20 30 40 Rule For Buying A House: Buy a Home Without Debt Stress

20 30 40 Rule For Buying A House: Buy a Home Without Debt Stress

Buying a house in India has become a major financial decision. Property prices are rising in most cities and home loan rates keep moving up and down. In this situation many buyers end up taking large loans which later create pressure on their monthly budget.

The 20 30 40 rule is a simple way to avoid this problem. It gives a clear structure on how much you should spend, borrow and save while planning a home purchase. This rule is now widely shared in Indian finance discussions because it helps people buy homes without losing financial control.

Table of Contents

Key Takeaways On 20 30 40 Rule

- 20 percent should go towards down payment

- 30 percent of income should be the EMI limit

- 40 percent should stay for savings and investments

- It helps avoid over borrowing

- It supports long term financial stability

Also Read: 10 5 3 Rule Of Investing: Why Most Investors Get Returns Wrong?

What Is The 20 30 40 Rule?

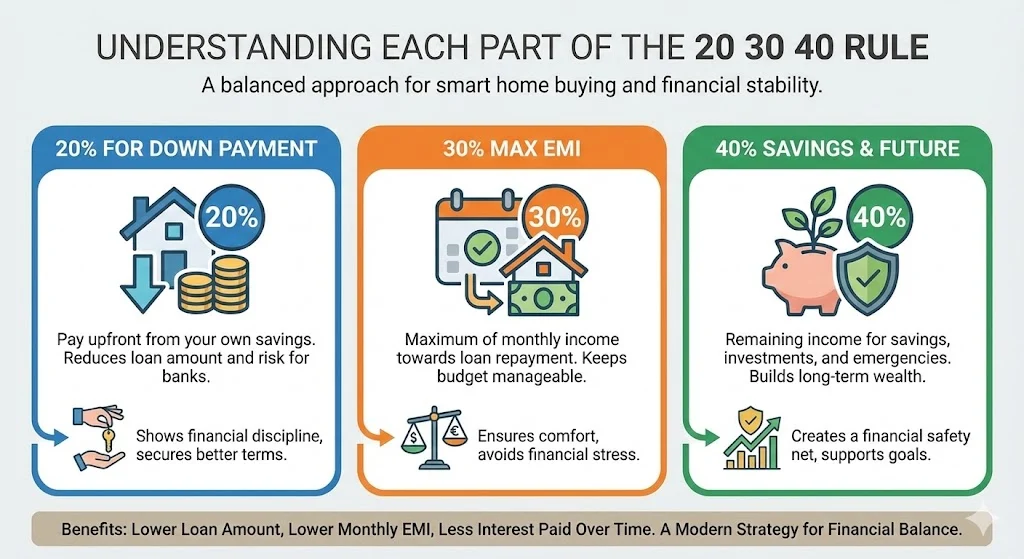

The 20 30 40 rule is a home buying guideline. It divides your income into three clear parts so that buying a house does not damage your overall finances.

This rule is popular in India because banks allow high loan amounts and long tenures. Many people qualify for big loans but later struggle with EMIs. The 20 30 40 rule prevents this by setting safe limits.

It works like this.

- 20 percent is the money you put down when you buy the home.

- 30 percent is the maximum part of your monthly income that should go towards EMI.

- 40 percent is the part of income that should remain for savings and future needs.

This structure keeps your loan manageable and your financial life balanced.

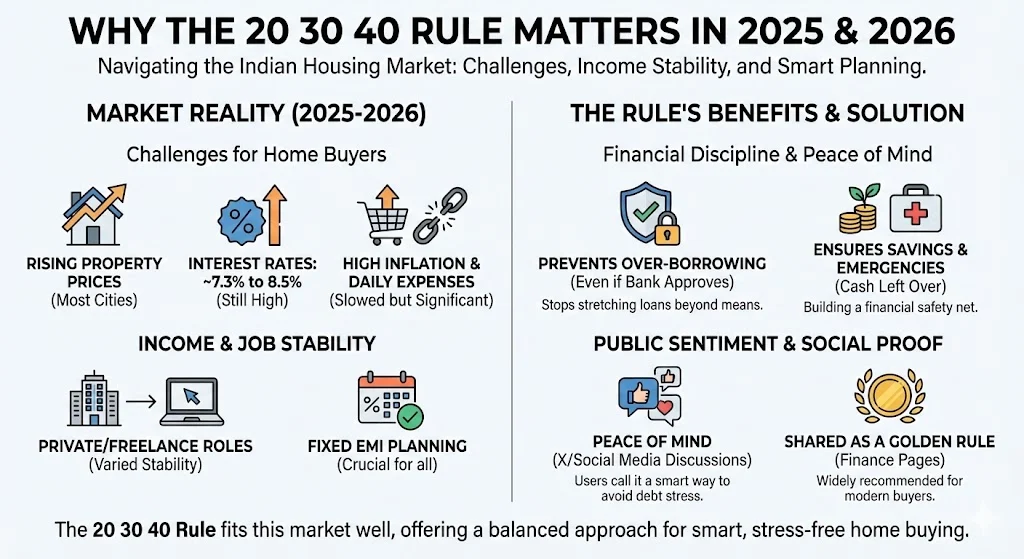

Why This Rule Matters In 2025 & 2026

In 2025 and 2026 home buying in India is not easy. Property prices have increased in most cities. Interest rates are still in the range of around 7.3 percent to 8.5 percent for many borrowers. Inflation has slowed but daily expenses are still high.

