28/36 Debt Rule Explained for Today’s Economy: This Rule Decides Your Mortgage

2836 Debt Rule Explained for Today’s Economy This Rule Decides Your Mortgage

Managing debt is one of the biggest challenges for households planning to buy a home or stabilize their finances. Among the many guidelines used by lenders and advisors, the 28/36 debt rule remains one of the most referenced benchmarks. Even in 2026, it continues to shape mortgage approvals, affordability checks, and long term financial planning decisions.

This rule is not a law. It is a practical framework that helps people understand how much debt is reasonable based on income. When used correctly, it acts as a safety line that prevents overborrowing and long term financial stress.

Table of Contents

Key Takeaways

- The 28/36 debt rule limits housing costs to 28 percent of gross income

- Total monthly debt should stay within 36 percent of gross income

- It is a guideline, not a strict requirement

- Lenders still use it as a baseline in 2026

- Exceeding it increases the risk of becoming house poor

What Is the 28/36 Debt Rule?

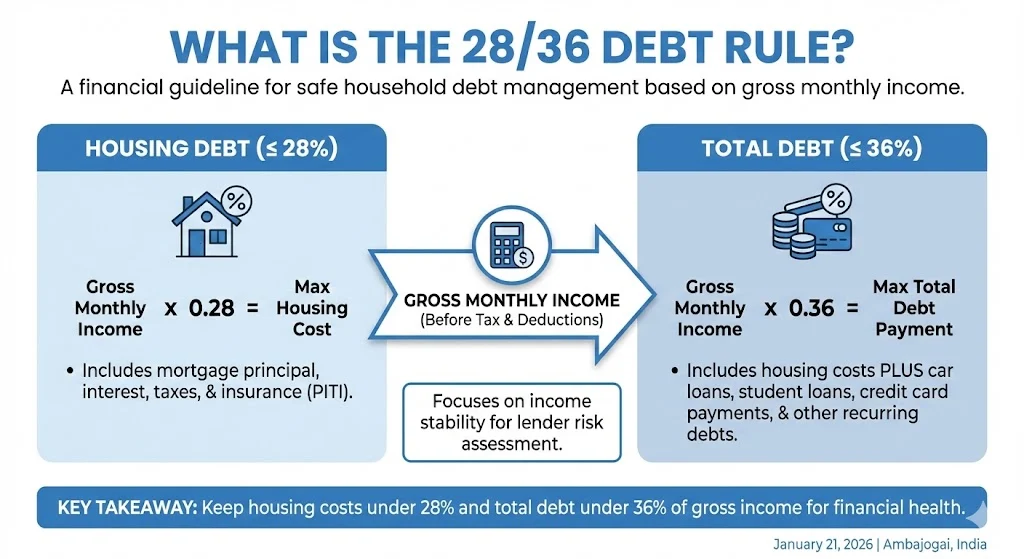

The 28/36 debt rule is a long standing financial guideline used to measure how much debt a household can handle safely. It divides debt into two clear parts. Housing costs and total debt obligations.

Under this rule, no more than 28 percent of your gross monthly income should go toward housing expenses. At the same time, all recurring debt payments combined should not exceed 36 percent of your gross monthly income.

Gross income means income before tax and deductions. The rule focuses on income stability rather than take home pay. This is why lenders prefer it when assessing risk.

Also Read: 28/36 Debt Rule Explained for Today’s Economy: This Rule Decides Your Mortgage

Breaking Down the Two Ratios

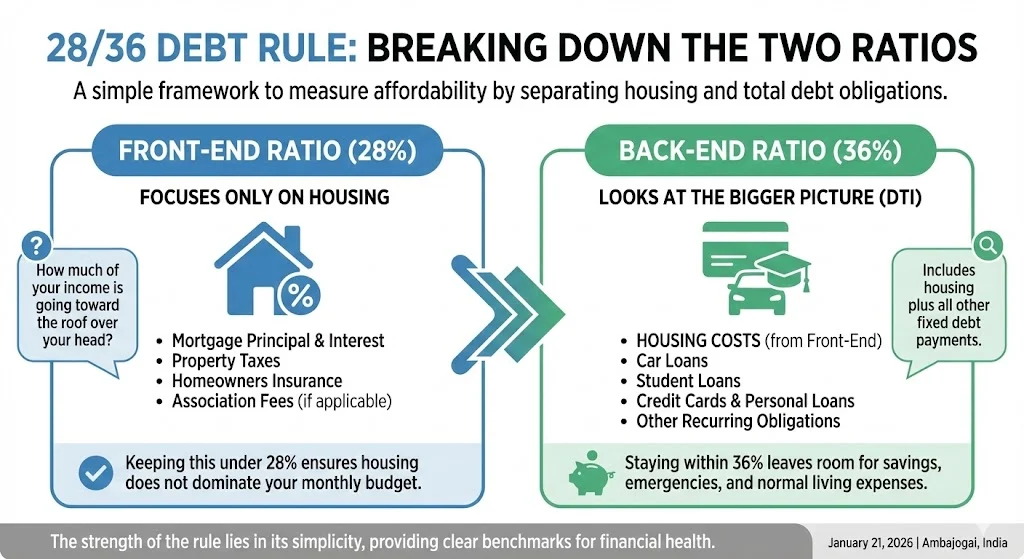

The strength of the 28/36 rule lies in its simplicity. Each ratio serves a specific purpose in measuring affordability.

