40% EMI Rule Explained: How Much Loan Can You Really Afford?

40% EMI Rule Explained: How Much Loan Can You Really Afford?

Managing loans has become a normal part of modern life. Home loans, car loans, and personal loans are now common for families and young professionals. But many people take on more debt than they can handle, which slowly creates pressure on monthly budgets and long term savings.

The 40% EMI rule is a simple financial guideline that helps people decide how much loan they can afford without harming their lifestyle or future plans. It is widely discussed in India and other growing loan markets and is still trending in 2025 and 2026 as property prices and living costs continue to rise.

Table of Contents

Key Takeaways

- The 40% EMI rule says total monthly EMIs should not exceed 40% of income.

- It protects your budget from financial stress and over borrowing.

- Banks may allow more than 40%, but experts suggest staying between 30 to 40%.

- It helps maintain savings, emergency funds, and investment plans.

- It works best when combined with other rules like the 5/20/30/40 home buying rule.

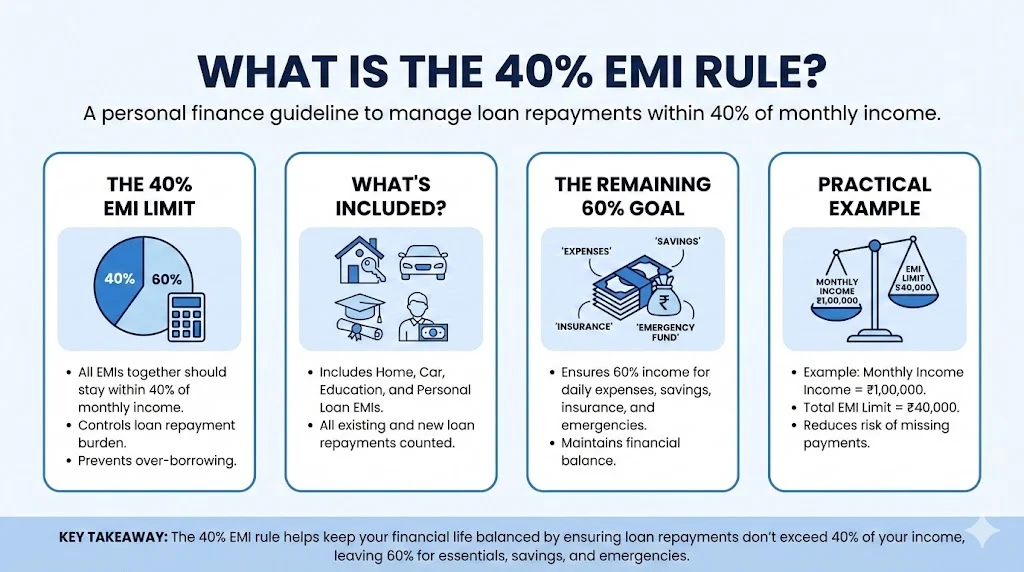

What Is the 40% EMI Rule?

The 40% EMI rule is a personal finance guideline used to control how much of your monthly income goes toward loan repayments. According to this rule, all your EMIs together should stay within 40% of your monthly income.

This includes home loan EMI, car loan EMI, education loan EMI, and personal loan EMI. The goal is to ensure that the remaining 60% of income is available for daily expenses, savings, insurance, and emergencies.

For example, if your monthly income is ₹1,00,000, then your total EMI limit should be around ₹40,000. This keeps your financial life balanced and reduces the risk of missing payments.

Why the 40% EMI Rule Matters in 2025 & 2026

Interest in the 40% EMI rule has grown because loan approvals have become easier and lifestyle costs have increased. Housing prices, fuel, education fees, and healthcare costs have all gone up.

Financial educators on social platforms explain that loans should support progress and not turn into pressure. Many posts describe the rule as a safety shield that keeps people from entering debt traps. The rule is now grouped with popular money habits such as the Rule of 72 and the 50 30 20 budget method.

Experts also warn that although banks may approve loans with higher ratios, doing so leaves very little room for savings or emergencies. Job changes and interest rate hikes can quickly turn high EMIs into stress.

Also Read: Rule of 5x Salary for Personal Loans: Fact Or Marketing Gimmick?

