( All Banks ) You Need These Document To Get Home Loan In India

Getting a home loan in India can feel overwhelming, especially when banks ask for multiple documents. I have helped countless clients navigate this process and trust me, having your paperwork ready makes everything smoother.

Whether you are applying to HDFC, Axis Bank, Bajaj Finserv or any other lender, the document requirements are quite similar across the board.

Let me walk you through exactly what documents you need to gather before applying for your home loan. I will break this down based on your employment type because requirements differ slightly between salaried and self-employed applicants.

Key Takeaways

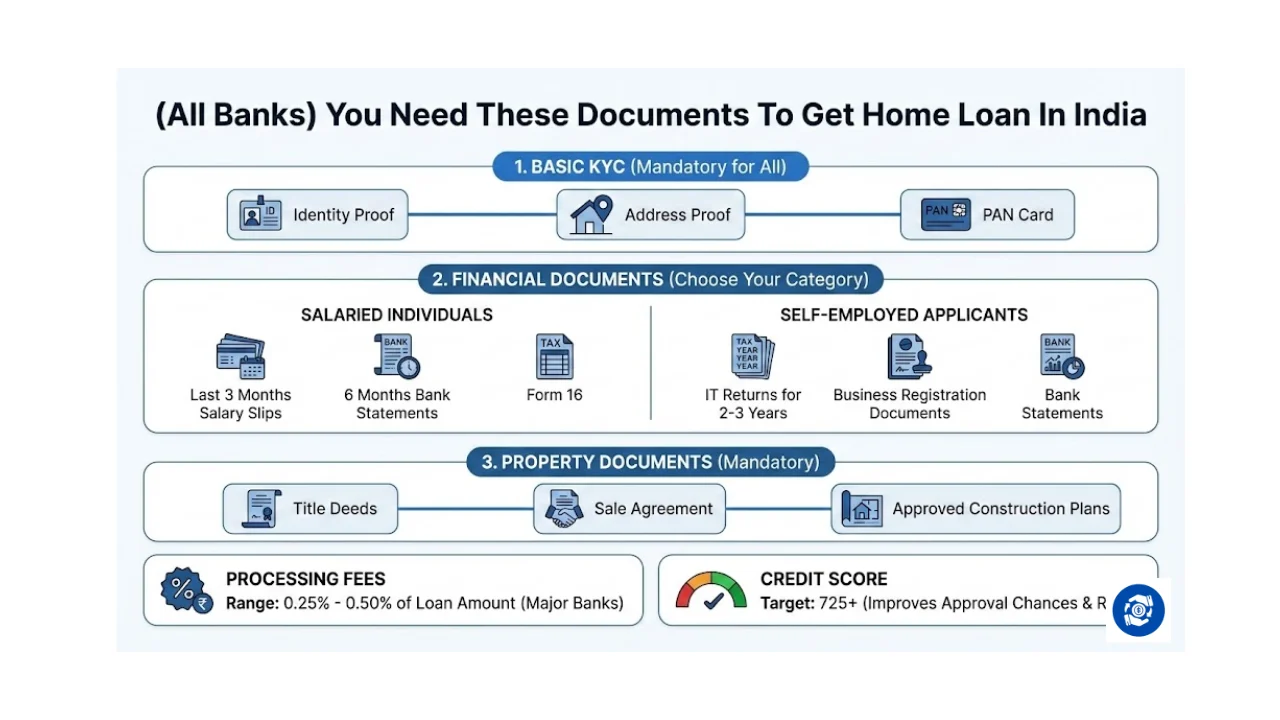

- All banks require identity proof, address proof and PAN card as basic KYC documents for home loan approval

- Salaried individuals must submit last 3 months salary slips, 6 months bank statements and Form 16

- Self-employed applicants need income tax returns for 2-3 years, business registration documents and bank statements

- Property related documents including title deeds, sale agreement and approved construction plans are mandatory

- Processing fees range from 0.25% to 0.50% of the loan amount across major Indian banks

- Credit score of 725 or above significantly improves your chances of loan approval at better interest rates

Also Asked: Which is the Best Bank to Take a Home Loan in India

Essential Documents Required for Home Loan – For Salaried Individuals

When I help salaried professionals with their home loan applications, I always create a checklist first. Banks want to verify your identity, income stability and repayment capacity. Here is what you need to arrange.

Identity and Address Proof Documents

Every bank in India asks for KYC documents as the first requirement. Your PAN card is absolutely mandatory. If you do not have a PAN card yet, you must submit Form 60. For identity and address verification, you can submit any one of these officially valid documents.

Your passport works as both identity and address proof if it is still valid. Similarly, your driving license, voter ID card or Aadhaar card can serve the dual purpose. I always recommend using Aadhaar as it is widely accepted and the verification happens quickly.

Some banks also accept job cards issued by NREGA or letters from the National Population Register. Make sure whichever document you submit has your current address matching your application form. If your address has changed recently, keep supporting documents like a utility bill or rent agreement handy.

