Best Investment Growth And Timeline Rules That You Should Know

Best Investment Growth And Timeline Rules That You Should Know

Understanding investment mathematics is crucial for building sustainable wealth. In my two decades of advising clients on financial planning, I have consistently relied on these fundamental rules to project growth timelines and set realistic expectations.

These mathematical shortcuts provide quick calculations for doubling, tripling, or quadrupling your investments without complex financial modeling. They have proven invaluable across thousands of investment portfolios I have managed.

What makes these rules particularly powerful is their applicability across various asset classes and market conditions. I use them daily when structuring portfolios for clients ranging from young professionals to retirees.

The accuracy of these formulas within their optimal range makes them indispensable tools for anyone serious about wealth creation. These are not just theoretical concepts but practical instruments that I have validated through real world investment outcomes over the years.

Table of Contents

Key Takeaways

- Rule of 72 provides instant calculation for investment doubling time by dividing 72 by annual return percentage

- Rule of 114 extends the framework to calculate tripling timelines for medium term wealth goals

- Rule of 144 helps visualize quadrupling periods essential for long term retirement and legacy planning

- 15-15-15 Rule offers a structured SIP approach to accumulate ₹1 crore through disciplined monthly investing

- Rule of 70 quantifies inflation impact showing how purchasing power erodes over specific timeframes

- 7-Year Rule establishes the minimum investment horizon for equity exposure to manage volatility risk

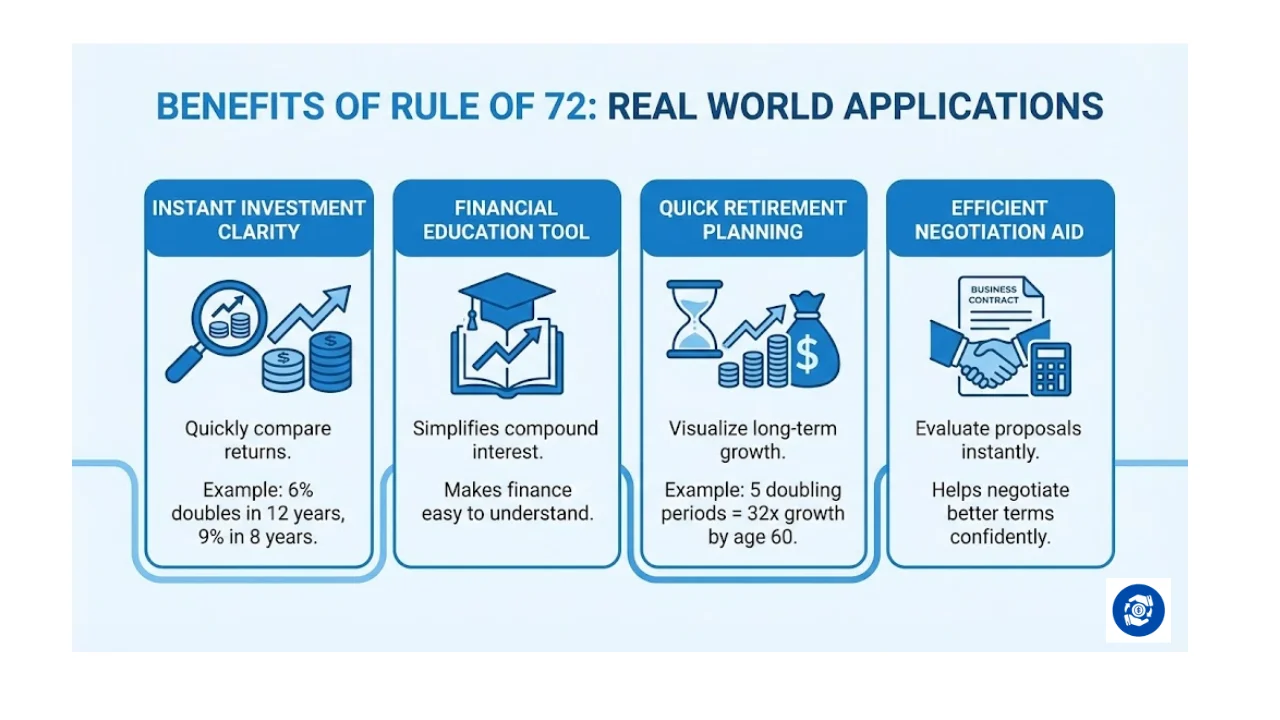

1. Rule of 72: The Foundation of Doubling Calculations

The Rule of 72 stands as the cornerstone of investment mathematics in my practice. This elegant formula allows instant calculation of the time required for your capital to double at any given rate of return. The application is remarkably simple yet profoundly useful.