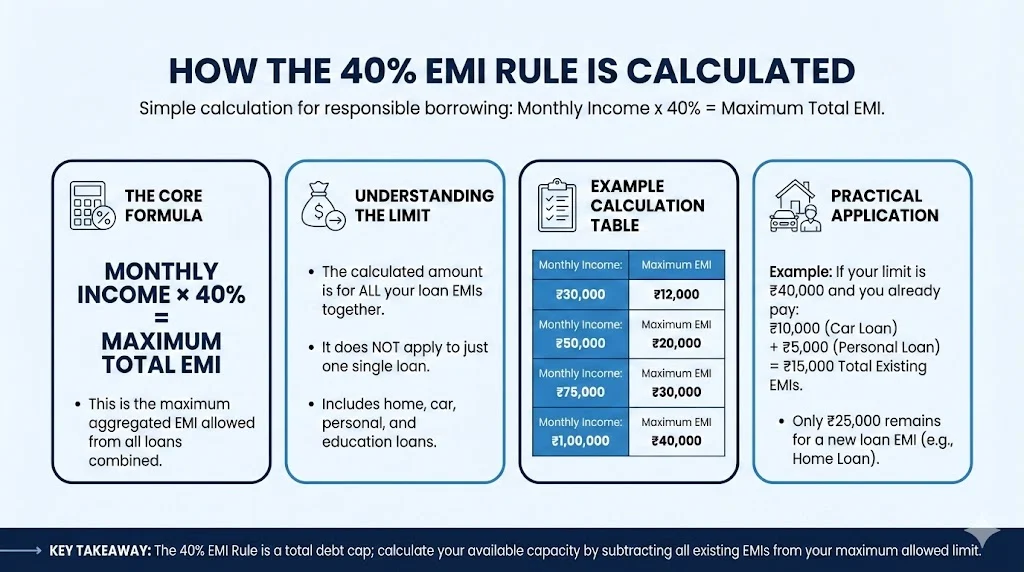

How the 40% EMI Rule Is Calculated?

The calculation is simple and easy to apply in daily life.

Monthly Income x 40% = Maximum EMI allowed

Here is a basic table for understanding.

| Monthly Income | Maximum EMI (40%) |

|---|---|

| ₹30,000 | ₹12,000 |

| ₹50,000 | ₹20,000 |

| ₹75,000 | ₹30,000 |

| ₹1,00,000 | ₹40,000 |

This amount includes all loan EMIs together. It does not mean only one loan. If you already pay ₹10,000 for a car loan and ₹5,000 for a personal loan, then only ₹25,000 remains for a home loan EMI if your limit is ₹40,000.

What Counts Under the 40% EMI Rule?

The rule includes all fixed loan obligations. These usually are:

- Home loans

- Car loans

- Personal loans

- Education loans

- Consumer durable loans

It does not include rent, groceries, electricity bills, or mobile bills. But these expenses still matter when planning your budget because they reduce your remaining income.

Credit card minimum payments are often not counted by banks, but they should be treated as debt while planning personally.

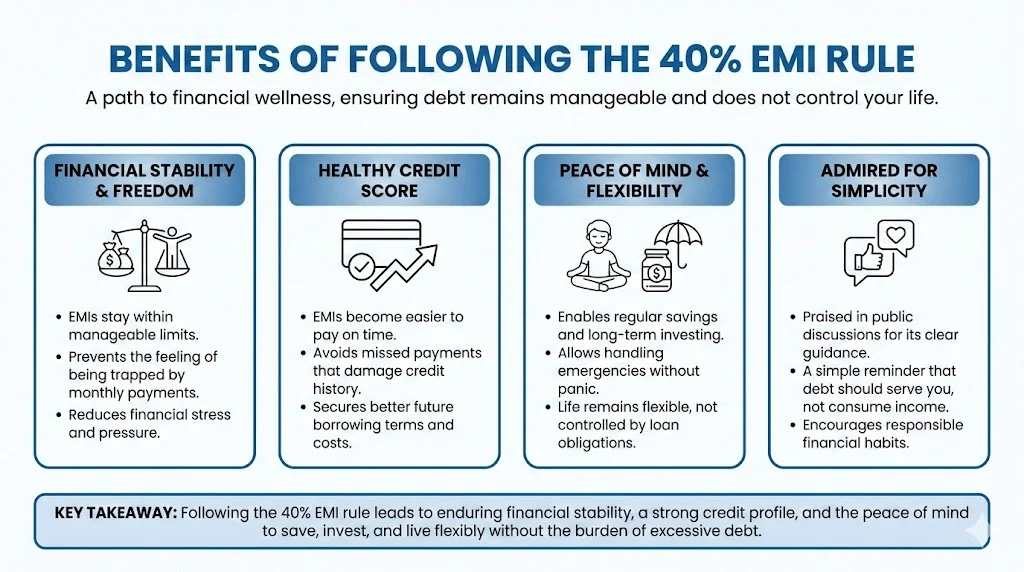

Benefits of Following the 40% EMI Rule

The biggest benefit is financial stability. When EMIs stay within limits, people do not feel trapped by monthly payments.

