4% Rule William Bengen: Why It Still Matters In 2026

4% Rule William Bengen: Why It Still Matters In 2026

The 4% rule remains one of the most important ideas in retirement planning. This simple guideline was developed by financial planner William Bengen in 1994 to answer one key question: how much can a retiree safely withdraw from savings each year without running out of money too soon?

It may look like an old idea, but the rule continues to shape retirement discussions. Investors, retirees, and the FIRE community still debate it, especially at a time of higher inflation, changing markets, and longer life expectancy.

Key Takeaways

- The 4% rule was developed by William Bengen to estimate a safe retirement withdrawal rate.

- The strategy suggests withdrawing 4% in the first year, then adjusting for inflation each year.

- Bengen now says 4.7% may be a safe starting point based on expanded research.

- Inflation remains the biggest threat to retirement spending power.

- Many investors now prefer flexible or personalized withdrawal strategies.

Also Read: Rule of 70 Economics: Meaning, Formula, Uses and Real-World Impact

The rule was first published in the Journal of Financial Planning in 1994. Using historical market data, Bengen tested how portfolios behaved during good markets and major downturns. He concluded that withdrawals starting at about 4% per year, when adjusted for inflation, would usually last at least 30 years. This made the rule popular among retirees looking for steady income and long-term security.

How The 4% Rule Works

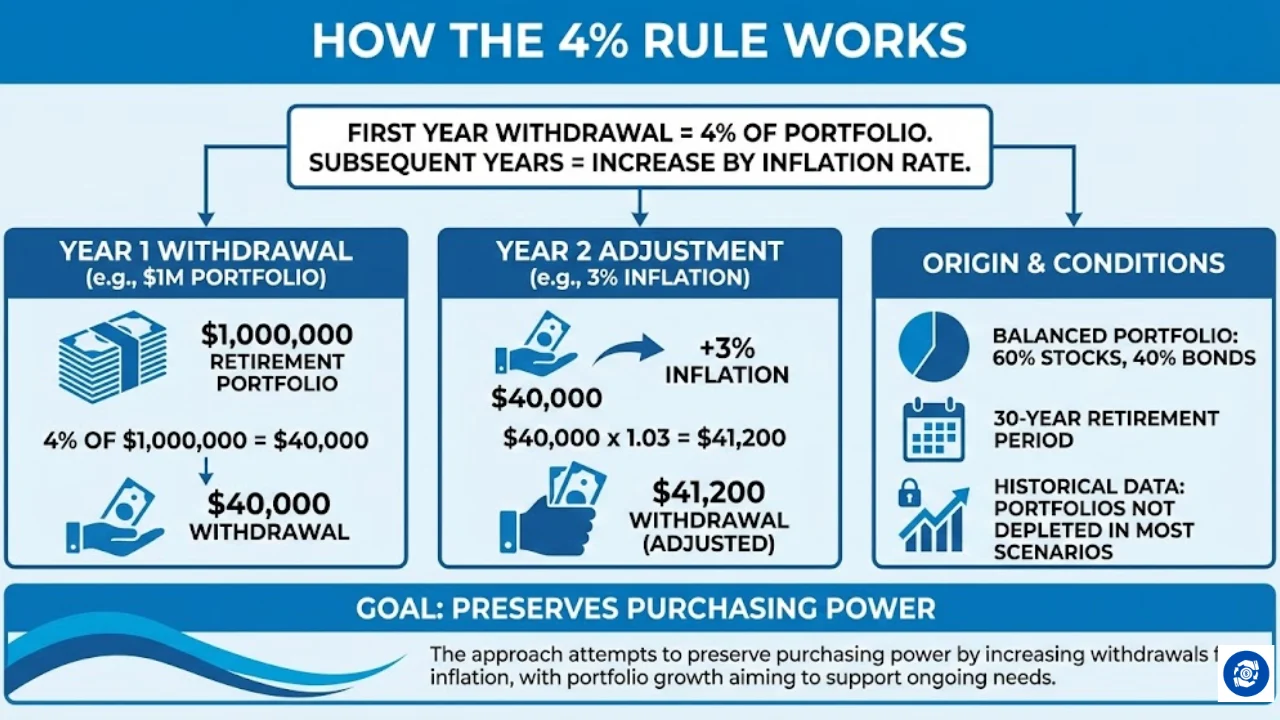

The 4% rule does not mean withdrawing 4% every single year. The 4% applies only in the first year of retirement. After that, the withdrawal amount increases each year to reflect inflation. This approach attempts to preserve purchasing power instead of fixing the withdrawal amount forever.

For example, on a $1 million retirement portfolio, the first withdrawal would be $40,000. If inflation is 3% the following year, the next withdrawal becomes $41,200. The portfolio continues to be invested, and the growth aims to support ongoing withdrawals.

