3X Emergency Fund Saving Rule By Suze Orman: Is It Still Enough Today?

3X Emergency Fund Saving Rule By Suze Orman: Is It Still Enough Today?

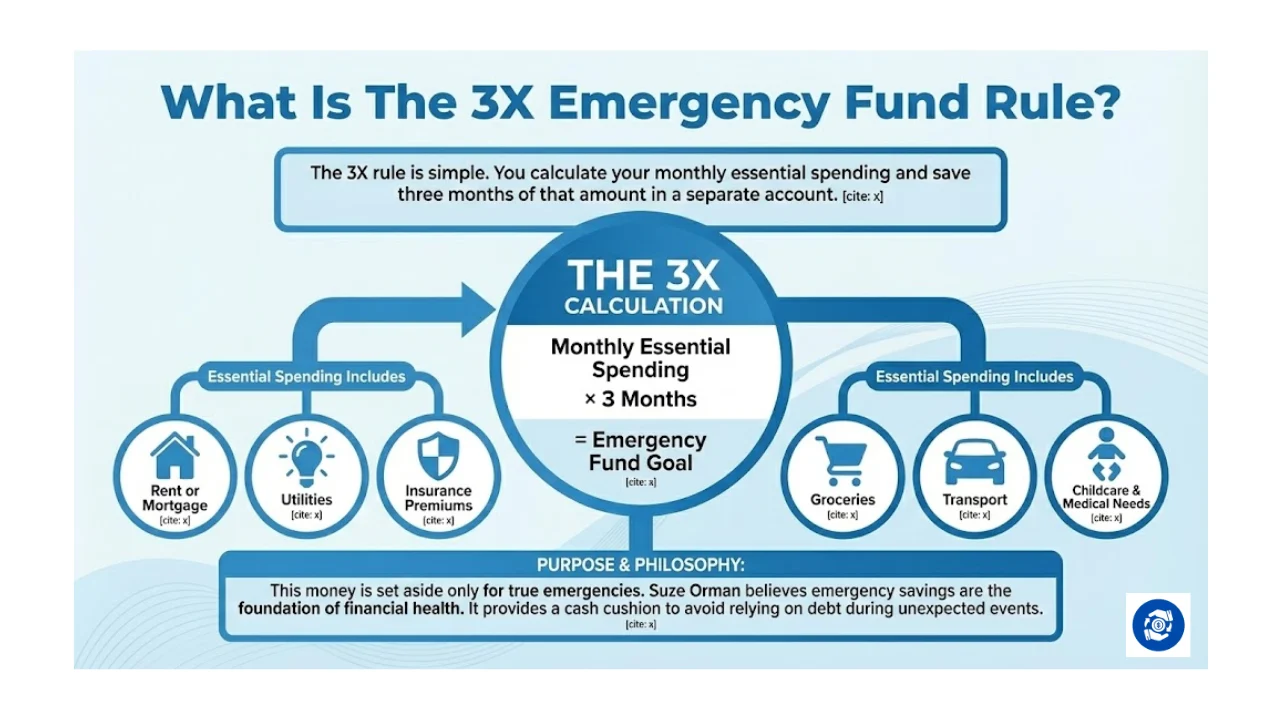

Building an emergency fund has always been one of the strongest ideas in personal finance. Suze Orman has spoken for years about the value of saving a cash buffer that can cover your basic expenses during tough times. Many people follow the 3X Emergency Fund rule, which means saving at least three months of essential living costs.

Key Takeaways

- The 3X rule suggests saving three months of necessary living expenses.

- Suze Orman believes emergency savings are non negotiable for financial security.

- Many experts today suggest saving six to twelve months due to rising economic risks.

- Emergency funds are best kept in safe and liquid accounts like HYSA or money market funds.

- A larger fund helps reduce stress, protect investments, and improve peace of mind.

Most finance advisors today agree that three months is the starting point, not the final goal. With ongoing economic uncertainty, long job searches, inflation, and AI driven changes in the job market, many experts call for six to twelve months of savings instead. Still, the 3X rule remains an important milestone that helps many people begin their journey toward financial security.

Also Read: The 50 30 20 Rule Of Budgeting By Elizabeth Warren

What Is The 3X Emergency Fund Rule

The 3X rule is simple. You calculate your monthly essential spending and save three months of that amount in a separate account. Essential spending includes rent or mortgage, utilities, insurance premiums, groceries, transport, childcare, medical needs, and any other unavoidable bills. This money is set aside only for true emergencies.