Formula: 72 ÷ Interest Rate = Years Required to Double

When I evaluate investment proposals, this rule serves as my first analytical tool. For instance, at an 8% annual return, dividing 72 by 8 yields 9 years for doubling. This quick calculation has helped me compare countless investment opportunities across fixed income, equity, and alternative assets. The rule maintains exceptional accuracy for returns between 6% and 12% which covers most traditional investment vehicles.

Benefits:

- Enables instant mental calculation without any computational tools or spreadsheets

- Provides standardized comparison framework across different investment products and asset classes

- Works effectively for compound interest instruments including mutual funds, stocks, and fixed deposits

- Helps establish realistic return expectations and identify potentially fraudulent schemes promising unrealistic returns

- Assists in reverse engineering required returns to meet specific financial goals within set timeframes

Use Cases:

- Evaluating fixed deposit versus debt mutual fund returns for conservative portfolio allocation

- Analyzing SIP projections in equity mutual funds for goal based investing

- Comparing real estate appreciation versus stock market returns for asset allocation decisions

- Assessing loan costs by calculating debt doubling timelines at given interest rates

- Educating clients about opportunity costs of keeping excess cash in low yield savings accounts

Drawbacks:

- Accuracy diminishes significantly at extreme rates below 4% or above 15% annually

- Assumes perfectly consistent compounding which rarely occurs in volatile equity markets

- Does not account for taxation impact which can substantially reduce net returns

- Ignores transaction costs, management fees, and exit loads that affect actual doubling time

- Oversimplifies market reality where returns fluctuate dramatically across different time periods

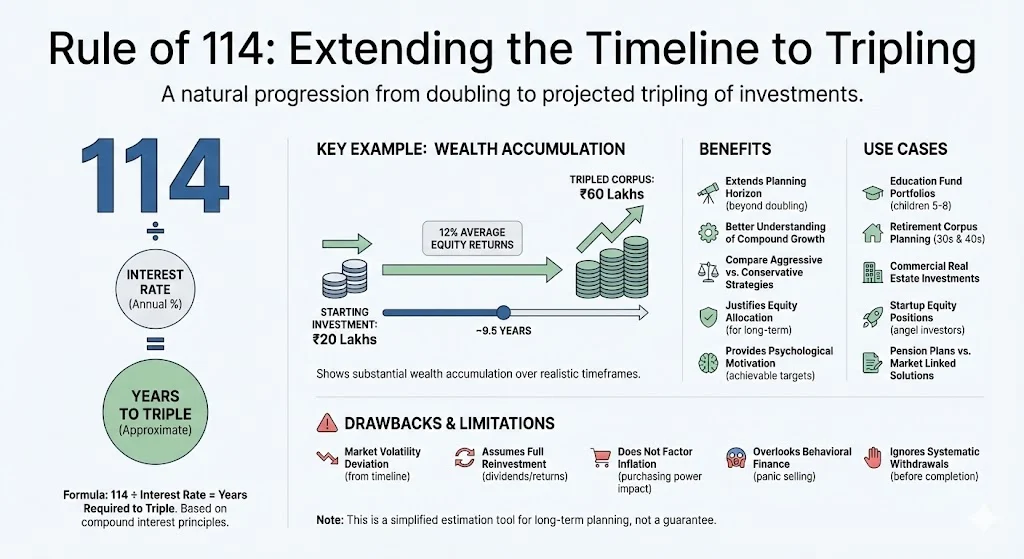

2. Rule of 114: Extending the Timeline to Tripling

The Rule of 114 represents the natural progression from doubling calculations to tripling projections. I deploy this rule extensively when structuring portfolios for clients with medium to long term objectives spanning 10 to 15 years. The mathematical principle remains identical to Rule of 72 but targets the next wealth milestone.

