Net Worth Rule Explained: What the Formula Really Tells You About Your Wealth

Net Worth Rule Explained: What the Formula Really Tells You About Your Wealth

The Net Worth Rule is one of the simplest benchmarks used in personal finance to check whether your wealth growth matches your age and income. It does not try to predict riches or guarantee financial success. It only offers a baseline to measure progress.

Even in 2025 and 2026, this rule continues to appear in finance blogs, podcasts, and social media discussions. Many people use it as a quick self check rather than a strict target. Its real value lies in helping people pause and review their saving and investing habits.

Table of Contents

Key Takeaways

- The Net Worth Rule links age and income to expected wealth

- It comes from long term research on everyday millionaires

- The formula works best as a guideline not a fixed standard

- Discipline and saving habits matter more than income level

- The rule may need adjustments for modern economic conditions

Also Read: 10% Retirement Rule Explained: Does It Still Work in 2026?

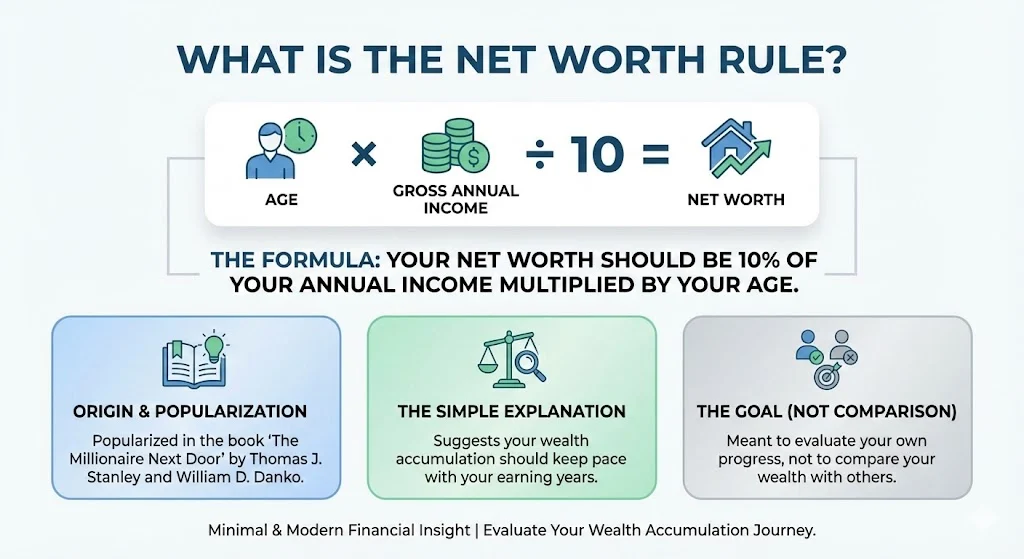

What Is the Net Worth Rule?

The Net Worth Rule is commonly written as:

Net Worth = Age × Gross Annual Income ÷ 10

In simple terms, it suggests that your net worth should equal ten percent of your annual income multiplied by your age. The formula was popularized in the book The Millionaire Next Door by Thomas J. Stanley and William D. Danko.

The goal of this rule is not to compare yourself with others. It is meant to help you evaluate whether your wealth accumulation is keeping pace with your earning years.

Where the Rule Comes From?

The formula is based on more than twenty years of research on self made millionaires. The authors studied people who quietly built wealth through steady saving, controlled spending, and long term investing.

Their research showed that many wealthy individuals did not live flashy lives. Instead, they focused on consistency. The Net Worth Rule became a quick way to reflect that behavior in numbers.

How to Calculate Your Net Worth Using the Rule

To apply the rule, you need two figures. Your current age and your gross annual income before taxes. Inheritances are usually excluded because the rule focuses on wealth built through earning and saving.

Example:

Age: 40

Annual income: 100000

Calculation:

40 × 100000 ÷ 10 = 400000

According to the rule, a net worth of around 400000 would place you at the expected level for your age and income.