Income Proof Documents

Banks scrutinize your income documents very carefully because they need to assess your repayment capacity. For salaried individuals, you must provide your last three months salary slips. Make sure these are original and carry your employer company seal.

Along with salary slips, submit your last six months bank statements showing regular salary credits. Banks check the consistency of your income and any irregular patterns can raise concerns.

Your latest Form 16 from your employer is crucial for tax verification purposes. Most banks also ask for your income tax returns for the last two years. If your current employment is less than one year old, attach your employment contract or appointment letter. This helps banks understand your job stability and career progression.

Property Related Documents

The property documents form the backbone of your home loan application. For purchasing a new home from a builder, you need the allotment letter or buyer agreement along with payment receipts showing the initial amounts paid to the developer.

If you are buying a resale property, gather all title deeds including the complete chain of ownership documents. Your agreement to sell and receipts of payments made to the seller must be included.

For those planning to construct their dream home, the requirements are slightly different. You must submit the title deeds of the plot, a no objection certificate proving there are no encumbrances on the property, approved construction plans from local authorities and a construction estimate prepared by a registered architect or civil engineer.

I have seen applications get delayed because people submit incomplete property documents, so double check everything before submission.

Documents Required for Self-Employed Individuals

Self-employed professionals and businessmen face slightly different documentation requirements. Banks need more detailed proof of income stability since monthly income can vary in businesses.

Business Registration and Financial Documents

Your business registration certificate is the starting point. This could be your shop establishment license, GST registration, partnership deed or company incorporation certificate depending on your business structure. Banks want to verify that your business is legitimate and has been operational for a reasonable period. Most lenders prefer businesses with at least three to five years of vintage.

You must submit your audited financial statements for the last two to three years. This includes your profit and loss statements, balance sheets and cash flow statements. Your income tax returns for the same period are mandatory. If you have a GST registration, provide your GST returns as well. Some banks also ask for a certificate from your chartered accountant confirming your business income and financial health.

Bank Statements and Additional Proof

Your business bank account statements for the last six to twelve months give banks a clear picture of your cash flow patterns. They analyze your average monthly income, consistency of revenue and your spending patterns. If you have multiple business accounts, submit statements for all of them.

Many banks ask for proof of business continuity like office rent agreements, client contracts or major purchase invoices. These supporting documents strengthen your application by demonstrating that your business is stable and growing. I always advise my self-employed clients to maintain clear separation between personal and business finances as this makes verification easier for banks.

Home Loan Fees and Charges You Should Know

Understanding the costs involved helps you plan your finances better. Different banks charge different fees but I will give you a general idea of what to expect.

Processing Fees Structure

Most major banks charge processing fees ranging from 0.25% to 0.50% of your loan amount. The minimum processing fee is typically between Rs 3000 to Rs 5000 plus applicable taxes. For example, if you are taking a loan of Rs 50 lakhs and the processing fee is 0.50%, you would pay Rs 25000 plus GST. Some banks have a maximum cap on processing fees which is beneficial for higher loan amounts.

The processing fee is generally non-refundable once your application is processed. However, some banks retain only 50% of the fee if you cancel your application at certain stages. I always recommend asking about the refund policy upfront before paying the processing fee.

Other Charges and Expenses

Beyond processing fees, there are several other charges you should budget for. Lawyer fees and technical valuation charges are paid directly to the external experts hired by the bank. These vary based on the property location and complexity but typically range from Rs 5000 to Rs 15000.

Property insurance is mandatory throughout the loan tenure and you pay premiums directly to the insurance provider. Late payment charges can be steep, often up to 24% per annum, so maintaining timely EMI payments is crucial. Banks also charge for services like cheque dishonor (around Rs 300), document photocopies (Rs 500), or requesting a list of documents.

Stamp duty and registration charges are statutory expenses that vary by state. You can check the exact amounts on the CERSAI website. These charges are your responsibility as the borrower. Some banks also levy prepayment charges if you close your loan early, especially on fixed rate loans. The prepayment charge is typically 2% of the outstanding amount plus taxes.

