10 5 3 Rule Of Investing: Why Most Investors Get Returns Wrong?

10 5 3 Rule Of Investing: Why Most Investors Get Returns Wrong?

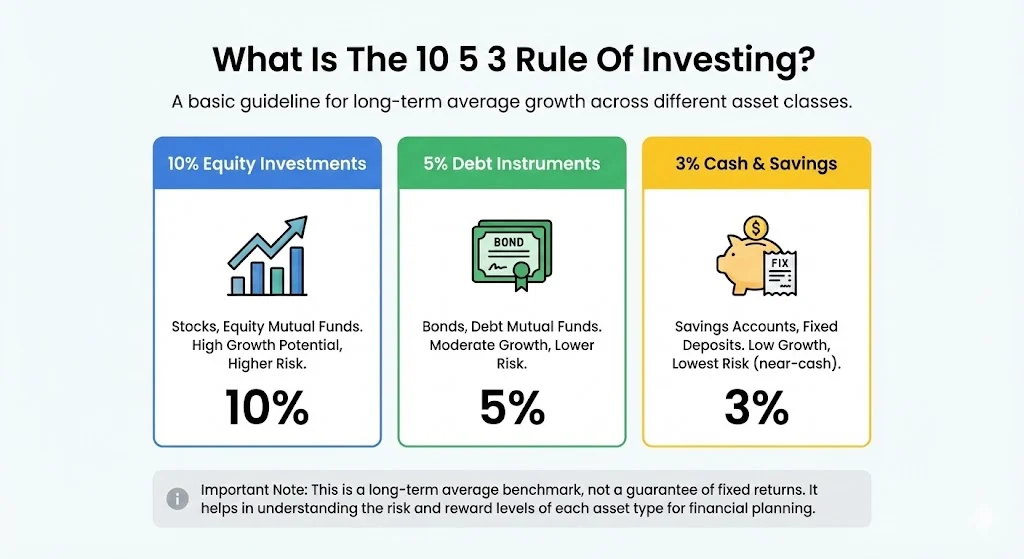

The 10 5 3 rule of investing is a simple way to understand how different types of money grow over time. It gives a clear picture of what long term investors can expect from equity, debt, and cash based investments. In a time when people are confused between mutual funds, fixed deposits, and savings accounts, this rule gives direction.

In 2025 and 2026 the rule is again getting attention on finance blogs and social media. New investors are using it to understand why some money grows faster and some stays stable. The rule helps set the right expectations before putting money into any investment.

Table of Contents

Key Takeaways On 10 5 3 Rule

- The 10 5 3 rule explains expected returns for equity, debt, and cash

- Equity aims for growth. Debt offers stability. Cash gives safety

- The rule helps in asset allocation and long term planning

- It is a guideline. It is not a guarantee of returns

- It is useful for beginners and long term investors

What Is The 10 5 3 Rule Of Investing?

The 10 5 3 rule is a basic investing guideline that shows how different asset classes grow on average over long periods. It suggests that equity based investments such as stocks and equity mutual funds may deliver around 10 percent annual returns. Debt instruments such as bonds or debt mutual funds may give around 5 percent. Cash based options such as savings accounts and fixed deposits may give close to 3 percent.

This rule was popularized in financial books and planning tools. It is used as a benchmark. It does not promise fixed returns. It helps investors understand the risk and reward level of each asset type.

Why This Rule Exists?

Not all money grows in the same way. Equity is linked to company growth and market demand. Debt is linked to interest payments. Cash is focused on safety and access. The 10 5 3 rule puts these differences into simple numbers.

Stocks carry higher risk. They can fall in the short term. Over long periods they have given higher growth. Bonds and debt funds are less volatile. They give steady income. Cash keeps money safe but growth is limited.

This rule helps investors avoid two common mistakes. One is expecting very high returns from safe investments. The other is taking too much risk without understanding it.

