The 50 30 20 Rule Of Budgeting By Elizabeth Warren

The 50 30 20 Rule Of Budgeting By Elizabeth Warren

Many people struggle to find a budgeting method that is simple to follow and easy to maintain. The 50 30 20 rule of budgeting has become one of the most popular systems for beginners and experienced planners.

The rule was popularized by U.S. Senator Elizabeth Warren and her daughter Amelia Warren Tyagi in their book All Your Worth The Ultimate Lifetime Money Plan. It breaks down after tax income into clear spending categories so that life needs are covered and savings stay consistent.

Key Takeaways On 50 30 20 Rule Of Budgeting

- The 50 30 20 rule divides after tax income into needs wants and savings.

- It was popularized by Elizabeth Warren and Amelia Warren Tyagi in 2005.

- Needs cover essential expenses like housing, utilities and transport.

- Wants include lifestyle spending like dining out and entertainment.

- Savings focus on investments, emergency funds and extra debt payments.

- The method is trending again in 2026 due to rising living costs and financial awareness.

The strength of this method lies in its structure. It gives people a simple way to manage money, reduce stress and prepare for the future. It also allows space for lifestyle enjoyment so the plan does not feel restrictive. That balance is one of the main reasons the rule still attracts attention nearly two decades after its introduction.

Also Read: 3X Emergency Fund Saving Rule By Suze Orman: Is It Still Enough Today?

What Is The 50 30 20 Rule

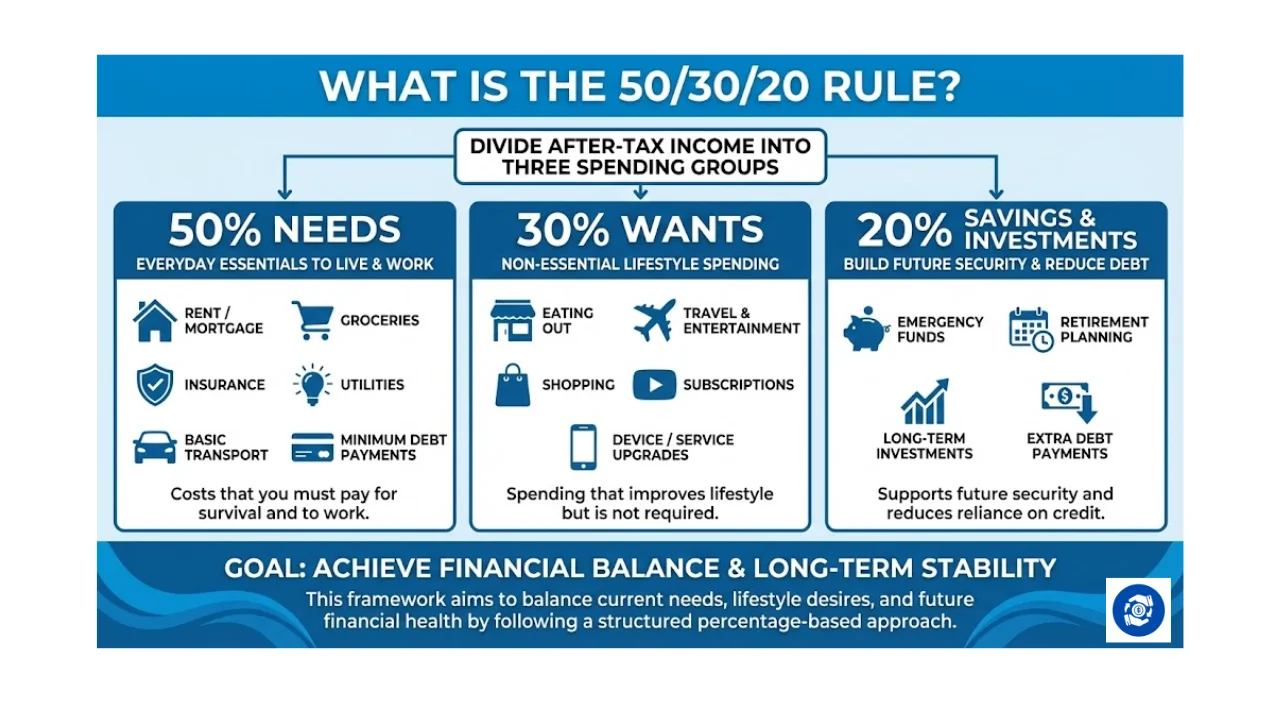

The 50 30 20 budgeting rule divides your after tax income into three spending groups. Half of your income goes toward needs. These are the everyday costs that you must pay in order to live and work. Rent or mortgage payments, groceries, insurance, utilities, basic transport and minimum debt payments fall into this category.

