100 Minus Age Rule by John Bogle Explained Clearly: This Rule Built Millionaire Portfolios

100 Minus Age Rule by John Bogle Explained Clearly: This Rule Built Millionaire Portfolios | Image With InvestoPedia

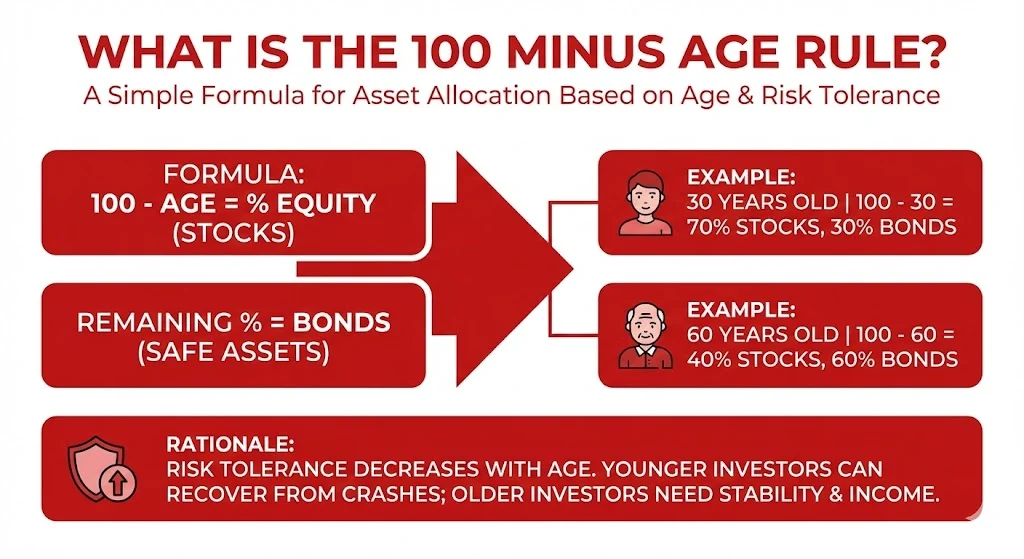

The 100 Minus Age Rule is one of the most widely known asset allocation ideas in long term investing. It is often linked to John Bogle, the founder of Vanguard and the pioneer of index investing. The rule gives investors a simple way to decide how much money should go into stocks and how much into safer assets like bonds.

This rule became popular because it removes confusion from portfolio construction. Instead of guessing or reacting to market noise, investors get a fixed structure based on age. Over the years, this rule has been discussed widely in personal finance circles, especially among beginners who want a disciplined starting point.

Table of Contents

Key Takeaways

- The rule suggests equity allocation equals 100 minus your age

- Younger investors take more equity risk due to longer time horizon

- Older investors shift gradually toward capital preservation

- John Bogle treated it as a guideline, not a strict formula

- Modern investors often adjust it to 110 or 120 minus age

What Is the 100 Minus Age Rule?

The idea behind the 100 Minus Age Rule is simple. You subtract your current age from 100. The result tells you how much of your portfolio should be invested in equities. The remaining portion goes into bonds or other low risk assets.

For example, if you are 30 years old, 100 minus 30 equals 70. That means 70 percent of your portfolio goes into stocks and 30 percent into bonds. If you are 60 years old, the formula gives you 40 percent stocks and 60 percent bonds.

This approach assumes that risk tolerance reduces with age. Younger investors have time to recover from market crashes. Older investors usually need stability and income rather than aggressive growth.

Also Read: Rule of 72 by Luca Pacioli: Meaning, History, and Why It Still Matters

Why John Bogle Supported This Rule

John Bogle believed that investing should be simple and disciplined. He often warned against complexity, frequent trading, and emotional decisions. The 100 Minus Age Rule fit well with his philosophy of long term investing using low cost index funds.

Bogle never claimed this rule was perfect. He described it as a starting point. His goal was to help investors avoid two common mistakes. One is taking too much risk early. The other is becoming too conservative too soon.

