between 1 and 7 percent. At these levels the Rule of 70 gives results that are close to exact doubling times.

Economists use it to compare:

- Countries

- Long term growth paths

- Living standards

- Productivity

- Population size

A country growing at 7 percent doubles output in about 10 years. A country growing at 2 percent doubles in about 35 years. This difference can shape income levels, wealth creation, and global rankings.

Real-World Examples

If a country grows at 1 percent per year, it doubles in 70 years. At 3 percent, it doubles in about 23 years. At 10 percent, the economy doubles in about 7 years.

Investors use the same logic. A 7 percent return doubles savings in 10 years. A 2 percent interest rate needs about 35 years.

Inflation also applies. If inflation is 3.5 percent, the value of money halves in about 20 years.

Population planners use it to project population size. A 1.4 percent growth rate doubles population in about 50 years.

Global Trends and Current Relevance

As of early 2026 the Rule of 70 remains a basic teaching tool. It appears in growth discussions across macroeconomics, AI progress debates, and long term forecasts.

Recent forecasts from major economic research bodies show clear divergence. Emerging markets often grow 4 to 7 percent. Advanced economies grow 1 to 2 percent. This means developing nations can double output faster. It also highlights global inequality risk.

Small growth rate changes can reshape economies over decades.

Public Opinion and Online Discussion

Recent posts on X (formerly Twitter) show people still value the rule as a financial literacy tool. Some users cite it to show that wealth can grow with compounding. Others use it to correct claims about investment limits. Many see it as a basic concept that everyone should know.

In technology discussions, the rule appears in debates about AI progress. Users estimate doubling periods of model capability. Some claim progress happens every 4 to 6 months. Others warn that infrastructure and cost limits slow growth.

Overall sentiment is positive and educational. The tool is seen as simple and reliable for quick estimates.

Rule of 70 vs Rule of 72

The Rule of 70 is often used in economics. The Rule of 72 is more common in investing. Both estimate doubling time. The difference is small. The Rule of 72 is easier to divide by many numbers. The Rule of 70 is slightly more accurate at lower growth rates.

Both rules rely on compound growth.

One Simple List to Understand Growth and Doubling Time

Here are example doubling times using the Rule of 70:

- 1 percent growth = 70 years

- 2 percent growth = 35 years

- 3 percent growth = 23.3 years

- 5 percent growth = 14 years

- 7 percent growth = 10 years

- 10 percent growth = 7 years

This shows how even small differences in growth create large change.

Accuracy and Limits

The Rule of 70 works best between 0.5 and 10 percent growth. At higher rates it becomes less precise. It also assumes constant growth. Real-world growth rates change with time. Inflation shifts, interest rates move, and GDP cycles.

The rule also assumes annual compounding. If compounding is monthly or quarterly, real results may differ.

So the rule is best used as an estimate, not an exact forecast.

Why It Matters in Economics and Finance

The Rule of 70 explains compounding in a way that is easy to understand. It shows how steady growth shapes long term wealth, output, and population. It also reminds investors and policymakers that small rate changes have big outcomes.

It also supports financial planning. People can estimate how long it takes for investments to grow. Governments can assess how fast economies expand. Analysts can study demographic change.

Conclusion

The Rule of 70 is a simple yet powerful tool in economics and finance. It helps estimate doubling time using a quick mental formula. It plays a key role in explaining compound growth, investment returns, GDP expansion, inflation impact, and population change. The rule remains widely used today because it offers clear insight without complex math.

While not exact, it is accurate enough for most real-world discussion. For detailed planning, experts still use full logarithmic calculations. But for fast understanding of growth dynamics, the Rule of 70 remains one of the most practical ideas in economics.

Tags: rule of 70, compound growth, economics explained, GDP growth, financial literacy, investment doubling

Share This Post