Formula: 114 ÷ Interest Rate = Years Required to Triple

In my wealth management practice, this rule proves particularly valuable for retirement planning scenarios. When a client invests ₹20 lakhs expecting 12% average equity returns, dividing 114 by 12 projects approximately 9.5 years to reach ₹60 lakhs. This calculation framework helps clients visualize substantial wealth accumulation over realistic timeframes.

Benefits:

- Extends planning horizon beyond doubling to capture more significant wealth creation milestones

- Facilitates better understanding of compound growth power over extended investment periods

- Enables comparison of aggressive versus conservative strategies for achieving tripling goals

- Helps justify equity allocation for clients with longer time horizons and higher risk tolerance

- Provides psychological motivation by demonstrating achievable wealth multiplication targets

Use Cases:

- Structuring education fund portfolios for children aged 5 to 8 years targeting college expenses

- Planning retirement corpus accumulation for clients in their 30s and 40s

- Evaluating commercial real estate investments with rental yield and appreciation components

- Analyzing startup equity positions for angel investors assessing exit timelines

- Comparing traditional pension plans versus market linked retirement solutions

Drawbacks:

- Market volatility creates significant deviation from projected tripling timelines in equity investments

- Assumes reinvestment of all dividends and returns which many investors fail to maintain

- Does not factor inflation impact on real purchasing power of tripled corpus

- Overlooks behavioral finance aspects where investors panic sell during market corrections

- Ignores systematic withdrawal requirements that many investors face before tripling timeline completes

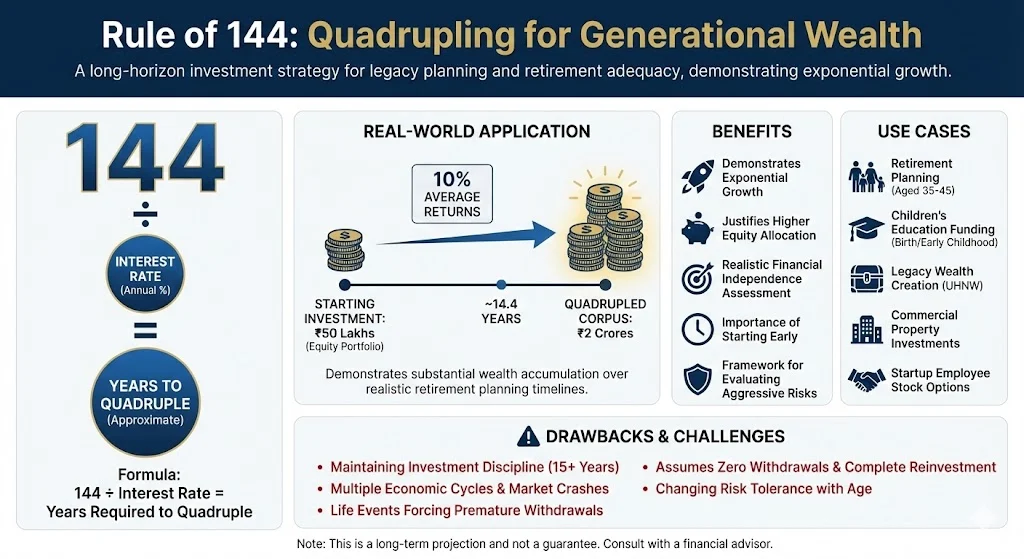

3. Rule of 144: Quadrupling for Generational Wealth

The Rule of 144 addresses the longest investment horizons in my advisory practice. This rule proves essential when discussing legacy planning, retirement adequacy, and generational wealth transfer with high net worth clients. The quadrupling calculation provides perspective on truly long term wealth accumulation.

Formula: 144 ÷ Interest Rate = Years Required to Quadruple

I frequently reference this rule when advising clients on aggressive wealth creation strategies. A ₹50 lakh equity portfolio targeting 10% average returns would quadruple to ₹2 crores in approximately 14.4 years. This timeline aligns perfectly with retirement planning for professionals in their early to mid 40s.

