12 + 1 Prepayment Rule for Home Loan: Pay 1 Extra EMI Save ₹14 Lakh

12 + 1 Prepayment Rule for Home Loan: Pay 1 Extra EMI Save ₹14 Lakh

Buying a home on loan is one of the biggest financial decisions for most Indian families. The loan tenure usually runs for 20 to 30 years, and a large part of the total amount paid goes toward interest. Because of this, borrowers constantly look for simple ways to reduce interest and close the loan early without disturbing their monthly budget.

One strategy that has gained strong attention in recent years is the 12 + 1 prepayment rule. This approach is widely discussed in personal finance circles because it is easy to follow and delivers visible results over time.

Key Takeaways

- The 12 + 1 rule means paying one extra EMI every year along with regular EMIs

- Extra payments directly reduce the principal amount

- Early prepayment saves the highest interest due to front loaded EMIs

- RBI rules effective January 1, 2026 remove prepayment penalties on floating rate loans

- The strategy suits borrowers who want faster debt freedom with low risk

What Is the 12 + 1 Prepayment Rule?

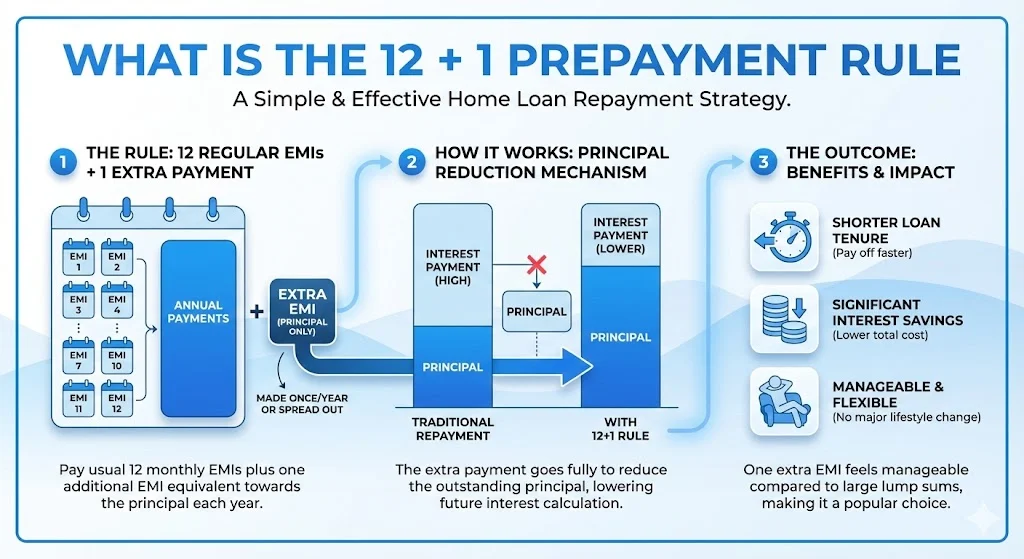

The 12 + 1 prepayment rule is a simple home loan repayment strategy. Under this method, you pay your usual 12 monthly EMIs in a year and add one extra EMI toward the loan principal. This additional payment can be made once a year as a lump sum or spread across the year in smaller parts.

The extra EMI goes fully toward reducing the principal. Since home loan interest is calculated on the outstanding principal, lowering it early brings down the total interest paid over the entire tenure.

Many borrowers follow this rule because it does not require a major lifestyle change. One extra EMI per year feels manageable compared to large lump sum prepayments.

Also Read: 28/36 Debt Rule Explained for Today’s Economy: This Rule Decides Your Mortgage

Why Home Loan Interest Feels Heavy in Early Years

Home loans follow a reducing balance method, but the interest component is front loaded. In the initial years, a large part of your EMI goes toward interest and only a small portion reduces the principal.

This is the main reason early prepayment works so well. When you reduce the principal in the first 5 to 10 years, the interest for all remaining years gets recalculated on a lower amount. The long term impact is massive compared to prepaying in the final years.

Borrowers who understand this structure often prefer systematic prepayments like the 12 + 1 rule.

How the 12 + 1 Rule Works in Practice?

