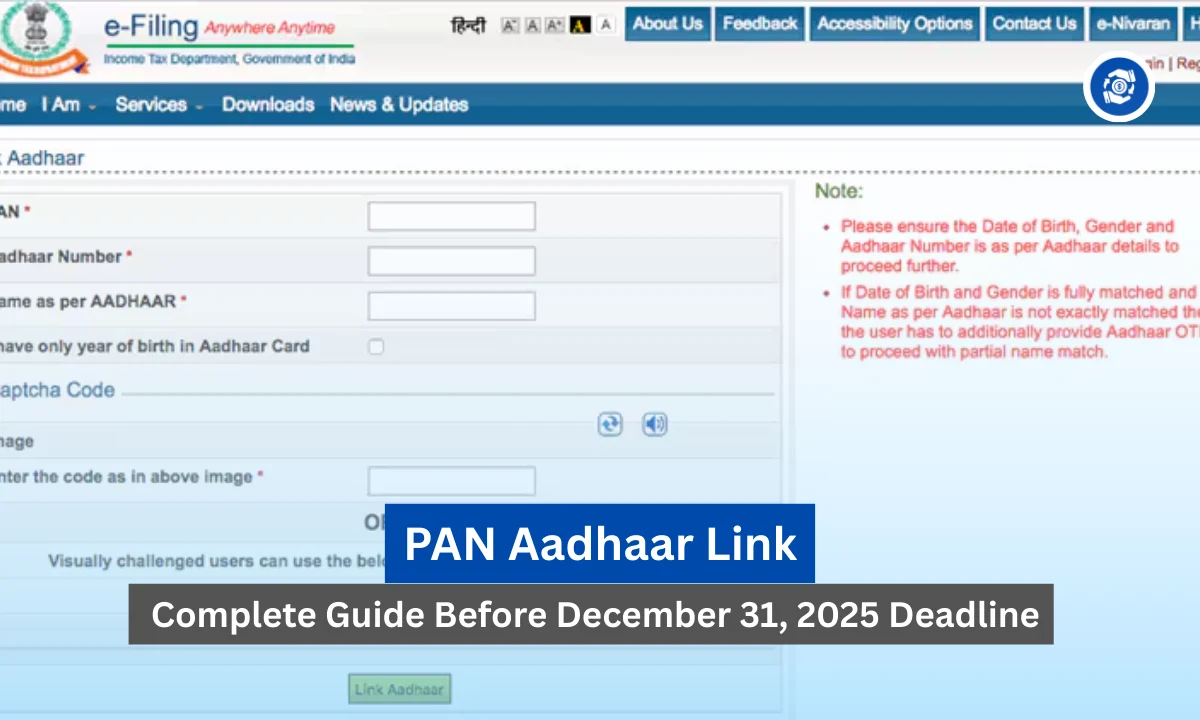

PAN Aadhaar Link: Complete Guide Before December 31, 2025 Deadline

The pan aadhaar link deadline is just around the corner and I want to make sure you don’t miss it. As someone who has helped countless people navigate this process, I can tell you that December 31, 2025 is the final date to complete your aadhar card pan card link.

After this deadline passes, your PAN will become inoperative from January 1, 2026. This means you won’t be able to file income tax returns, claim refunds, or conduct high-value financial transactions.

I have seen people panic at the last minute, so I am writing this guide to help you understand everything about the aadhaar pan linking deadline and how to check your link aadhaar status.

The government has made it clear through CBDT Notification No. 26/2025 that there will be no further extensions. Trust me, acting now is better than facing the consequences later.

Also Read: Shyam Dhani Industries IPO GMP Crosses 100% Mark As Subscription Hits Record High

Key Takeaways

- The final deadline for PAN-Aadhaar linking is December 31, 2025, with no further extensions announced

- Unlinked PANs will become inoperative from January 1, 2026, affecting tax filing and financial transactions

- You can link online via Income Tax e-filing portal or through SMS within minutes

- A penalty of ₹1,000 will apply for reactivation and linking after the deadline

- Check your link aadhaar status regularly on the official portal to ensure successful linking

- Mismatched details like name, DOB, or gender must be corrected before linking

- Exemptions apply to NRIs and residents of certain states like Assam, J&K, and Meghalaya

Why PAN Aadhaar Link is Mandatory

I cannot stress enough how critical this linking process is for your financial life. The government introduced this mandate to reduce tax evasion and eliminate duplicate PANs. When I first learned about this requirement, I understood its importance in creating a unified database.