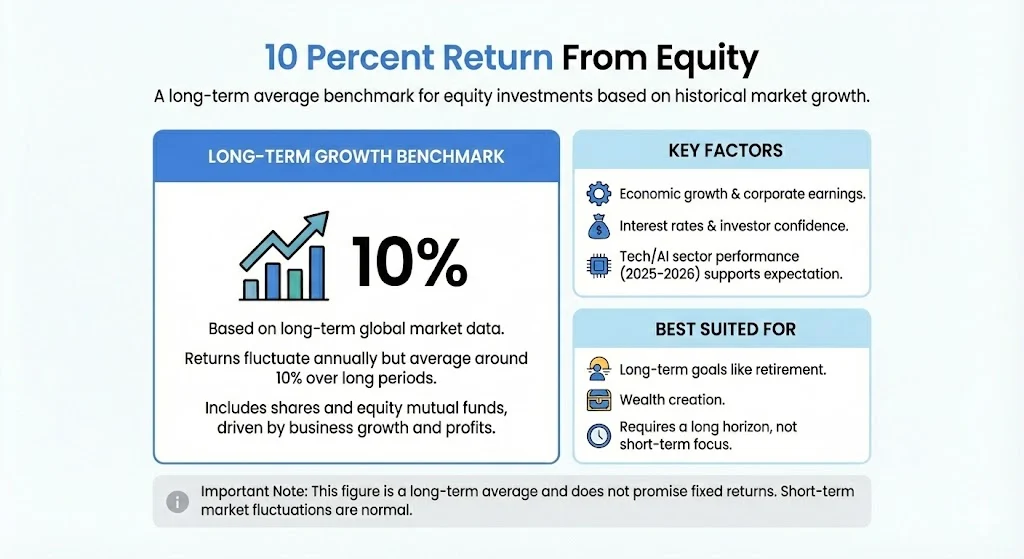

10 Percent Return From Equity

Equity includes shares of companies and equity mutual funds. These investments depend on business growth, profits, and market trends. When companies earn more and expand, their stock prices usually rise.

Over long periods global equity markets have shown close to 10 percent annual growth. Some years give more. Some years give less. The long term average stays near this range.

Factors that affect equity returns include economic growth, corporate earnings, interest rates, and investor confidence. In 2025 and 2026 tech and AI related companies have shown strong performance. This has helped keep the long term equity return expectation close to the 10 percent mark.

Equity is best for people with long term goals like retirement or wealth creation. Short term ups and downs should not be the main focus.

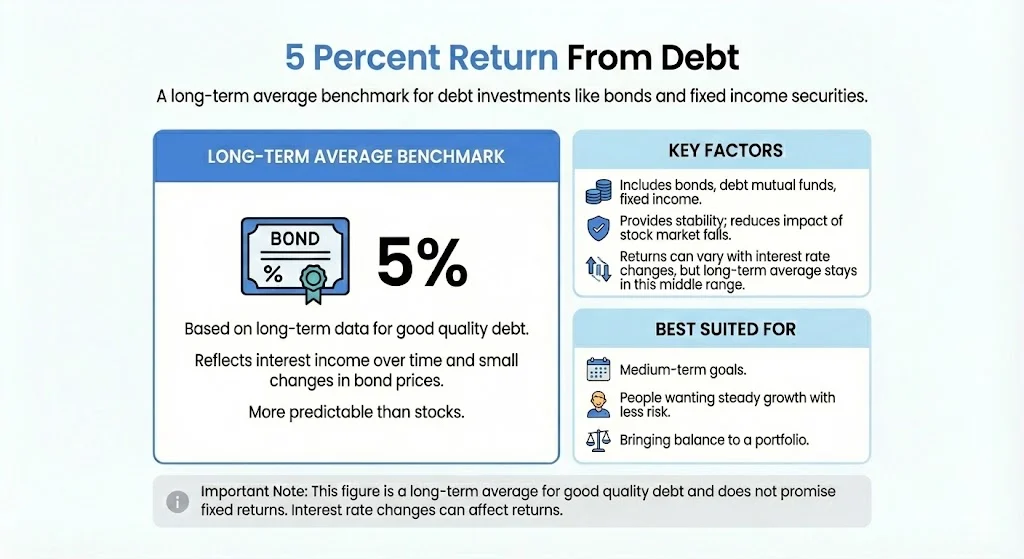

5 Percent Return From Debt

Debt investments include bonds, debt mutual funds, and fixed income securities. These investments pay interest. The returns are more predictable than stocks.

A 5 percent return is often used as a long term average for good quality debt investments. It reflects interest income over time. It also includes small changes in bond prices.

Debt is used to bring stability to a portfolio. It reduces the impact of stock market falls. In times when interest rates change, debt returns can go up or down. Still over long periods it stays closer to the middle range.

Debt is useful for medium term goals. It suits people who want steady growth with less risk.