Benefits:

- Demonstrates exponential nature of compound growth over extended periods beyond 15 years

- Justifies higher equity allocation for younger investors with multi decade investment horizons

- Enables realistic assessment of whether current savings rate will meet long term financial independence goals

- Helps clients understand the critical importance of starting investments early in their careers

- Provides framework for evaluating whether aggressive growth strategies justify their associated risks

Use Cases:

- Retirement corpus planning for professionals currently aged 35 to 45 years

- Children’s higher education funding started at birth or early childhood

- Legacy wealth creation strategies for ultra high net worth families

- Evaluating commercial property investments for long term capital appreciation

- Assessing startup employee stock options with extended vesting and holding periods

Drawbacks:

- Maintaining investment discipline for 15 plus years proves extremely challenging for most investors

- Multiple economic cycles and market crashes occur within quadrupling timeline creating panic selling opportunities

- Life events including medical emergencies, job loss, or major purchases often force premature withdrawals

- Assumes zero withdrawals and complete reinvestment which conflicts with income needs during this period

- Does not account for changing risk tolerance as investors age and approach their goal timelines

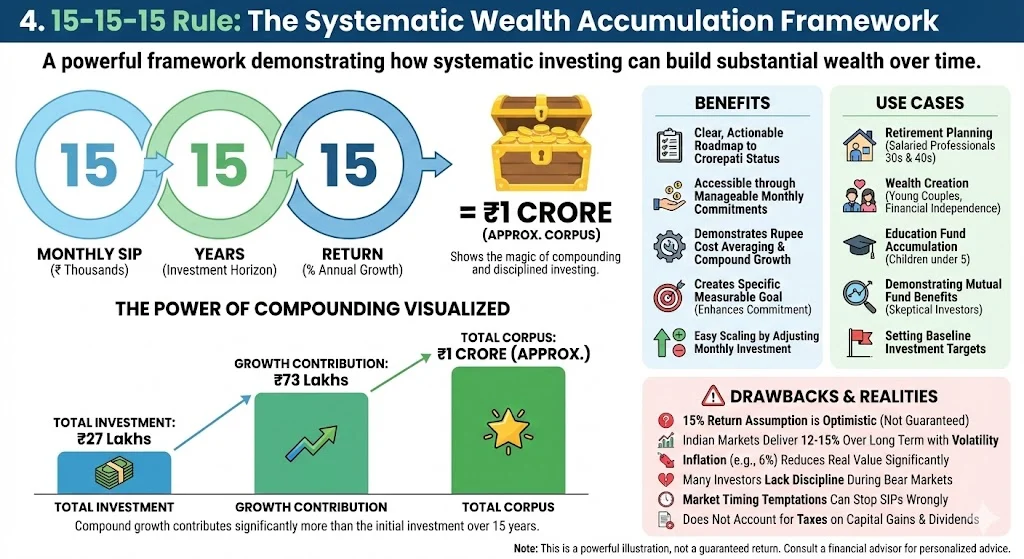

4. 15-15-15 Rule: The Systematic Wealth Accumulation Framework

The 15-15-15 Rule has become the gold standard recommendation in my SIP advisory practice. This rule crystallizes the power of systematic investing by demonstrating how ₹15,000 monthly investments for 15 years at 15% returns can build approximately ₹1 crore corpus. The triple fifteen framework makes it remarkably memorable for clients.

Formula: ₹15,000 monthly × 15 years × 15% returns = ₹1 Crore approximately

When I calculate this precisely, the total investment equals ₹27 lakhs while compound growth contributes approximately ₹73 lakhs to reach the ₹1 crore milestone. This vivid illustration of compounding power has convinced countless skeptical investors to begin their SIP journey. The second crore then accumulates much faster in just 5 to 6 additional years due to the larger base compounding.