At the same time job stability is not the same for everyone. Many people work in private jobs or freelance roles. This makes fixed EMI planning more important.

The 20 30 40 rule fits this market well. It stops people from stretching their loan just because a bank approves it. It also makes sure there is enough cash left for savings and emergencies.

Recent public discussions on X show that people like this rule because it gives peace of mind. Users often call it a smart way to avoid debt stress. Many finance pages are sharing it as a golden rule for home buyers.

Understanding Rach Part Of The 20 30 40 Rule

20 Percent For Down Payment

The down payment is the first amount you pay when you buy a house. The rule says you should aim to pay at least 20 percent of the property value from your own money.

This has many benefits. A higher down payment reduces the loan amount. A smaller loan means lower EMI. It also means you pay less interest over the full loan period.

Banks also prefer borrowers who can put more money upfront. It shows financial discipline and lowers their risk.

For example if a house costs 50 lakh rupees then 20 percent is 10 lakh rupees. If you pay this upfront you only need a loan of 40 lakh. Your EMI and interest both drop.

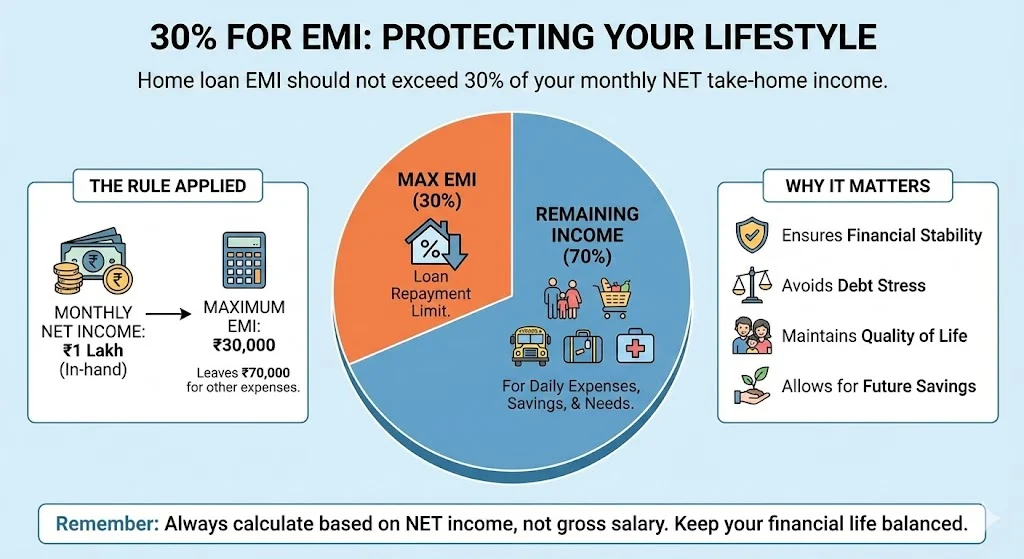

30 Percent For EMI

This part of the rule says your home loan EMI should not be more than 30 percent of your monthly take home income.

This is very important. Many people use gross salary to calculate EMI but the rule should be applied to net income which is the money you actually receive.

If you earn 1 lakh rupees per month in hand then your EMI should not be more than 30 thousand rupees. This leaves 70 thousand for other expenses and savings.

This limit protects your lifestyle. You can still pay for food, school fees, travel and medical needs without stress.

40 Percent For Savings & Investments

The last part of the rule is often ignored but it is the most powerful. It says 40 percent of your income should go towards savings and investments.

This money builds your emergency fund. It also supports goals like retirement, children education and travel.

It also helps you stay safe if your income changes. If you lose a job or face a medical bill you still have cash available.

This 40 percent is what gives long term financial security.

Example Of The 20 30 40 Rule

Let us take a simple example. Rohit earns 1 lakh rupees per month.

Using the 20 30 40 rule, his monthly income is divided into three clear parts. This helps him plan for a home purchase without putting pressure on his monthly budget.

Monthly Income Breakdown

| Component | Percentage | Amount per month | Purpose |

|---|---|---|---|

| Down payment fund | 20 percent | 20,000 | Saving for home purchase |

| Home loan EMI | 30 percent | 30,000 | Loan repayment |

| Savings and investments | 40 percent | 40,000 | Emergency fund and future goals |

With this structure, Rohit can move toward buying a home in a steady way. His EMI stays within a safe range. His savings continue to grow. His down payment fund also builds every month.