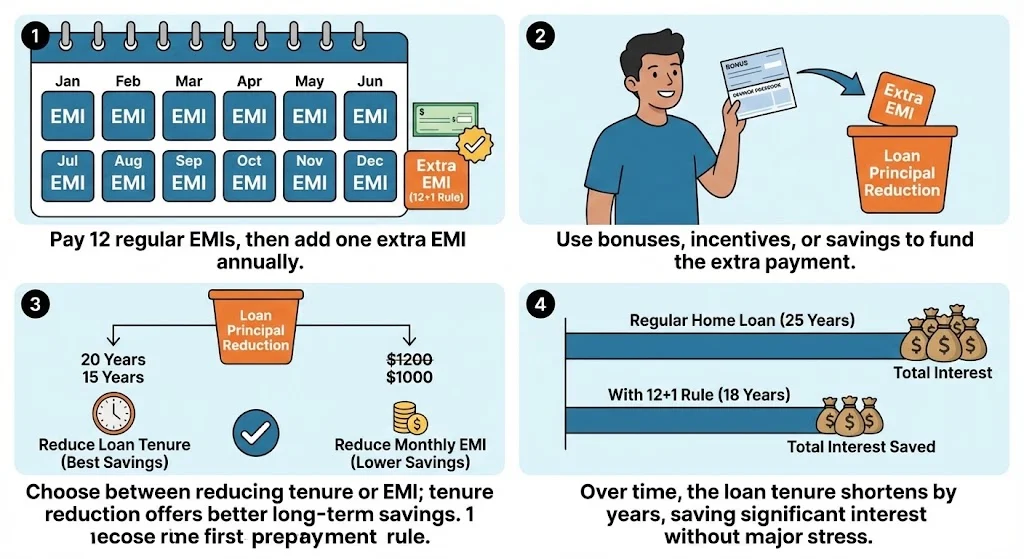

Under this approach, you continue paying your regular EMI every month. Once a year, you make an additional payment equal to one EMI amount. Some people pay it using annual bonuses, incentives, or savings from salary hikes.

Banks usually give two options after prepayment. You can reduce the loan tenure while keeping the EMI same, or reduce the EMI while keeping the tenure same. Financially, tenure reduction delivers better interest savings, and most borrowers following the 12 + 1 rule choose this option.

Over time, the loan shortens by several years without increasing monthly stress.

Example of Interest Savings Using 12 + 1 Rule

Consider a home loan of ₹50 lakh taken for 25 years at an interest rate of 8.5 percent. The monthly EMI comes to around ₹40,000.

If you follow the 12 + 1 rule and pay one extra EMI every year:

- The loan tenure can reduce by around 4 to 5 years

- Total interest savings can reach ₹13 to ₹14 lakh

- The loan closes much earlier than scheduled

These numbers improve further if the extra payments are made in the first half of the loan tenure.

RBI Prepayment Rules That Changed the Game

One major concern borrowers had in the past was prepayment penalty. Many lenders charged 2 to 4 percent on partial or full prepayment, which reduced the benefit.

This changes with the RBI directions on prepayment charges effective January 1, 2026. As per the updated rules:

- No prepayment or foreclosure charges on floating rate home loans for individuals

- The rule applies to non business personal loans and most MSE borrowers

- Borrowers can freely prepay without penalty on floating rate loans

Since most home loans in India are floating rate, this rule removes a major barrier and makes strategies like the 12 + 1 rule more practical and cost effective.

Why Borrowers Are Adopting Systematic Prepayments

Recent trends show a shift toward disciplined and planned prepayments. Borrowers treat the extra EMI like an SIP, but for debt reduction instead of investment.

With interest rates hovering around 8.5 to 9 percent in 2025 and 2026, many people prefer guaranteed savings over uncertain returns. Paying extra toward the loan gives mental peace and reduces long term obligations.

Social media discussions also show strong appreciation for early prepayment, especially after penalties were removed.

Public Sentiment Around the 12 + 1 Strategy

Recent posts on social platforms reflect mixed but mostly positive opinions.

Many users highlight the math behind the strategy. One extra EMI per year going fully toward principal leads to large interest savings and a shorter tenure. Several borrowers shared real examples of saving lakhs simply by prepaying early.

There is also a strong debt free mindset. People prefer closing loans early rather than carrying them for decades. For many families, the emotional benefit of owning a home outright matters more than maximizing returns elsewhere.

At the same time, some users raise valid concerns about opportunity cost.

Prepay Home Loan or Invest the Money

A common debate is whether it is better to prepay a home loan or invest surplus money.

Those against aggressive prepayment argue that home loans offer long tenure at relatively low interest. Equity markets have delivered average returns of 12 percent or more over long periods. From this view, investing surplus funds may create more wealth than saving interest.

On the other hand, prepayment offers guaranteed returns equal to the loan interest rate. It also reduces financial risk and monthly pressure. There is no market volatility involved.

The right choice depends on income stability, risk tolerance, and personal goals. Many borrowers follow a balanced approach by investing part of the surplus and using part for prepayment.

When the 12 + 1 Rule Makes the Most Sense

The strategy works best in specific situations:

- The loan is in the early years

- The interest rate is high

- You have surplus income or annual bonuses

- You prefer stability over aggressive investing

- You want faster debt freedom

Borrowers spending 50 to 60 percent of income on EMIs often use prepayment to reduce stress and improve cash flow in future years.

Points to Check Before Starting Prepayment

Even with RBI rules in place, borrowers should check certain conditions:

- Lock in period may apply for the first 1 to 3 years

- Minimum prepayment amounts may exist at some lenders

- Always choose tenure reduction instead of EMI reduction

- Maintain emergency funds before prepaying

Home loan prepayment also locks money into an illiquid asset, so balance is important.

Final Thoughts on the 12 + 1 Prepayment Rule

The 12 + 1 prepayment rule is not a shortcut or trick. It is a disciplined and realistic way to reduce home loan burden without changing daily life. With RBI removing penalties on floating rate loans from 2026, the strategy becomes even more attractive.

For borrowers who value certainty, savings, and peace of mind, paying one extra EMI every year can lead to early loan closure and significant interest savings. For others focused on wealth creation, combining this method with smart investing may offer the best outcome.

Used wisely, the 12 + 1 rule can turn a long and heavy loan into a manageable and rewarding financial journey.

Tags: home loan prepayment, 12 plus 1 rule, extra EMI home loan, RBI prepayment rules 2026, floating rate home loan, reduce home loan interest

Share This Post