10x Insurance For Family Security: Why The Right Cover Matters More Than Ever

10x Insurance For Family Security: Why The Right Cover Matters More Than Ever

Life insurance is not only about buying a policy. It is about building a safety wall around your family. The idea of 10x insurance means taking life cover equal to at least 10 times your annual income. This gives your family money to manage expenses if your income stops.

Today experts across India and global markets say that 10x to 20x income cover is more practical due to inflation, higher medical costs, and rising education expenses. This simple rule helps young families stay financially stable during difficult times.

Key Takeaways

- Experts now recommend 10x to 20x annual income as ideal life insurance cover

- Inflation is reducing the value of older policies

- Riders like critical illness and disability are becoming standard

- Online platforms make term insurance cheaper and easier to buy

- Families in Tier 2 and Tier 3 cities are buying more insurance

- Review your policy every few years to match life changes

Also Read: 20 4 10 Debt Rule For Buying Cars: Does It Still Work Today?

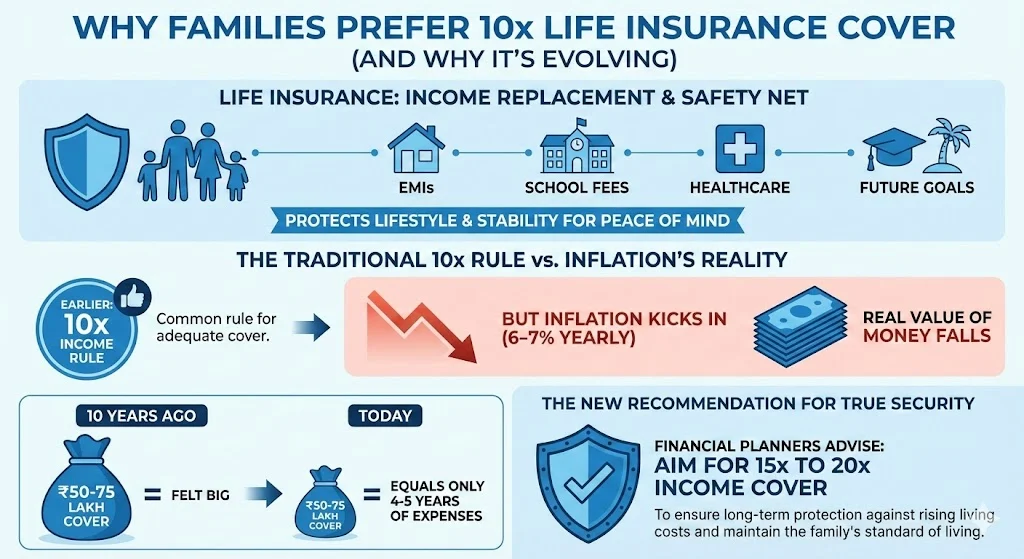

Why Families Prefer 10x Life Insurance Cover

Life insurance works as income replacement. If the earning member is not around, the policy payout supports the family. It covers living expenses, EMIs, school fees, healthcare, and future goals. People today see term life insurance as a tool for peace of mind. It protects lifestyle and stability.

Earlier, 10x income was the common rule. But with 6 to 7 percent yearly inflation, the real value of money keeps falling. A policy that once looked big now feels small. In many cases, ₹50 to 75 lakh cover from 10 years ago equals only 4 to 5 years of expenses today. Financial planners now say families must aim for 15x to 20x income cover for true security.

Why The 10x Rule Is Still A Good Starting Point

10x income is simple to understand. It ensures your family gets enough funds to live comfortably for at least 10 years. This helps during the most sensitive period after loss. Families do not need to depend on relatives or loans. The payout becomes a financial cushion.

But every family is different. Expenses, loans, kids education plans, lifestyle costs, and healthcare needs vary. That is why experts advise calculating cover based on real needs. The higher your responsibilities, the higher your cover should be.

What People Are Saying Online

Recent conversations show strong support for higher coverage. People like that term insurance is affordable and gives pure protection. Many users believe even 20x income may be needed in some cases. Others say at least 5x to 6x income should be the minimum base.

One strong theme keeps repeating:

Families want stability without financial stress.

There is also a rise in dual income homes. Even then, both partners often take individual coverage. Women buyers are increasing every year. Tier 2 and Tier 3 cities are also showing higher participation.

Key Market Trends In 2025–2026

Digital buying makes things simple. Young professionals now purchase plans online. AI underwriting gives approvals within 24 hours. For a 30 year old non smoker, ₹1 crore term cover starts around ₹900 to ₹1,100 per month.

Riders are becoming common

People prefer plans that include

- critical illness cover

- accidental death benefit

- disability cover

- monthly income riders

These riders ensure long term financial protection beyond basic death cover.

Insurance penetration is rising in India

Growing awareness and pandemic lessons have changed thinking. People now understand that wealth creation and protection must go together.

Globally, the 10 to 12x income rule is widely followed. Families with young children often choose 15 to 30 year terms.

Simple Guide To Decide Your Ideal Coverage

Here is one basic listicle to help you estimate the right cover:

Recommended Life Insurance Coverage Range

- Minimum: 10x annual income

- Ideal: 15x to 20x annual income

- Higher responsibility families: 20x+ income

Keep higher cover if you have

- home loans

- school or college expenses

- dependent parents

- single income household

Always keep the policy active for the entire earning phase.

Why Term Insurance Is The Best Option For Most Families

Term plans are simple. They provide only protection, not investment. This makes the premium much lower compared to other policy types. The full sum assured goes to your family. There is no market risk. That is why many experts recommend term plans as the first insurance step.

A 30 year term works best for many people. It covers the period when responsibilities are highest.

Policy Reviews Are Important

You should review your policy when

- you get married

- you become a parent

- your income increases

- you take a home loan

Financial needs grow with time. Your cover should keep pace.

What Makes This Topic So Relevant Today

There is rising interest in financial protection. People now understand that investments alone are not enough. Savings may fluctuate with markets. Insurance gives certainty.

India is also seeing stronger participation from young adults. Digital buying platforms and transparent plans have changed trust levels. More families now see life insurance as a basic financial need.

Final Thought

Life insurance is not a product purchase. It is a protection plan for your family.

The 10x income rule offers a strong beginning. But real planning must consider inflation, loans, education, and healthcare. A cover between 10x to 20x annual income is now seen as a better shield.

The goal is simple.

Your family should stay secure, comfortable, and stable even if life takes a sudden turn.

Tags: life insurance, family security, finance planning, term insurance, 10x insurance, income protection, inflation impact

Share This Post