The pan aadhaar link ensures that all your financial activities are tracked under one identity. This helps the Income Tax Department monitor transactions and prevent fraud effectively.

If you skip this process, your PAN becomes useless. You will face higher TDS and TCS rates on your transactions. I have personally witnessed cases where people couldn’t withdraw their provident fund or make property purchases because their PAN was inoperative. The consequences are real and immediate once the deadline passes.

How to Complete Your Aadhar Card Pan Card Link

I always recommend the online method because it is the fastest and most convenient. First, visit the Income Tax e-filing portal and look for the link aadhaar option. You need to enter your 10-digit PAN number and 12-digit Aadhaar number.

The system will send an OTP to your registered mobile number for verification. I complete this process in under five minutes when all details match perfectly.

Alternatively, you can use the SMS method which I find equally effective. Simply send UIDPAN followed by your 12-digit Aadhaar number and 10-digit PAN to 567678 or 56161. This method works great when you are on the go and don’t have internet access.

Checking Your Link Aadhaar Status

After linking, I always verify the status immediately. Go to the Income Tax portal and click on link aadhaar status under the services section. Enter your PAN and Aadhaar numbers to check if the linking was successful. The system shows three statuses that I commonly see. Linked means your process is complete, pending indicates it is under processing, and not linked means you need to try again.

I check my status twice to be absolutely sure. Sometimes the portal takes a few hours to update, so don’t panic if it shows pending initially. Give it some time and check again later in the day.

Common Issues and Solutions

In my experience, mismatched details are the biggest problem people face. Your name, date of birth, and gender must match exactly on both PAN and Aadhaar. I once helped a friend whose name had a slight spelling difference. We had to update the Aadhaar details through UIDAI before we could complete the linking.

If you face OTP issues, make sure your mobile number is registered with both documents. I recommend updating your contact details on the UIDAI portal first. Some people also face portal errors during peak hours. I suggest attempting the pan aadhaar link process early in the morning or late at night when traffic is low.

For PAN corrections, visit NSDL or UTIITSL websites. The correction process takes about 15 to 20 days, so start immediately if you notice any discrepancies. I always advise people to keep both their original documents handy for reference during corrections.

What Happens After the Aadhaar Pan Linking Deadline

Once January 1, 2026 arrives, unlinked PANs will stop working completely. I want you to understand the severity of this situation. You cannot file your income tax returns or claim any pending refunds. Your bank might restrict certain transactions that require PAN verification. High-value purchases above ₹10,000 in some categories will become problematic.

The penalty for late linking is ₹1,000, which you must pay to reactivate your PAN. I think it is better to link now for free than to pay later. Moreover, the rush in the final days often crashes servers. I have seen people struggling with technical glitches when everyone tries to link simultaneously.

Who is Exempt from This Requirement

Not everyone needs to complete the aadhar card pan card link. I know that NRIs are exempt from this mandate. If you are a non-resident Indian, you don’t need to worry about this deadline. Residents of Assam, Jammu and Kashmir, and Meghalaya also enjoy exemptions due to regional considerations.

People who don’t have Aadhaar, like foreign nationals, are naturally exempt. However, if you are an Indian citizen residing in India, I strongly recommend completing this process regardless of exemptions. It simplifies your financial dealings significantly.

My Final Advice on PAN Aadhaar Link

I have guided many people through this process and my advice is simple. Don’t wait until the last moment to complete your pan aadhaar link. The aadhaar pan linking deadline of December 31, 2025 is firm and final. Check your link aadhaar status today and ensure everything is in order.

Keep your documents ready and verify that all details match perfectly. If you find any discrepancies, start the correction process immediately. I believe that taking action now saves you from stress and penalties later. The process is straightforward when done calmly without the last-minute rush.

Tags: pan aadhaar link, link aadhaar status, aadhar card pan card link, aadhaar pan linking deadline, pan card linking, income tax pan aadhaar, aadhaar linking process

Share This Post