Tips to Improve Your Home Loan Eligibility

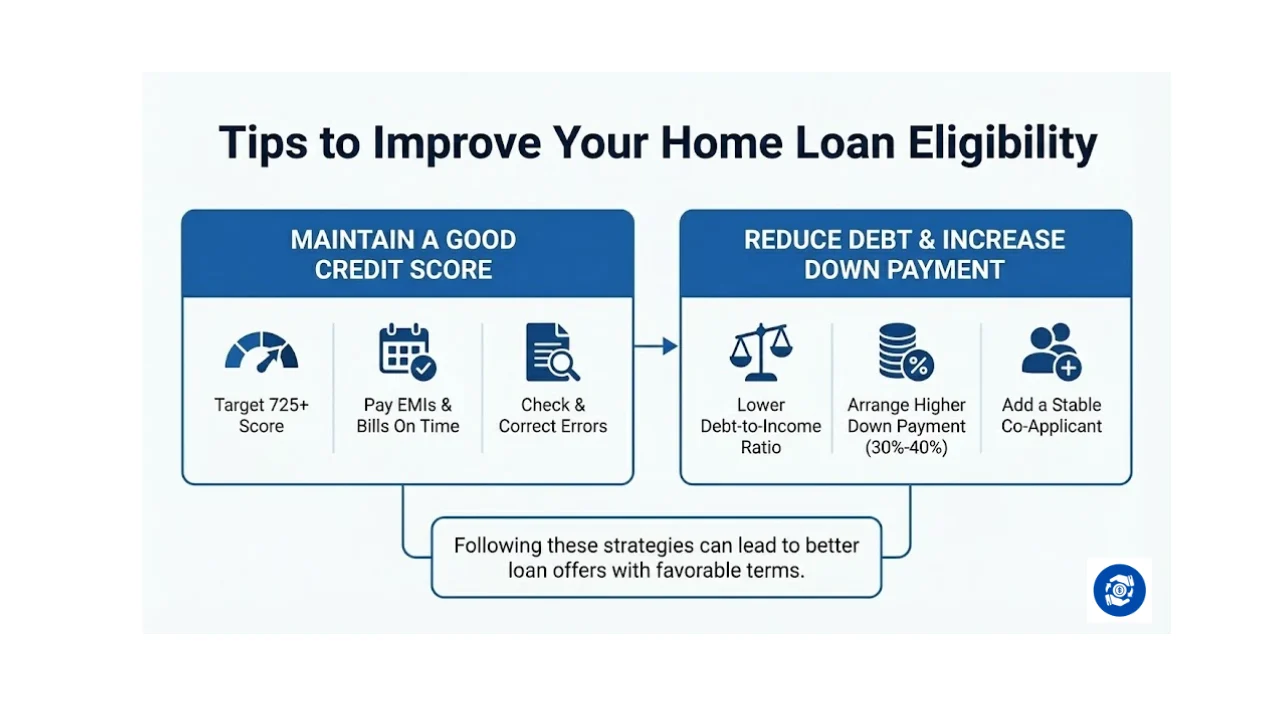

I have noticed that applicants who follow these strategies get better loan offers with favorable terms.

Maintain a Good Credit Score

Your credit score plays a huge role in loan approval decisions. A score of 725 or above is considered good by most banks. If your score is lower, work on improving it before applying. Pay all your existing EMIs and credit card bills on time. Clear any outstanding dues completely. Even small delays in payments can pull down your score significantly.

Check your credit report for errors and get them corrected immediately. Sometimes wrong information gets reported which affects your score unnecessarily. Avoid making multiple loan inquiries in a short period as each inquiry creates a hard pull on your credit report. I recommend checking your credit score at least three months before applying for a home loan so you have time to fix issues.

Reduce Existing Debt and Increase Down Payment

Banks calculate your debt to income ratio carefully. If you already have running loans with high EMIs, try to close some of them before applying for a home loan. This improves your repayment capacity in the bank eyes. Paying off credit card balances completely also helps.

Arranging a higher down payment works in your favor. If you can pay 30% to 40% of the property value upfront instead of the minimum 20%, banks view you as a lower risk borrower. This can get you better interest rates and higher loan amounts. I have seen clients negotiate interest rate reductions by offering larger down payments.

Adding a co-applicant with stable income strengthens your application significantly. Your spouse, parent or sibling can be a co-applicant. Their income gets added to yours which increases the total eligible loan amount. Just make sure the co-applicant also has a good credit score because banks check everyone credit history.

Frequently Asked Questions About Home Loan Documents

Many people ask me these common questions during the home loan application process.

Can I apply for a home loan without a PAN card?

No, PAN card is mandatory for all home loan applications in India. If you do not have a PAN card, you can apply for one online through the income tax website. The process takes about 10 to 15 days. Alternatively, if your income is below the taxable limit, you can submit Form 60 but most banks still prefer a PAN card.

How long does document verification take?

Once you submit all documents, banks typically take 3 to 7 working days for verification. If any document is missing or unclear, they will ask for resubmission which can delay the process. My advice is to submit clear, legible copies of all documents in one go to avoid back and forth.

Do I need to submit original documents?

For initial application, self attested photocopies are sufficient. However, you must carry original documents when meeting the bank representative for final verification. After loan disbursement, banks return all your original documents except those related to the property which they hold as security until you repay the loan completely.

What if I have changed jobs recently?

Banks prefer applicants with stable employment history. If you changed jobs within the last year, submit your current appointment letter and employment contract. Some banks may ask for a confirmation letter from your new employer. Having a good relationship with your previous employer who can provide a reference also helps.

Tags: home loan documents India, home loan eligibility, home loan application process, documents for home loan, home loan requirements India, property loan documents, housing loan paperwork

Share This Post