ITR Refund Delay 2025: Why Your Tax Refund is Stuck and How to Check Status

ITR Refund Delay 2025: Why Your Tax Refund is Stuck and How to Check Status

ITR refund delay has become a major headache for taxpayers in 2025. If you filed your income tax return for assessment year 2025-26 and still waiting for your refund then you are not alone.

Over 75 lakh taxpayers are facing the same problem right now. The income tax department has processed only 8.43 crore returns out of the total filed returns. Many people who filed their ITR in June and July are still checking their refund status every day with frustration.

The normal timeline for getting your tax refund is 4 to 5 weeks after e-verification of your return. But this year things are different. The Central Board of Direct Taxes has put extra verification checks on many returns especially those with high value refunds above Rs 50000.

CBDT Chairman Ravi Agrawal mentioned that most genuine refunds will be credited by December 2025 but taxpayers with suspicious deductions need to wait longer. The total refund amount issued so far is Rs 58580 crore which is 48 percent less than last year. This drop happened because the department is now more careful about fake and inflated claims.

The delay is not just a technical issue. It affects your financial planning and creates mental stress. Many taxpayers were counting on this refund money for medical emergencies, loan EMIs or family expenses. Social media is full of complaints from people who feel that government collects tax quickly but returns it very slowly.

The situation is especially hard for senior citizens and salaried people who paid excess TDS throughout the year.

Key Takeaways

- Over 75 lakh ITR returns remain unprocessed as of December 2025 due to enhanced verification

- High value refunds above Rs 50000 face stricter scrutiny and longer processing times

- Common delay reasons include bank account errors, PAN-Aadhaar mismatch, TDS discrepancies and incomplete e-verification

- You can check refund status on income tax portal using PAN and viewing filed returns section

- Interest at 6 percent per annum applies on delayed refunds but only after processing completes

- Senior citizens and taxpayers with urgent needs should file grievances on e-Nivaran portal

- Most legitimate refunds expected by end of December 2025 according to CBDT officials

Also Read: Federal Reserve Interest Rate Cuts: What December 2025 Decision Means for Your Money

Main Reasons Behind ITR Refund Delay

Understanding why your refund is stuck helps you take the right action. The income tax department has multiple checkpoints before releasing any refund amount.

Incomplete E-Verification and Manual Scrutiny

E-verification is the first step that triggers refund processing. Many taxpayers forget to verify their return within 30 days of filing. Without verification your return becomes invalid and processing never starts. You can verify using Aadhaar OTP, net banking or by sending signed ITR-V to CPC Bengaluru. This year the department is manually checking returns with year on year higher refund amounts. If your claimed refund is significantly more than previous years then expect additional verification time of 2 to 6 months.

Data Mismatches and TDS Issues

The biggest culprit for delays is mismatch between your ITR data and Form 26AS or Annual Information Statement. The department cross checks every income source, TDS deduction and tax payment you mentioned. Even small differences like wrong gross salary compared to Form 16 can hold up your refund. Freelancers and people with multiple income sources face this problem more often. If you claimed TDS on certain income but did not report the full income amount then you will definitely get a notice.

Bank Account Problems

Your refund cannot reach you if bank details are wrong. This includes incorrect account number, wrong IFSC code or unvalidated bank account on the income tax portal. Due to recent bank mergers many IFSC codes have changed. If your account is dormant or inactive then the refund will fail. The portal shows refund failed status in such cases and you need to update details and request re-issue. Around 20 to 30 percent of failed refunds happen because of bank account issues.

Suspicious Claims and Fake Deductions

The government has become very strict about checking deduction claims under the old tax regime. Many taxpayers in past years claimed fake HRA, home loan interest or Section 80C deductions without proper documents. Now the department is asking for policy numbers, PAN of lender, Aadhaar numbers and detailed breakup of all deductions. If you claimed deductions that seem excessive compared to your income bracket then your return will go into deep verification. Some cases show people claiming 80 percent of income as deductions which immediately triggers red flags.

System Overload and Processing Backlog

The Centralised Processing Centre in Bengaluru is handling crores of returns with limited resources. Late release of ITR forms for FY 2024-25 created a rush of filings near the deadline. This workload combined with new AI based fraud detection systems has slowed down everything. Returns filed in July and August especially ITR-2 forms are taking up to 5 months for processing. September filers are getting processed relatively faster because the department cleared the initial backlog by then.

How to Check Your ITR Refund Status Step by Step

Checking your refund status takes just 2 to 5 minutes on the official income tax portal. Follow these simple steps to know where your money is.