The second group is wants. This covers non essential spending that improves lifestyle but is not required for survival. Examples include eating out, travel, entertainment, shopping, subscriptions and upgrades to devices or services. Under the 50 30 20 framework this group should account for 30 percent of your after tax income.

The final 20 percent is set aside for savings and investments. This portion supports emergency funds, retirement planning, long term investments and extra payments toward debt. The goal is to build future security and reduce reliance on credit.

Why Elizabeth Warren’s Rule Became So Popular

The reason this rule spread worldwide is its simplicity. Many people avoid budgeting because traditional methods feel complex. This structure removes the need to track every detail. Instead it guides spending behavior at a high level.

Financial planners often recommend it for beginners because it sets a strong foundation. It balances daily life with future planning. It does not force people to cut out enjoyment. It simply gives clear boundaries.

In early 2026 the rule is trending again. Rising inflation and high living costs are pushing people to rethink their financial habits. News coverage, social media threads and financial influencers describe it as a tool to restore financial hygiene. TV segments in countries like Kenya feature experts explaining how the method helps families reset their finances for the year.

How The 50 Percent Needs Category Works

The needs category includes essential living costs. These are expenses that you cannot easily remove without serious disruption. Typical examples include:

- Rent or mortgage

- Utilities

- Groceries

- Transportation

- Insurance

- Minimum loan repayments

If needs rise beyond 50 percent, then the rule suggests reviewing lifestyle choices. Some households adjust by choosing cheaper accommodation, using public transport, cooking at home or reducing bills. The goal is not perfection but awareness.

How The 30 Percent Wants Category Works

The wants category gives room for lifestyle spending. This is one reason the method feels sustainable. You do not need to remove all fun. You simply keep it under control.

This group may include:

- Travel

- Dining out

- Streaming services

- Upgraded devices

- Fashion purchases

- Events

Many users online describe the rule as a guilt free structure. You enjoy your money but still prepare for the future.

The Role Of The 20 Percent Savings Group

Savings are the base of financial security. The 20 percent category can be used for:

Emergency funds

Investment accounts

Retirement planning

Extra debt repayment

Experts often recommend building three to six months of expenses in an emergency fund first. After that, long term investments can grow wealth over time. People with higher financial goals sometimes increase this category beyond 20 percent.

Public Opinion In 2026

Recent discussions across social platforms show strong support for the rule. Many readers call it the simplest way to budget. Others describe it as a cheat code for beginners. Families and first time earners report that it helps them get control without feeling overwhelmed.

Some posts also credit Elizabeth Warren directly. Users explain how the method came from her 2005 book. This has helped renew interest in her financial guidance.

Criticisms And Adjustments

Not everyone agrees with the rule in its original form. Some people in high cost cities say needs alone can exceed 50 percent. Others believe the savings rate should be higher for faster wealth building.

Common alternatives include:

40 20 40

60 20 20

50 40 10

These adjustments often reflect different income levels or aggressive saving plans. Despite this, most users still appreciate the structure behind the rule. They see it as a guideline, not a strict command.

A Simple Example Of The Rule In Action

Below is one simple example to show how the system works.

After tax income: 4000 per month

Needs: 2000

Wants: 1200

Savings: 800

This setup covers essential costs, leaves room for lifestyle spending and builds long term security.

Why The Rule Still Matters Today

The 50 30 20 rule supports discipline without pressure. It helps reduce debt, improve stability and encourage smart choices. It also reminds people that money planning should support both today and tomorrow.

In a world of rising expenses and financial stress, the clarity of this rule stands out. It acts as a starting point for anyone who wants to improve their financial life.

Final Thought

The 50 30 20 budgeting rule by Elizabeth Warren remains one of the most recognizable money management frameworks.

It keeps budgeting simple, clear and structured. It suits beginners and also works as a reset tool for those rebuilding their financial habits. While many people adjust the percentages to match their lifestyle, the core idea remains powerful. Spend wisely on needs. Enjoy wants in moderation. Save for the future with intention.

Tags: 50 30 20 rule, budgeting tips, personal finance, Elizabeth Warren, money management, savings plan

Share This Post