It also helps maintain a healthy credit score because EMIs become easy to pay on time. Missed payments damage credit history and increase future borrowing costs.

Another benefit is peace of mind. You can save regularly, invest for long term goals, and handle emergencies without panic. Life remains flexible instead of controlled by loans.

Public opinion from recent discussions shows that many admire this rule for its simplicity. People call it a reminder that debt should serve you and not consume your income.

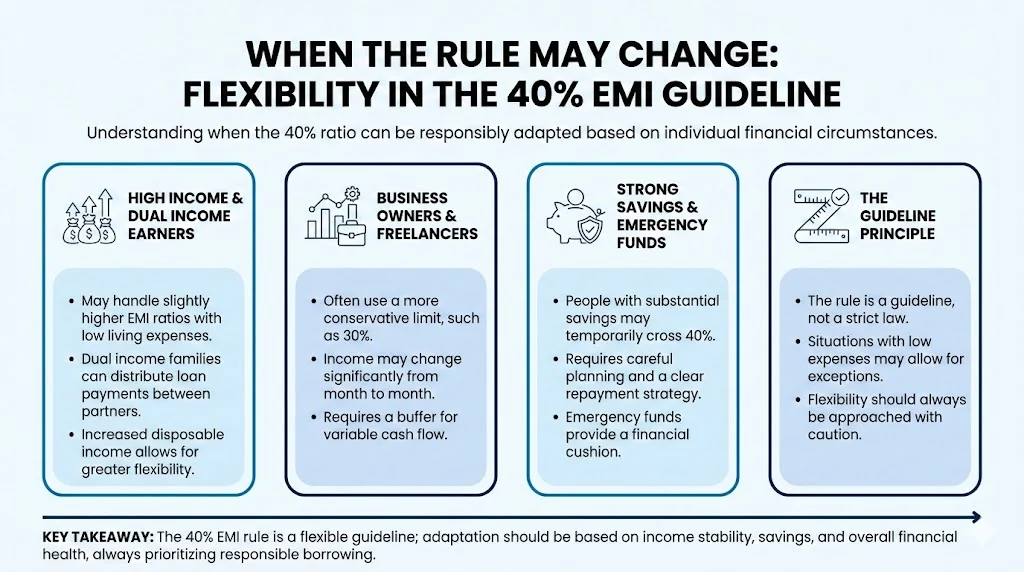

When the Rule May Change?

The rule is a guideline and not a strict law. Some situations may allow flexibility.

High income earners with very low living expenses may handle slightly higher EMI ratios. Dual income families can also distribute loan payments between both partners.

Business owners and freelancers often use a more conservative limit such as 30% because income may change month to month.

People with strong savings and emergency funds may temporarily cross 40%, but only with careful planning.

How Banks Use the 40% Rule

Banks and NBFCs use something called FOIR or Fixed Obligation to Income Ratio. This is similar to the 40% EMI rule but sometimes they allow 50% or even 60% based on credit profile.

If your EMIs are already high, banks may reduce your loan amount or increase loan tenure to lower the EMI. They may also ask for a co applicant or reject the application.

Personal finance experts suggest not using the maximum bank approval as your personal limit. Bank approval only checks risk for the lender and not comfort for the borrower.

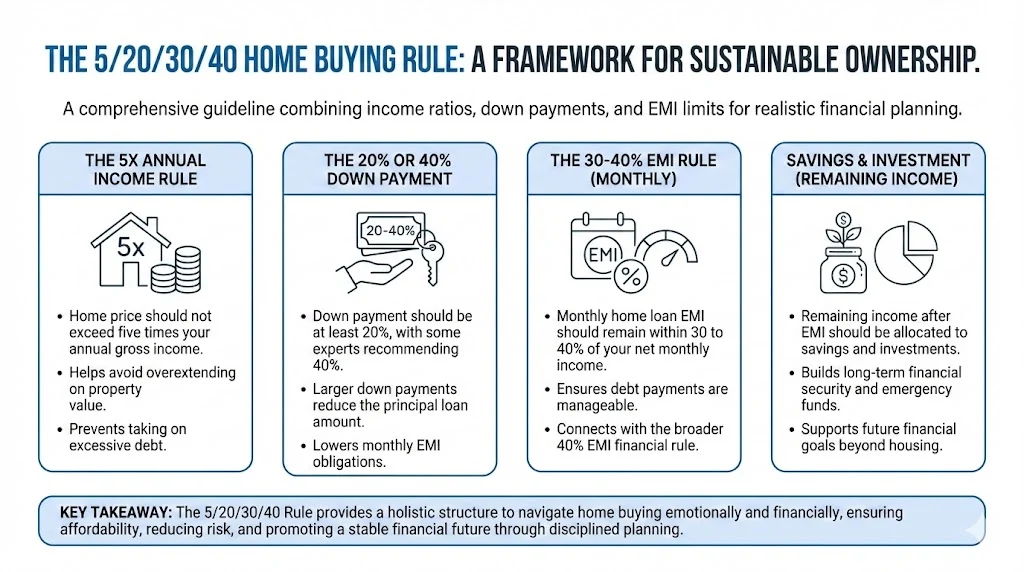

Connection With the 5/20/30/40 Home Buying Rule

The 40% EMI rule is often part of a larger framework used for buying a home. The 5/20/30/40 rule combines several ideas:

- Home price should not exceed five times annual income.