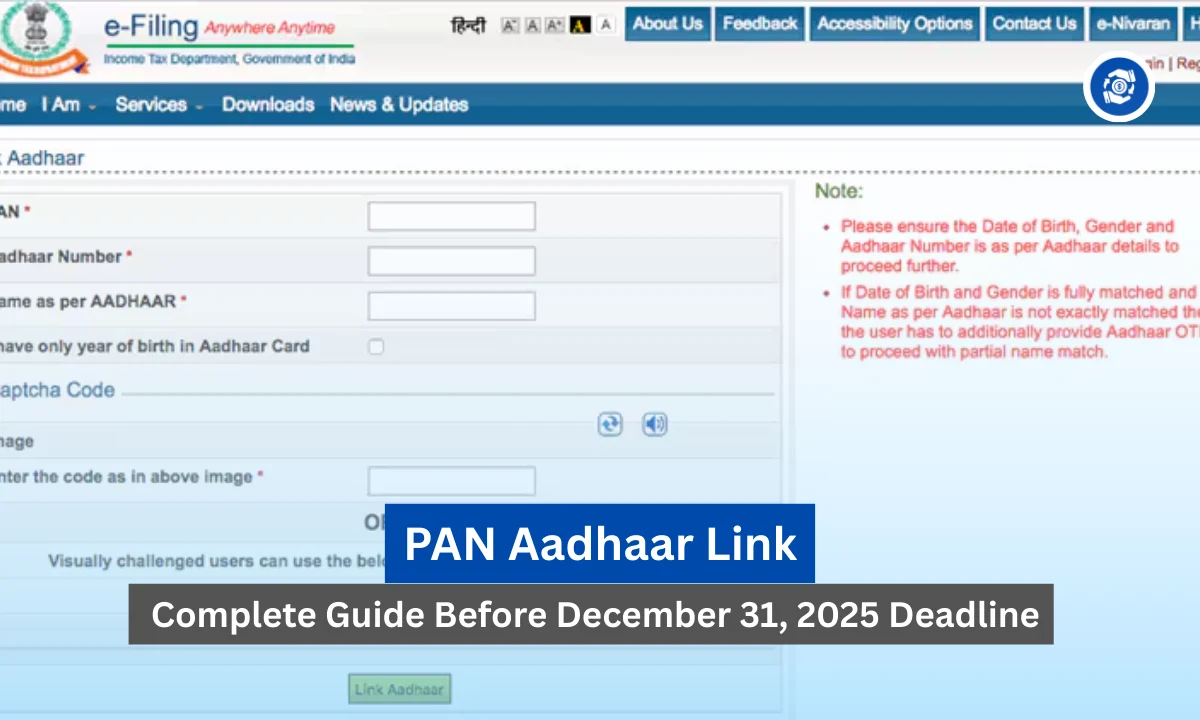

First visit the income tax e-filing portal at incometax.gov.in and login using your PAN as user ID along with your password. If you have not linked PAN with Aadhaar you will see a warning message but you can still continue to check status. After login go to the e-File tab at the top and click on Income Tax Returns option. Then select View Filed Returns from the dropdown menu.

The portal will show all your filed returns for different assessment years. Select AY 2025-26 and click on View Details button next to your return. This opens the complete processing lifecycle showing dates of filing, e-verification and processing. Under Refund Details section you can see the current status. The status can be Processed which means department finished checking, Refund Initiated which means money transfer started, Refund Failed which means there was a problem or Refund Credited which means money reached your account.

If status shows Refund Failed then check the reason mentioned. Usually it is bank account mismatch or validation issue. You need to pre-validate your bank account on the portal and then request re-issue of refund. For this go to My Profile section and add correct bank details with proper IFSC code. The department will verify with your bank and then re-issue the refund.

If your return shows still under processing after 4 weeks and you are confident about all details being correct then you can file a grievance. Go to the grievance section on the portal or visit eportal.incometax.gov.in and click on e-Nivaran option. Use your acknowledgement number to file the complaint. Senior citizens and people with urgent medical needs can escalate the matter by calling CPC helpline at 1800-103-0025.

Timeline and What to Expect Next

CBDT has set a target to clear 90 percent of pending refunds by end of December 2025. Small refunds below Rs 50000 are being prioritized and processed faster. High value refunds will take more time because of extra verification layers. If you filed your return in September or October then expect processing by mid December. Earlier filers from June and July might have to wait till late December or early January 2026.

Interest on delayed refunds is calculated at 6 percent per annum under Section 244A of Income Tax Act. But this interest starts only after the processing is complete not from your filing date. So if department takes 6 months to process your return you will get interest only for the period beyond 3 months from processing date. This is different from the interest government charges on late tax payments which starts immediately.

One positive development is that pre-validated bank accounts are seeing lightning fast processing. Some taxpayers reported their refund getting credited within 2 hours of processing completion. The new AI systems are also helping to identify genuine cases and fast track them. NUDGE 2.0 reminders have helped many people correct small errors before processing which reduced rejection rates by 15 percent.

For taxpayers whose refunds are held due to pending scrutiny or assessment there is no fixed timeline. The department will send a notice asking for documents and clarification. You should respond promptly with proper proof of income, TDS certificates and deduction documents. Delayed response will only increase the waiting time further.

What Taxpayers Are Saying

Social media platforms especially X formerly Twitter show massive frustration among taxpayers. People are calling the delay an interest free loan to government. One user with 157000 views complained about filing ITR in July and getting no refund even after raising complaint with RBI Ombudsman. Another post from an 86 year old taxpayer’s son got 150000 views asking why senior citizens are being ignored for Rs 36000 refund.

However there are also positive stories of quick processing. Some users shared that their refund got processed and credited within one hour which shows the system can work efficiently when everything is in order. Tax experts are advising people not to plan their finances around refund timing because delays have become common.

The overall sentiment is that honest taxpayers who paid excess TDS throughout the year should not suffer because department wants to catch fake claims. Better communication about expected timelines would help reduce anxiety and build trust in the system.

Tags: ITR refund delay 2025, income tax refund status check, tax refund pending reasons, ITR processing delay, income tax refund India, AY 2025-26 refund, CBDT refund update

Share This Post