Front End Ratio at 28 Percent

The front end ratio focuses only on housing. It answers one simple question. How much of your income is going toward the roof over your head.

Housing expenses usually include mortgage principal, interest, property taxes, homeowners insurance, and association fees if applicable. These costs together are often grouped under one monthly housing payment.

Keeping this number under 28 percent ensures housing does not dominate your monthly budget.

Back End Ratio at 36 Percent

The back end ratio looks at the bigger picture. It includes housing costs plus every other fixed debt payment.

This covers car loans, student loans, credit cards, personal loans, and any recurring obligations reported to lenders. This ratio is commonly known as the debt to income ratio.

Staying within 36 percent leaves room for savings, emergencies, and normal living expenses.

Why Lenders Still Use This Rule

Even with changing markets and rising costs, lenders continue to rely on the 28/36 rule as a foundation. The reason is risk management.

When borrowers stay within these limits, default rates tend to be lower. Payments remain manageable during job changes, health issues, or economic slowdowns. The rule also aligns with responsible lending standards that focus on ability to repay.

While some loan programs allow higher ratios, the 28/36 rule remains the reference point against which flexibility is measured.

What Counts as Housing Expenses

Housing costs under the 28 percent limit are broader than just the mortgage payment. Lenders usually include all required monthly housing charges.

These expenses typically include principal and interest on the mortgage, property taxes, homeowners insurance premiums, and homeowners association fees. In rare cases, certain utilities may be reviewed, though they are usually counted separately.

This full picture helps lenders estimate the real cost of homeownership rather than focusing only on loan payments.

Understanding Debt to Income Ratio

The back end ratio is essentially your debt to income ratio. It measures how much of your income is already committed to debt.

This ratio is calculated by dividing total monthly debt payments by gross monthly income. The result is expressed as a percentage.

A lower ratio signals financial flexibility. A higher ratio indicates that income is already heavily committed, leaving little room for unexpected expenses.

Example Calculation Using the 28/36 Rule

Consider a household earning 5000 per month before taxes.

- Maximum housing cost at 28 percent would be 1400 per month

- Maximum total debt at 36 percent would be 1800 per month

If housing costs are kept at 1200, the household has 600 remaining for other debts. If housing rises to the full 1400, only 400 remains for all other obligations.

This example shows how housing decisions directly affect overall financial balance.

How the Rule Fits Into the 2026 Housing Market

Housing affordability has become more strained in recent years. Higher interest rates, rising property taxes, and increased insurance costs have pushed monthly payments upward.

As a result, many households find it difficult to stay within the 28 percent housing limit. In several regions, spending closer to 30 or even 35 percent on housing has become common.

Despite this pressure, the rule is still viewed as a healthy starting point. It helps buyers understand the tradeoff between buying more house and maintaining financial stability.

Public Opinion Around the Rule Today

Public sentiment around the 28/36 debt rule is mixed. Many see it as smart financial discipline. Others feel it no longer reflects reality.

Supporters argue that staying near or below these limits reduces stress and allows for savings growth. They view the rule as protection against becoming house poor.

Critics argue that strict adherence delays homeownership. In high cost areas, following the rule often means settling for much smaller homes or renting longer.

Most financial discussions now describe it as a rule of thumb rather than a strict boundary.

When Lenders Allow Higher Ratios

While the 28/36 rule is common, it is not absolute. Some lenders allow higher ratios depending on loan type and borrower profile.

Government backed loan programs may approve borrowers with higher debt ratios. Strong credit history, stable income, and significant savings can also provide flexibility.

These exceptions do not replace the rule. They simply allow lenders to take calculated risks when other strengths are present.

Risks of Ignoring the Rule Completely

Stretching beyond the 36 percent total debt threshold increases financial pressure. Monthly cash flow becomes tight. Savings often suffer. Emergency expenses turn into debt.

Many stories of financial burnout trace back to high housing costs combined with other obligations. The rule exists to prevent this cycle before it begins.

Ignoring it does not guarantee failure, but it raises the margin of error significantly.

Also Read: 12 + 1 Prepayment Rule for Home Loan: Pay 1 Extra EMI Save ₹14 Lakh

Using the Rule as a Planning Tool

The most effective way to use the 28/36 rule is during planning, not approval. It helps households test affordability before committing.

By calculating ratios early, buyers can adjust expectations, reduce existing debt, or increase savings. This proactive approach leads to better outcomes than relying on lender approval alone.

The rule works best when combined with realistic budgeting and long term financial goals.

Is the 28/36 Rule Still Relevant

Despite criticism, the rule remains relevant because its core purpose has not changed. Income stability and manageable debt still matter.

What has changed is how strictly people can follow it. In today’s market, it may require compromise, patience, or creative planning.

Viewed as guidance rather than restriction, it continues to offer value.

Final Thoughts on the 28/36 Debt Rule

The 28/36 debt rule is not outdated wisdom. It is conservative advice shaped by decades of lending experience.

In 2026, it remains a useful benchmark for understanding affordability and risk. While not everyone can meet it perfectly, knowing where you stand against it provides clarity.

Financial freedom often comes from staying within limits that protect future choices rather than stretching every dollar today.

Also Read: 30 Day Rule Meaning and Why It Is Still Relevant Today

Tags: 28/36 debt rule, debt to income ratio, home affordability, mortgage planning, personal finance basics, housing budget

Share This Post