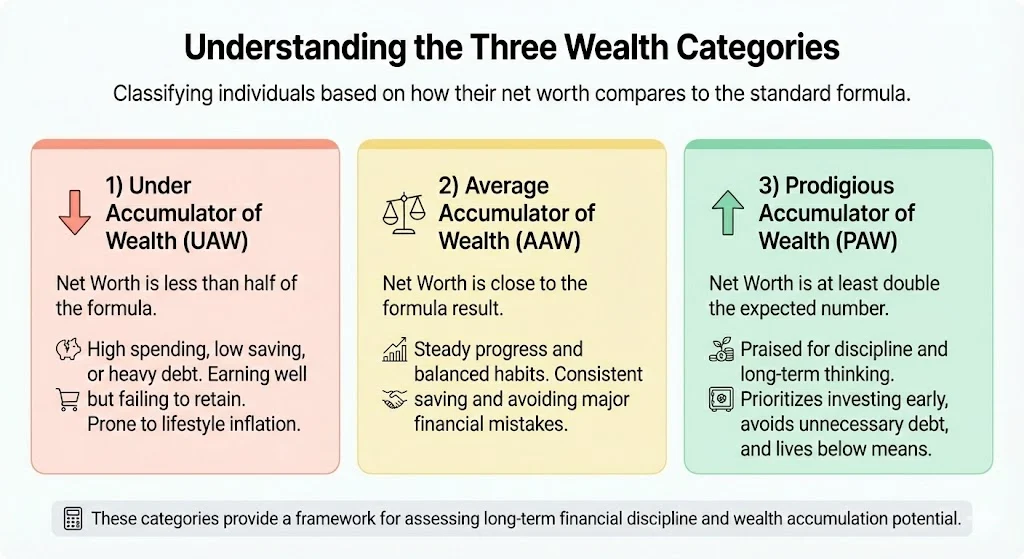

Understanding the Three Wealth Categories

The Net Worth Rule also classifies people into three groups based on how their actual net worth compares to the formula.

1) Under Accumulator of Wealth

An Under Accumulator of Wealth has a net worth that is less than half of what the formula suggests. This often signals high spending, low saving, or heavy debt.

People in this category usually earn well but fail to retain wealth. Lifestyle inflation is a common reason.

2) Average Accumulator of Wealth

An Average Accumulator of Wealth has a net worth close to the formula result. This indicates steady progress and balanced financial habits.

This group represents people who save consistently and avoid major financial mistakes.

3) Prodigious Accumulator of Wealth

A Prodigious Accumulator of Wealth has a net worth that is at least double the expected number. These individuals are often praised for discipline and long term thinking.

They usually prioritize investing early, avoid unnecessary debt, and live below their means even as income rises.

Does the Rule Include Your House?

One of the most debated aspects of the Net Worth Rule is whether home equity should be included. Different interpretations exist, even among readers of the original research.

Some argue that a primary residence should count because it is an asset with value. Others believe it should be excluded when assessing financial independence or retirement readiness.

The reasoning behind exclusion is simple. A house is not easily converted into spending money without selling or downsizing. Because of this, many modern advisors focus on liquid assets when applying the rule.

Why the Rule Still Matters Today?

Despite criticism, the Net Worth Rule remains popular because it is easy to understand. It highlights a key truth. High income alone does not create wealth.

The rule rewards consistency over risk taking. It reminds people that saving and investing over time matter more than short term gains.

In online discussions, many people share the formula to motivate better habits. It often appears alongside other rules like budgeting percentages or retirement multiples.

Common Criticism of the Net Worth Rule

The modern economy has changed since the rule was first introduced. Rising housing costs, student debt, and inflation have made wealth building harder for younger generations.

Critics argue that the formula is less realistic for people in their twenties and early thirties. Wealth accumulation usually accelerates later due to compounding.

Others point out that entrepreneurs and high risk investors experience uneven net worth growth. For them, a steady benchmark may feel irrelevant or discouraging.

Adjustments People Make to the Formula

To reflect current conditions, many people adapt the Net Worth Rule instead of abandoning it.

Some adjust the divisor to reflect local costs of living. Others apply the rule only after a certain age. In some regions, people divide the result by twenty instead of ten.

These changes do not replace the original idea. They simply make the rule more flexible.

How the Rule Fits Into Retirement Planning

In retirement discussions, the Net Worth Rule is often paired with income multiples. Examples include saving three times salary by your forties or ten times by retirement.

The rule acts as an early checkpoint rather than a final destination. It helps identify gaps before retirement years arrive.

Financial planners often stress that it should be used alongside other measures such as savings rate, investment allocation, and debt levels.

Why High Net Worth Individuals Often Ignore Income Rules

Some wealthy individuals dismiss income based formulas entirely. They focus on spending as a percentage of net worth rather than salary.

This approach reflects a shift from earning to preservation. Once assets are large enough, income becomes less relevant than sustainable withdrawal rates.

Still, for average earners building wealth, the Net Worth Rule remains a practical starting point.

Final Thoughts on the Net Worth Rule

The Net Worth Rule is not a law and it is not destiny. It is a mirror that reflects habits over time.

Used correctly, it encourages accountability and long term thinking. Used blindly, it can feel discouraging or misleading.

For most people, the best approach is simple. Treat the rule as one tool among many. Focus on saving consistently, investing wisely, and controlling spending. Wealth grows quietly through discipline, not formulas alone.

Tags: net worth rule, personal finance, wealth building, net worth formula, financial planning, money habits

Share This Post