The rule was originally based on a balanced portfolio of about 60% stocks and 40% bonds. The testing assumed a 30-year retirement period. Under those conditions, historical data suggested portfolios would not be depleted in most scenarios.

William Bengen’s Updated Research

Over the years, Bengen continued to study withdrawal strategies. In 2025, he published a new book titled A Richer Retirement: Supercharging the 4% Rule to Spend More and Enjoy More. In this new work, he updated the analysis using more asset classes, including small-cap and value stocks, as well as international diversification.

Based on this expanded data, Bengen now estimates that a 4.7% initial withdrawal rate may still be safe over 30 or more years. This rate even considers historically difficult periods such as the late-1960s stagflation era.

This means a retiree with $1 million may be able to withdraw $47,000 in the first year instead of $40,000, then adjust for inflation thereafter.

Bengen also stresses a key point. The rule is meant as a conservative baseline, not a rigid command. Real-life spending can change. Markets do not always behave the same way. Personal financial goals differ. He encourages retirees to review their income needs, investment mix, tax situation, and time horizon before deciding on any withdrawal plan.

Why Inflation Is Still The Biggest Risk

Inflation plays a major role in retirement planning. Rising prices reduce what savings can buy over time. Bengen has repeatedly called inflation the “greatest enemy” of retirees.

Even when Social Security or income rises, higher expenses can absorb much of the increase. A long period of high inflation early in retirement can weaken portfolios faster because withdrawals continue while investments struggle to keep pace.

This is why Bengen suggests retirees be ready to respond to inflation quickly. Adjusting spending, reviewing portfolios, and maintaining diversification can help protect long-term income stability.

What People Are Saying Today

Conversations on X (formerly Twitter) show that the 4% rule continues to generate strong opinions, especially within FIRE, dividend investing, and wealth-building communities. Many users still admire the rule for its clarity and data-driven design. Others feel that modern markets and high yields create better alternatives.

Positive Views

- Users highlight real-life stories where retirees lived comfortably using a structured withdrawal plan.

- Some welcome Bengen’s increase to 4.7%, seeing it as approval to enjoy more lifestyle spending.

- Historical results often show portfolios ending with surplus assets, not zero balances.

Critical Views

- Some investors believe markets have changed and the original rate may be too aggressive.

- Long early-retirement periods may benefit from rates closer to 3–3.5%.

- Dividend investors prefer strategies focused on income-only withdrawals.

- Taxes, RMDs, and sequence-of-returns risk remain key concerns.

Despite the debate, Bengen himself encourages flexibility. Static withdrawal plans may not fit everyone, especially with evolving financial tools and personalized strategies.

A Simple List Of Key Factors That Influence Withdrawal Safety

Here are the main elements that affect whether the 4% rule works for someone:

- Total retirement savings balance

- Length of retirement period

- Market performance and volatility

- Inflation trends

- Portfolio allocation and diversification

- Tax treatment of income

- Desire to leave an inheritance

- Rebalancing frequency

- Spending patterns

- Income from other sources

This shows why many planners now treat the 4% rule as a foundation rather than a final answer.

Changing Trends In 2025–2026

Recent discussions increasingly focus on safe withdrawal rate (SWR) strategies that adjust based on market behavior. Guardrail methods, percentage-based withdrawals, and Monte Carlo analysis are becoming more common.

The FIRE community also experiments with combinations such as:

- index funds

- dividend portfolios

- covered call ETFs

- crypto exposure

Income-focused investors argue that generating 7–12% yields from certain funds can support retirement spending without selling assets. However, these methods come with their own levels of risk and volatility.

Research from firms such as Morningstar and Vanguard in recent years still supports rates near 4% for balanced portfolios. But both also suggest that personalized planning may outperform one fixed rule.

Why The 4% Rule Still Matters

Even with new tools, the 4% rule remains important for a simple reason. It gives people a clear starting point. Instead of guessing, retirees can build an income plan around a tested framework. This helps reduce fear of running out of money and supports better decision-making.

It also highlights the value of discipline. Limiting early withdrawals may protect savings during market downturns, giving portfolios time to recover.

At the same time, the rule shows that financial planning must evolve. Retirees today face higher life expectancy, changing tax laws, and new investment choices. Flexibility is now part of the conversation, not an exception.

Final Thought

William Bengen’s work reshaped retirement planning more than 30 years ago. His original 4% rule helped millions of people feel more confident about withdrawing income in retirement. Now, with his updated 4.7% guidance and continued research, the conversation is shifting toward spending more, enjoying retirement, and managing risk in smarter ways.

The rule may not be perfect, and it may not apply equally to everyone. But its core idea remains powerful. A structured, data-based withdrawal plan can help retirees live better, plan better, and face the future with greater certainty.

Tags: retirement planning, 4 percent rule, William Bengen, safe withdrawal rate, FIRE investing, inflation and retirement

Share This Post