- Down payment should be at least 20% or even 40% according to some experts.

- EMI should stay within 30 to 40% of monthly income.

- The remaining income should go toward savings and investments.

This structure helps buyers avoid emotional decisions and plan realistically. It also reduces the risk of owning a home that becomes too expensive to maintain.

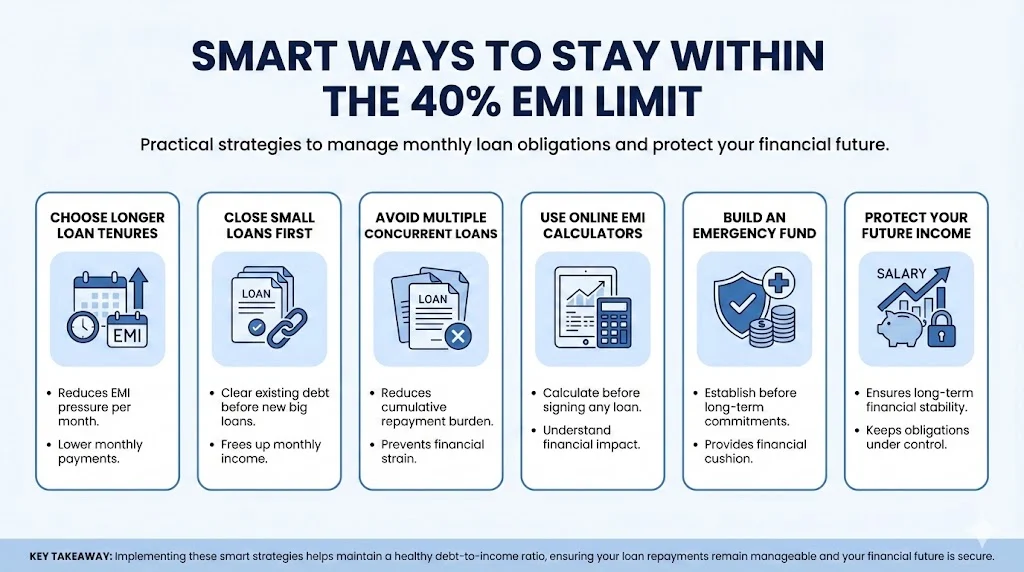

Smart Ways to Stay Within the 40% EMI Limit

- Choose longer loan tenures to reduce EMI pressure.

- Close small loans before applying for a big loan.

- Avoid taking multiple loans at the same time.

- Use online EMI calculators before signing any loan.

- Build an emergency fund before committing to a long loan.

These steps keep your monthly obligations under control and protect your future income.

Public View and Trends (Data From X)

Recent posts from personal finance educators highlight that the rule is not about restriction but protection. Many describe it as a habit that builds discipline and long term financial health.

Statements such as borrowing is not bad but over borrowing is and debt should not eat your future income are common in discussions. The rule is admired for helping people slow down and think before signing loan agreements.

Search trends show rising interest in phrases like 40% EMI rule explained and home loan affordability rule. This shows people want practical tools to decide how much they can safely borrow.

Should You Always Follow the 40% EMI Rule

Not always in a strict way. Every person has a different lifestyle and financial situation. Some people may feel stressed at 30% while others manage 45% easily.

The rule should be used as a starting point. It gives direction and helps prevent regret later. The safest zone for most households remains between 30 to 40% of income.

Ignoring the rule completely often leads to reduced savings and delayed life goals such as education, retirement, and travel.

Conclusion

The 40% EMI rule is one of the simplest and most practical personal finance guidelines available today. It helps people understand how much loan they can really afford without damaging their financial stability.

In a time when loans are easy to get and costs are rising, this rule acts as a financial boundary. Banks may approve higher amounts, but smart borrowers choose limits that protect their future.

Used wisely, the 40% EMI rule supports balanced living, steady savings, and long term peace of mind. It reminds us that progress should feel secure and not stressful.

Tags: personal finance, EMI rule, loan affordability, home loan planning, money management, financial discipline

Share This Post