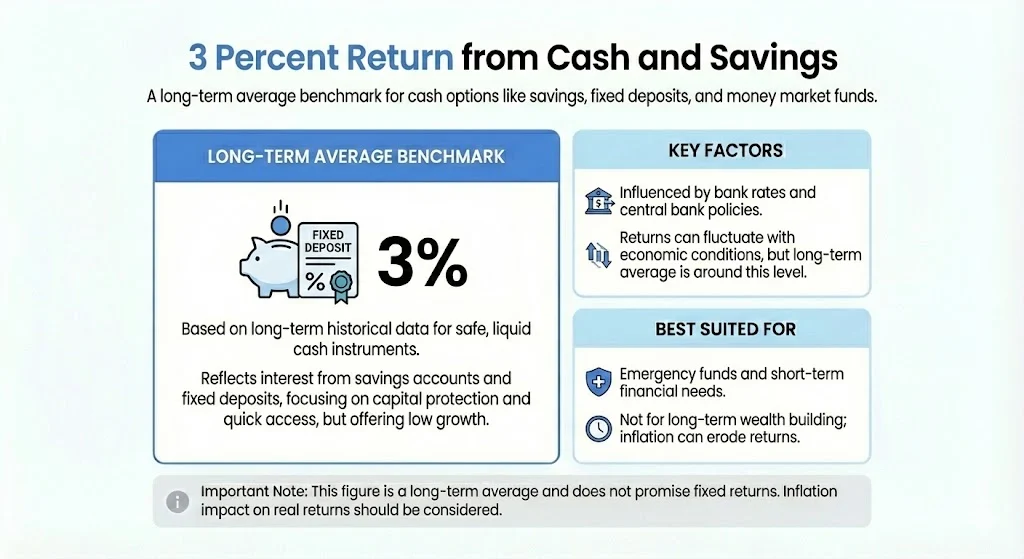

3 Percent Return from Cash and Savings

Cash includes savings accounts, fixed deposits, and money market funds. These options focus on safety and quick access. They protect capital but offer low growth.

A 3 percent return is a long term average for these instruments. It changes with bank rates and central bank policy. In some years it may be higher. In others it may be lower.

Cash is important for emergency funds and short term needs. It should not be used for long term wealth building. Inflation often eats into cash returns.

10 5 3 Rule Data from Recent Finance Discussions

This data is widely shared in finance education posts in 2025 and 2026. Many tweets point out that equity helps beat inflation, while keeping too much money in cash slows down long term wealth growth.

Expected Returns by Asset Class

| Asset Class | Expected Long Term Return | Risk Level | Main Purpose |

|---|---|---|---|

| Equity | Around 10 percent | High | Long term growth |

| Debt | Around 5 percent | Medium | Stability and income |

| Cash | Around 3 percent | Low | Safety and liquidity |

This simple structure helps investors understand how different types of money work and why a balanced mix is important for steady financial progress.

How the Rule Helps in Real Life

The 10 5 3 rule helps people set realistic expectations. It shows that money in savings will not double fast. It shows that equity needs time to work.

It also helps with asset allocation. A balanced investor may keep part of money in stocks for growth. Another part in debt for safety. A small part in cash for emergencies.

This balance protects investors during market ups and downs. When stocks fall, debt and cash provide support. When stocks rise, growth comes from equity.

Using the Rule for Long Term Goals

Long term goals like retirement or children education need growth. Equity plays a big role here. The 10 percent expectation shows why stocks are important.

Medium term goals like buying a house or funding a wedding need some stability. Debt helps here with its 5 percent return.

Short term goals and emergency funds need safety. Cash with 3 percent return is used here.

This structure helps match money with time horizon. It also avoids panic during market movements.

Public View on the 10 5 3 Rule

Recent posts on X show that people like this rule for its simplicity. Many finance educators share it with other rules like the Rule of 72. Users say it helps them move money from low yield savings to balanced investing.

The rule is often called a simple yet powerful framework. It is used in discussions about mutual funds, fixed deposits, and SIP planning. It is seen as a way to avoid over confidence and fear.

Some investors also say it reminds them that all money does not grow equally.

Limitations of the 10 5 3 Rule

The rule is not a promise. Markets change. Inflation changes. Interest rates move. Equity returns can be higher or lower than 10 percent in different periods.

Debt returns can fall when rates rise. Cash returns may not keep up with rising prices. The rule does not consider taxes or costs.

It also does not suit every person. Some people can take more risk. Others need more safety. The rule should be used as a guide. Not as a fixed formula.

Why the Rule Still Works in 2026

Even with new trends like AI stocks and global rate changes, the basic idea stays the same. Risk and return are linked. Growth comes from equity. Stability comes from debt. Safety comes from cash.

The 10 5 3 rule keeps investors focused on this balance. It stops them from chasing very high returns without understanding risk. It also stops them from staying too safe and losing growth.

This is why it is still used by beginners and long term planners.

Final Thoughts

The 10 5 3 rule of investing gives a clear way to see how money grows across different asset classes. It does not need complex math. It does not need deep market knowledge. It only needs basic understanding of risk and time.

By using this rule, investors can build a balanced portfolio. They can plan goals with more clarity. They can avoid common mistakes. In an uncertain market, simple rules like this help keep discipline and focus.

Tags: 10 5 3 rule, investing basics, equity vs debt, mutual fund returns, personal finance, long term investing

Share This Post