If he saves 20,000 per month for the down payment, he can collect 2.4 lakh in one year. Over a few years, this becomes a strong amount that can be used as a solid down payment for a house.

How It Protects You From Debt Stress

The biggest problem in home buying is over borrowing. Banks often approve large loans based on eligibility. This does not mean it is safe for you.

The 20 30 40 rule creates a clear safety line.

- It keeps EMIs low.

- It forces you to save.

- It limits loan size.

This is why people on X call it a protection against debt slavery. It helps you own a house without becoming stuck in long term money pressure.

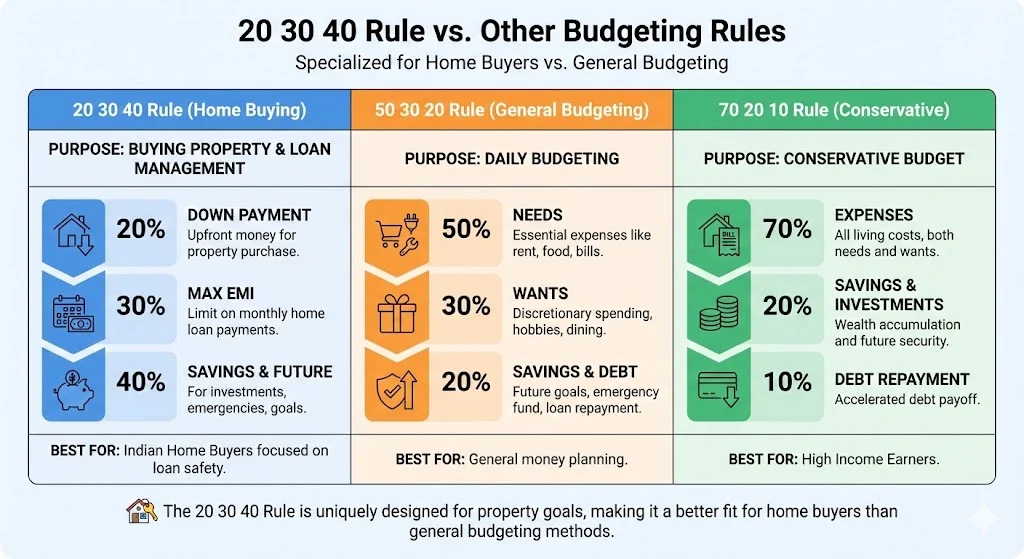

20 30 40 Rule vs Other Budgeting Rules

There are many popular money rules like 50 30 20 and 70 20 10. These are mainly used for daily budgeting. They are not made for home loan planning. The 20 30 40 rule is different because it is built around buying property and managing loan payments.

Comparison of Budgeting Rules

| Rule | Purpose | Allocation | Best for |

|---|---|---|---|

| 50 30 20 | Daily budgeting | Needs, wants, savings | General money planning |

| 70 20 10 | Conservative budget | Expenses, savings, debt | High income earners |

| 20 30 40 | Home buying | Down payment, EMI, savings | Property buyers |

The 20 30 40 rule focuses directly on property goals and loan safety. This is why it fits Indian home buyers better than general budgeting rules.

How To Use The 20 30 40 Rule Before Buying

- Start by listing your monthly income. Use your take home pay.

- Next list your expenses. This shows how much room you have for EMI and savings.

- Then apply the 30 percent rule to find your safe EMI. Use this EMI to calculate the loan amount.

- Start saving 20 percent every month for the down payment. This also covers registration and furnishing.

- Put 40 percent into savings and investments. Build at least six months of expenses as emergency fund.

- Compare loan offers. Look at interest rates and repayment options. Do not choose the maximum loan. Choose the loan that fits the rule.

Common mistakes people make

Many people break the rule without realizing.

- Some use gross salary instead of net income.

- Some count bonuses as fixed income.

- Some ignore emergency savings.

- Some forget family expenses.

These mistakes lead to stress later. The rule only works when you apply it honestly.

Is The 20 30 40 Rule For Everyone

The rule is flexible.

- High earners can keep EMI even lower and save more.

- Dual income families can manage slightly higher EMIs if savings remain strong.

- People in metro cities may adjust the ratio but should keep the core idea.

The rule is a guide. It is not a rigid formula. It should match your income and life goals.

What Experts & Public Opinion Say

Finance experts support this rule because it balances loan and savings. Banks also prefer borrowers whose EMIs stay below 30 to 40 percent of income.

On X people admire this rule for its simplicity. It is often shared as a smart way to avoid regret. Many posts say it helps people buy smaller homes but live with more peace.

This mindset is important in today’s market where easy loans can lead to long term problems.

Conclusion

The 20 30 40 rule is one of the most practical ways to buy a house in India. It keeps your loan affordable. It protects your savings. It supports long term financial growth.

In a time of rising property prices and uncertain income this rule gives structure and safety. It helps you own a home without losing financial freedom.

Tags: home loan planning, property buying rules, personal finance india, housing affordability, down payment tips, emi planning

Share This Post