He also emphasized that asset allocation matters more than stock picking. According to Bogle, the mix of stocks and bonds has a bigger impact on long term returns than chasing hot investments.

How the Rule Works With Real Age Examples

Here is how the rule looks at different life stages. These examples are widely shared in personal finance discussions and reflect the classic version of the rule.

| Age | Equity Allocation | Bond Allocation |

|---|---|---|

| 30 | 70 percent | 30 percent |

| 40 | 60 percent | 40 percent |

| 50 | 50 percent | 50 percent |

| 60 | 40 percent | 60 percent |

| 70 | 30 percent | 70 percent |

This gradual shift creates a natural glide path. Risk reduces as age increases. Volatility impact also becomes lower over time.

The Logic Behind Age Based Allocation

The rule is built on time horizon and recovery ability. A younger investor may face multiple market cycles. Short term losses matter less because contributions continue and time allows recovery.

As investors age, the portfolio often becomes a source of income. Large drawdowns near retirement can permanently damage capital. A higher bond allocation helps reduce this risk.

Inflation protection also plays a role. Equities tend to outperform inflation over long periods. Bonds provide stability but weaker growth. The rule tries to balance both.

Why Many Experts Say the Rule Is Outdated Today

In recent years, many investors argue that the strict 100 Minus Age Rule is too conservative. Life expectancy has increased. Retirement periods now last 25 to 30 years for many people.

Bond yields are also much lower compared to earlier decades. Heavy bond allocation may fail to protect purchasing power over time. Inflation risk becomes more serious when growth assets are reduced too much.

Because of these changes, many experts now treat the rule as a baseline rather than a final answer.

Modern Variations Like 110 or 120 Minus Age

To adjust for longer lifespans and low bond returns, newer versions of the rule are commonly discussed. These variations increase equity exposure across all age groups.

Here is how they differ:

- 110 minus age increases equity allocation by 10 percent

- 120 minus age allows even higher growth exposure

- Some investors keep a minimum equity floor even after retirement

For example, a 60 year old investor under the 120 rule would hold 60 percent equities instead of 40 percent. This helps maintain growth during long retirement years.

What Recent Twitter Discussions Reveal

Public discussions on X during 2025 and 2026 show that the rule is still widely used. Most investors treat it as an educational tool rather than a strict command.

Several finance accounts and influencers share it as a beginner framework. It often appears alongside other classic rules like the Rule of 72 or basic budgeting formulas.

At the same time, many users openly criticize it for ignoring personal factors. Common feedback includes concerns about income stability, pensions, early retirement goals, and individual risk tolerance.

The general sentiment is balanced. Simplicity is respected. Rigidity is questioned.

Why Personal Factors Matter More Than Any Formula

Age alone does not define financial risk. Two investors of the same age can have very different situations. One may have stable income and low expenses. Another may depend entirely on investments for living costs.

Important factors include income security, emergency funds, debt levels, health, and behavioral tolerance. Some investors panic during market falls even with small equity exposure.

John Bogle himself acknowledged this limitation. He often said rules of thumb are helpful only when combined with common sense.

How Beginners Should Use This Rule

For beginners, the 100 Minus Age Rule works well as a starting structure. It prevents extreme decisions. It encourages diversification. It creates discipline without complexity.

Once the basics are understood, investors can modify it slowly. Adjustments should be deliberate and consistent. Sudden shifts based on market news defeat the purpose of long term investing.

The rule also works best with low cost index funds. This aligns with Bogle’s core philosophy of minimizing fees and avoiding speculation.

Final Perspective on the 100 Minus Age Rule

The 100 Minus Age Rule remains relevant because it teaches balance and patience. It is not a perfect formula and was never meant to be one.

In modern investing, the rule works best as a foundation. Variants like 110 or 120 minus age reflect changing realities. The key lesson remains unchanged. Asset allocation should evolve with life stage and personal comfort.

Investors who respect simplicity and discipline often benefit more than those chasing precision.

Tags: 100 minus age rule, John Bogle investing, asset allocation by age, equity vs bonds, long term investing, portfolio diversification

Share This Post