Benefits:

- Provides clear, actionable roadmap to achieving crorepati status for middle class investors

- Makes disciplined investing accessible through manageable monthly commitments rather than large lump sums

- Demonstrates remarkable power of rupee cost averaging and compound growth over medium term

- Creates specific measurable goal that enhances investor commitment during market volatility

- Allows easy scaling by adjusting monthly investment amount for higher or lower target corpus

Use Cases:

- Retirement planning for salaried professionals in their 30s and early 40s

- Wealth creation strategies for young couples saving for financial independence

- Education fund accumulation for parents with children under 5 years old

- Demonstrating mutual fund benefits to investors skeptical about equity market exposure

- Setting baseline investment targets for clients starting their wealth creation journey

Drawbacks:

- The 15% return assumption represents optimistic scenario not guaranteed in equity markets

- Indian equity markets deliver 12 to 15% over very long periods but with extreme year to year volatility

- Inflation at 6% annually reduces real value of ₹1 crore significantly over 15 year period

- Many investors lack discipline to continue SIPs during severe bear markets when losses mount

- Market timing temptations cause investors to pause or stop SIPs at precisely wrong moments

- Does not account for taxes on capital gains and dividends that reduce net corpus accumulation

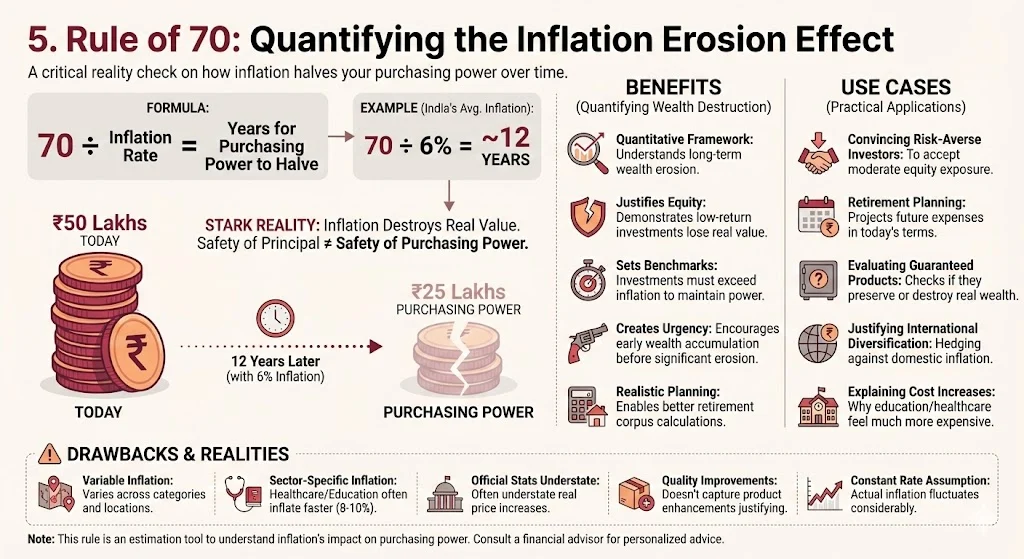

5. Rule of 70: Quantifying the Inflation Erosion Effect

The Rule of 70 serves as a critical reality check in my financial planning discussions. While other rules project growth, this one quantifies wealth destruction through inflation. It calculates precisely how many years until your money’s purchasing power gets halved due to price increases.

Formula: 70 ÷ Inflation Rate = Years for Purchasing Power to Halve

India’s average inflation runs around 6% in recent years. Dividing 70 by 6 yields approximately 12 years. This calculation means ₹50 lakhs today will have the purchasing power of only ₹25 lakhs in 12 years. This stark reality helps me convince conservative investors that safety of principal means nothing if inflation destroys real value.

Benefits:

- Provides quantitative framework for understanding inflation impact on long term wealth preservation

- Justifies equity allocation by demonstrating that low return safe investments lose real value

- Helps set minimum return benchmarks that investments must exceed to maintain purchasing power

- Creates urgency for younger investors to start wealth accumulation early before inflation erodes significant value

- Enables realistic retirement corpus calculations that account for future cost of living increases

Use Cases:

- Convincing risk averse investors to accept moderate equity exposure in their portfolios

- Retirement planning calculations that project future expenses in today’s rupee terms

- Evaluating whether guaranteed return products actually preserve or destroy wealth after inflation

- Justifying international diversification to hedge against domestic inflation spikes

- Explaining why parents feel current education costs are much higher than their generation

Drawbacks:

- Inflation varies significantly across different expense categories and geographic locations