Suze Orman has always said that emergency savings are the foundation of financial health. She believes everyone needs a cash cushion so they do not rely on debt when something unexpected happens. It protects you when life does not go as planned.

Why Three Months Became The Standard Rule

For many years, financial education materials promoted three to six months of savings. This guidance worked well in periods when jobs were more stable and unemployment was shorter. Three months offered basic breathing room so families could stay afloat without borrowing.

Today, many people still see three months as a major achievement. Young professionals, beginners, or lower income households celebrate reaching this milestone. It shows discipline, planning, and financial awareness.

Some users on social platforms share stories of saving a three month fund split between a bank account and liquid funds. Others praise couples or professionals who reach this goal early in life and stay out of debt.

Three months remains a strong base goal. It builds confidence. It also reduces stress. People feel less pressure when they know they can handle at least one short disruption.

Why Many Experts Now Recommend More Than 3X

Recent data and public discussion show a clear shift in thinking. More people feel that three months may not be enough anymore. Surveys and expert reports in 2025 and 2026 suggest that six to twelve months of savings is becoming the new target for many households.

Several reasons drive this shift:

- Job searches now often last five to six months or longer in some fields.

- Layoffs can happen suddenly in tech and AI linked industries.

- Inflation increases living costs and reduces purchasing power.

- Medical issues or family emergencies may stack up.

- Economic uncertainty remains high across global markets.

Many users online describe three months as the minimum. Some even call it weak for families or single earners. One common opinion is that the first month after losing a job may pass in shock or emotional stress. That leaves little time for recovery.

A few people even keep one to two years of liquid savings. They say it helps them sleep peacefully because they never feel rushed to sell investments during downturns.

Suze Orman’s View On Emergency Funds

Suze Orman has always taken a strong position. She believes emergency savings are non negotiable. For years she has encouraged people to build cash reserves before focusing fully on aggressive investing.

Her view is simple. If you do not have cash available in a crisis, you may rely on high interest credit cards or loans. That can destroy financial stability. Emergency funds act like self insurance. They protect your progress.

In past interviews and speeches, she has suggested six months as a minimum for many people. In some cases, she recommends eight to twelve months for true safety and peace of mind.

Where To Keep Your Emergency Fund

Many savers today use:

- High yield savings accounts

- Money market funds

- Liquid savings accounts

These options normally allow easy withdrawals while earning interest. In recent years, returns around 4 to 5 percent have been common in some accounts. This helps your savings grow slowly without risk.

The key rule is simple. Your emergency fund should stay liquid. It should not be locked in risky investments or accounts with penalties.

Who Needs More Than 3X Saved

Some groups benefit from a larger safety net. These include:

- Freelancers and gig workers

- Business owners

- Single income households

- High cost of living families

- People supporting dependents

- Workers in unstable or volatile industries

- Individuals with medical concerns

For these people, six to twelve months of expenses can reduce stress and prevent panic decisions.

A Simple Way To Build Your Emergency Fund

Here is one listicle to help structure your savings plan:

- Calculate your true essential monthly expenses. Include only what you must pay to live.

- Multiply that number by three to set your first target goal.

- Open a separate savings or money market account for this fund.

- Automate monthly transfers so saving happens without effort.

- Increase your goal to six to twelve months once you reach the three month level.

- Review your fund once a year and adjust for lifestyle or cost changes.

This approach allows you to grow steadily without pressure.

Why Emergency Funds Reduce Stress

Money stress is one of the biggest emotional burdens people face. Surveys show that households with even three months of savings report lower stress levels than those with none.

An emergency fund gives you time. Time to think. Time to search for work. Time to heal. Time to plan next steps without fear.

It also protects investments. People with savings do not need to sell stocks during market downturns. This helps long term wealth building.

As one common saying goes, it is better to have an emergency fund and not need it than to need it and not have it.

The Growing Consensus Today

The modern view is clear. Three months is still a good milestone. It is a strong start. It helps millions of people progress toward security. But in 2026, many experts now see six to twelve months as the more realistic shield against uncertain times.

Your final number should match your life situation, your risk level, and your comfort. The goal is not fear. The goal is stability.

Final Thought

Suze Orman has been right about one thing for decades. Emergency funds are essential. Whether you start with $500, one month, or three months, what matters most is beginning today. As your income grows, your fund can grow with you.

A strong cash reserve brings peace of mind. It protects your financial journey. And it helps you stay calm when the world around you changes.

Tags: emergency fund, suze orman, personal finance, saving money, financial planning, money management

Share This Post