- Healthcare and education typically inflate at 8 to 10% while other categories may be lower

- Official inflation statistics often understate real price increases experienced by consumers

- Does not capture quality improvements in products that may justify some price increases

- Assumes constant inflation rate whereas actual inflation fluctuates considerably across different periods

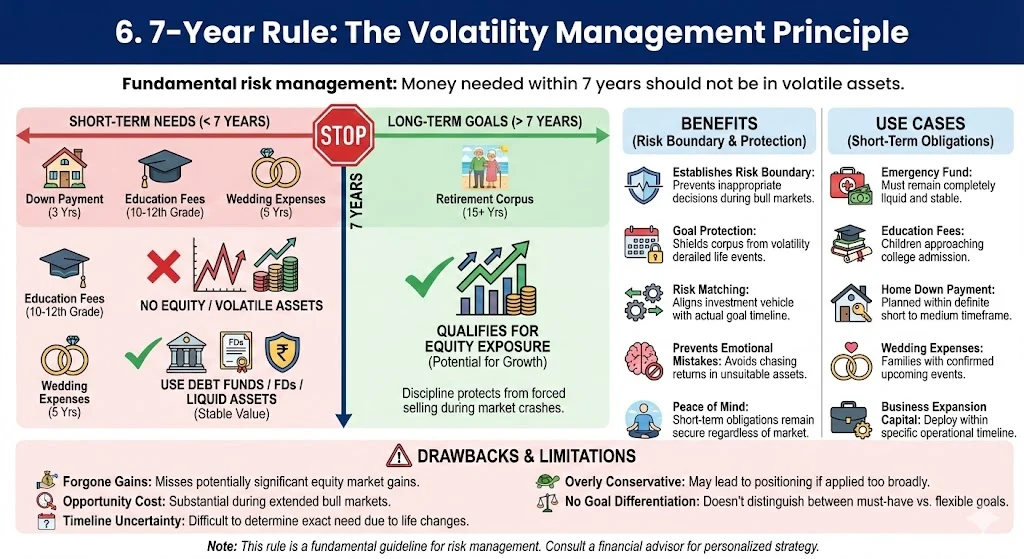

6. 7-Year Rule: The Volatility Management Principle

The 7-Year Rule represents fundamental risk management wisdom in my portfolio construction methodology. This principle states categorically that money required within the next 7 years should never be invested in volatile assets like stocks. I have seen this rule prevent countless financial disasters for clients.

Formula: Never invest money needed within 7 years in equity or volatile assets

When clients approach me with specific goal timelines, I rigorously apply this rule. House down payment required in 3 years stays in debt mutual funds. Wedding expenses planned for 5 years remain in fixed deposits. Only corpus not needed for 7 plus years qualifies for equity exposure. This discipline has protected my clients from forced selling during market crashes.

Benefits:

- Establishes clear risk boundary that prevents inappropriate investment decisions during euphoric bull markets

- Protects goal specific corpus from market volatility that could derail important life events

- Aligns investment vehicle selection with actual goal timeline creating appropriate risk matching

- Prevents emotional mistakes where investors chase returns in unsuitable high risk assets

- Provides peace of mind knowing short term obligations remain secure regardless of market conditions

Use Cases:

- Emergency fund allocation which must remain completely liquid and stable in value

- Education fee corpus for children currently in classes 10 to 12 approaching college admission

- Down payment savings for home purchase planned within definite short to medium timeframe

- Wedding expense accumulation for families with confirmed upcoming marriage events

- Business expansion capital that entrepreneurs will deploy within specific operational timeline

Drawbacks:

- Strictly following this rule means forgoing potentially significant equity market gains on short term money

- Opportunity cost can be substantial during extended bull markets where equities deliver exceptional returns

- Determining exact need timeline proves difficult due to life uncertainties and changing circumstances

- May lead to overly conservative positioning if investors apply blanket 7 year rule too broadly

- Does not differentiate between must have goals versus flexible nice to have objectives that can be postponed

Tags: investment mathematics, compound growth rules, wealth creation strategies, financial planning principles, SIP investment planning, inflation impact analysis, portfolio risk management

Share This Post